Fed sees no US rate hikes through at least 2023

( 10 min. )

- Go back to blog home

- Latest

The Federal Reserve indicated last night that interest rates were likely to remain at current record low levels for the foreseeable future, but the US dollar actually rallied following the announcement.

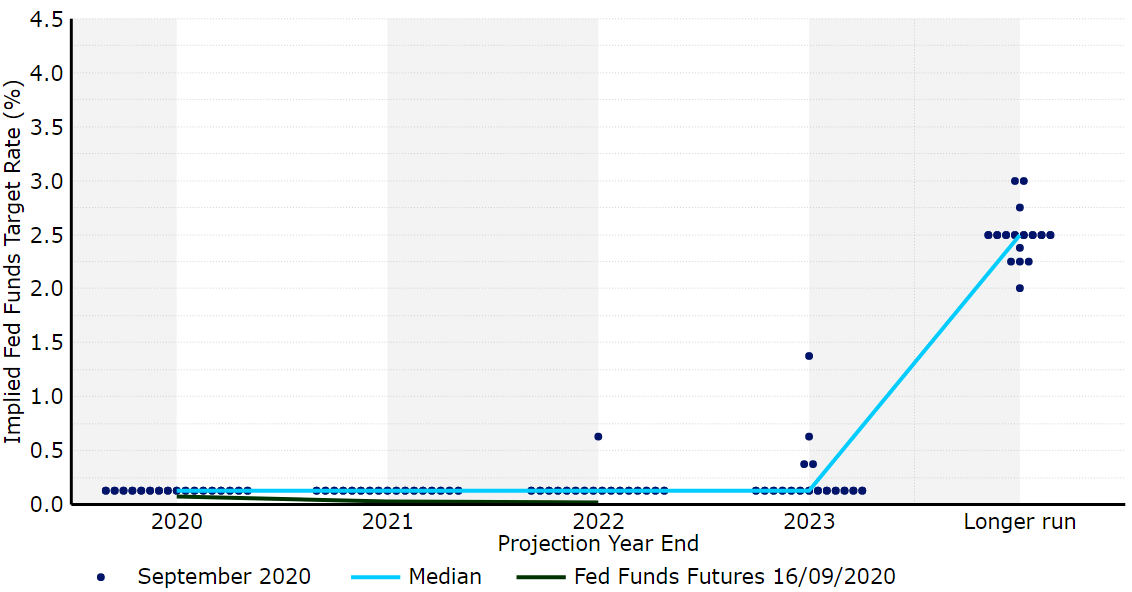

Figure 1: FOMC Dot Plot [September 2020]

Source: Refinitiv Datastream Date: 17/09/2020

Notably, there was a sharp upward revision to the Fed’s GDP projections. The US economy is now only expected to contract by 3.5% this year, far less than the 6.5% it had anticipated in June. Unemployment was also revised lower, with the Fed now expecting the jobless rate to decline to 7.6% by the end of the year, versus June’s 9.3% projection. In its communications, Chair Powell noted that rates would be going nowhere until the bank achieves maximum employment and inflation ‘moderately exceeded’ its 2% target. This inflation target is now not expected to be breached until 2023.

While the reaction in the dollar to the promise of low rates for the foreseeable future may seem counterintuitive, it is worth noting that the market had largely expected this prior to the meeting. There were also some investors that had braced for an even more dovish outlook, with many left somewhat disappointed by the ambiguity of the Fed’s forward guidance. These factors, combined with hefty upward revision to the bank’s GDP estimate, triggered an unwinding in short dollar positions, sending EUR/USD back below the 1.18 level for the first time in a week.

What to expect from today’s Bank of England meeting

Sterling edged higher versus its peers yesterday, even ending the day up against the broadly stronger dollar, ahead of today’s Bank of England meeting.

With investors bracing for a cautious message from the BoE today, we think that the rally in the pound can be attributed, at least in part, to investors unwinding some of their bearish bets in the knowledge that the bar for a dovish surprise is now quite high. As we talked about in this week’s episode of FX Talk, we think that the key to the market reaction will be the vote on the bank’s QE programme. While our base case scenario is for policymakers to vote 9-0 in favour of keeping the programme unchanged, we think there is a very good chance that at least one of the more dovish members of the committee votes for an immediate increase in QE this week. This would open the door to an increase in the programme towards the end of the year, potentially the November meeting. A unanimous 9-0 vote would, by contrast, likely support sterling, in our view.

The bank’s rhetoric will also be watched closely by currency traders. A more dovish set of communications that talks up downside risks posed by Brexit and the end of the government’s furlough scheme could weigh on sterling. Any comments from the bank that raises the chances of the BoE cutting interest rates below zero would also be greeted negatively by the market and would likely trigger an aggressive move lower in the pound.

The Bank of England’s interest rate decision, meeting minutes and monetary policy summary will all be released at 12pm BST on Thursday (1pm CET).