Fed to stick with 75bp hike, despite inflation shocker

( 5 min )

- Go back to blog home

- Latest

The Federal Reserve is expected to deliver another sizable interest rate hike at its July policy meeting on Wednesday, although we think that calls for a 100 basis point move are unjustified.

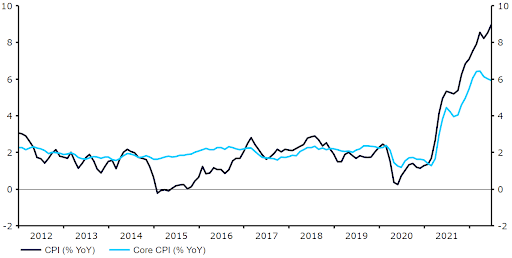

Figure 1: US Inflation Rate (2012 – 2022)

Source: Refinitiv Datastream Date: 25/07/2022

With another 75 basis point hike seemingly a done deal at Wednesday’s meeting, and with no fresh macroeconomic or interest rate projections to be released this week, room for a surprise may be limited. That said, investors will be paying close attention to chair Powell’s comments on the state of the US economy and the Fed’s view on the size of additional hikes beyond the July meeting. On the economy, we think that the Fed will continue to say that underlying forces of demand are strong, and that the US labour market is performing well. While we have seen some evidence of a mild slowdown in the jobs market, the big upside surprise in the June payrolls report suggests there has so far been limited impact on hiring from the Fed’s tightening measures.

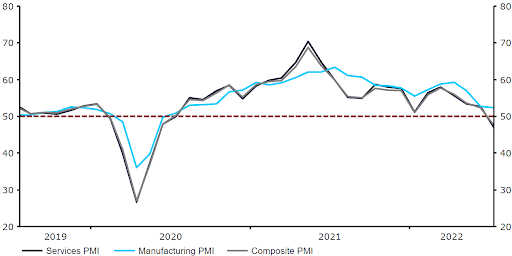

Policymakers will, however, likely acknowledge the latest slowdown in activity data since the last FOMC meeting in mid-June, particularly in light of last week’s disappointing PMI numbers. The key composite index from S&P fell below the level of 50 and into contraction territory this month for the first time in two years (47.5), while printing well below economists’ expectations. Indicators of housing activity also point to a cooling in the housing market, with a non-negligible chance that the US economy falls into a technical recession once Thursday’s Q2 GDP data is released. We think that this warrants a softening in the Fed’s language on the outlook, and a possible shift away from its ultra-hawkish rhetoric on rates.

Figure 2: US PMIs (2019 – 2022)

Source: Refinitiv Datastream Date: 25/07/2022

We expect the Fed to continue to adopt a data-dependent approach to policy normalisation. The next FOMC meeting is not until 21st September, almost two months away, so we don’t believe that Powell will pre-commit to the magnitude of the next hike. We think that the discussion in the interim will centre around the choice between another 75bp move, or a return to a 50bp rate increase – Powell will most likely keep both options on the table on Wednesday. In our view, the Fed is highly unlikely to consider the possibility of raising rates in 100 basis point increments, barring a significant blowout in US inflation, and Powell may say this week that the bar for such a move is a very high one.

Given current market pricing (165 basis points priced in through the November meeting), any firm indication from Powell that another 75 basis point rate hike may be on the way in September would be perceived as bullish for the US dollar. By contrast, should Powell hint that the Fed will likely revert back to a 50 basis point move, then we see room for some immediate downside in the dollar. We see a strong chance that the vote on rates will be unanimous on Wednesday, although any dissenters in favour of a smaller immediate hike would also be seen as a US dollar negative.

While our base case is for the FOMC to leave its options open this week, of the two scenarios listed above we think that the latter is more likely. The deterioration in activity data, particularly the collapse in the July PMI numbers, and signs of an easing in core inflation, means that we think that a slowing in the speed of the hike cycle is on the way, whether hinted at following Wednesday’s meeting or not. We expect the Fed to raise rates by 50bps in September, with a possibility that it reverts back to a 25bp hike in November.

The FOMC will announce its latest policy decision at 7pm BST (8pm CET) on Wednesday, with chair Powell’s press conference to follow 30 minutes later.