Fed meeting weighs on US Dollar, while Bank of England hawkish dissent sends Sterling soaring

- Go back to blog home

- Latest

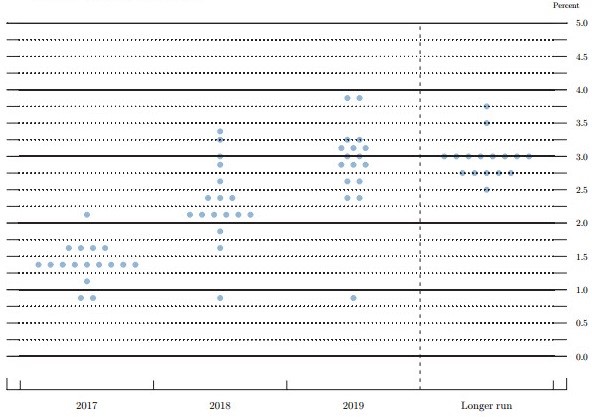

The hawkish expectations that had been built up around last week’s Federal reserve meeting were disappointed.

Figure 1: FOMC March 2017 ‘Dot Plot’

The flight from the Dollar was helped along by receding political fears in Europe. The anti-EU PVV Party in the Netherlands did far worse than opinion polls had predicted and French polls continue to put Le Pen far behind any plausible rival in the second round of the French Presidential elections. The net result is that for the first time in months the US Dollar fell against every other G10 currency. The dovish Fed message was particularly helpful to emerging market currencies, which also rose sharply led by the Turkish Lira and the South African Rand.

This week will be relatively light in terms of major news. We do expect Sterling to react strongly to any potential surprise in inflation data for February, should it show stronger than expected pass through from the weak Pound. We look to Friday’s flash PMI business surveys to confirm the general uptick in economic data in the Eurozone.

Major currencies in detail

GBP

Sterling received some badly needed help from the Bank of England last week. Our view that the market is underestimating the chances of an early hike received some support on Thursday, when MPC member Kristin Forbes filed a dissenting vote and asked for an immediate hike.

The recent Pound rally may yet have some legs if UK inflation surprises to the upside on Tuesday. At any rate, we expect the upward trend in core inflation that we have seen recently to continue, and it is quite possible that other dissenters will join Forbes at the MPC before very long. With a messy Brexit negotiation process fully priced in and Sterling around record lows, we see risks skewed towards further upside in the Pound over the next few weeks.

EUR

With the ECB meeting out of the way, politics again takes center stage in the Eurozone. Newsflow was very supportive for the common currency last week. The populist PVV performed poorly in the European elections, coming in a distant second to the center-right VVD with barely 13% of the vote. Dutch establishment parties should have little difficulties forming a coalition that again excludes the PVV.

As immediate political risks fade away, we expect markets to focus attention back on economic fundamentals. The key will be to see whether future inflation numbers validate the ECB’s rather optimistic projections. Should core inflation fail to rise in line with those forecasts, we expect to see renewed weakness in the common currency.

USD

The relative dovishness in Federal Reserve communications last week, even as it hiked rates to the 0.75-1% range, may result in soft Dollar trading over the short term.

Political wrangling among Republicans over the terms of repealing President Obama’s signature healthcare law are also pushing expectations for a tax cut and any significant infrastructure spending further into the future. The news calendar is relatively light over the next couple of weeks, so we expect the US Dollar to mostly trade sideways until the next payroll report due on 7th April.