Federal Reserve to keep rates unchanged, hint at December action

- Go back to blog home

- Latest

At the Federal Reserve’s most recent monetary policy meeting in September, FOMC Chair Janet Yellen hinted that the next interest rate hike in the US could be on the horizon by stating that ‘the case for an increase in the federal funds rate has strengthened’.

The Fed is likely to highlight the ongoing improvement in the labour market, while signalling a growing confidence that inflation will return to target. We also anticipate an increasing number of dissenters voting in favour of higher rates, bringing the overall vote close to a tipping point where the majority of members vote for an immediate rate increase. All of which should, in our view, provide good support for the US Dollar against most of its peers.

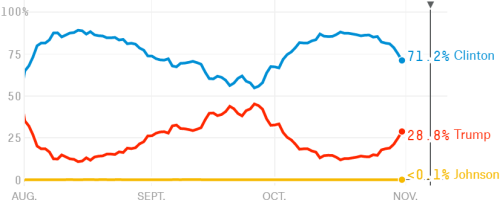

Ahead of tonight’s crucial meeting, the Dollar slumped against the Euro for the second day this week, remaining pinned down by uncertainty regarding the outcome of next week’s Presidential Election. Another poll released by the Washington Post yesterday gave Trump a narrow advantage for the first time since May. Prediction website fivethirtyeight.com has seen Clinton’s probability of winning slumping to 71% from closer to 90% last week (Figure 1).

Figure 1: Fivethirtyeight US Presidential Election Odds (August ‘16 – November ‘16)

Nearer to home, the Pound held its own despite a slightly disappointing manufacturing PMI. Elsewhere, the Swiss Franc ended the day as just about the best performing currency in the world, surging by over one percent after its own manufacturing PMI rose to a five month high.

Major currencies in detail:

GBP

Sterling dipped by 0.1% during London trading yesterday, receiving little help from the news that Mark Carney was extending his term as BoE Governor until 2019.

Yesterday’s manufacturing PMI came in broadly in line with expectations, further suggesting that the UK economy was holding up relatively well despite the uncertainty created following the Brexit vote. The index dipped to 54.3 last month from 54.5, although an upward revision in the September number made up for much of the disappointment.

The UK’s manufacturing sector has already received a boost from the recent fall in the Pound, which has made Britain’s goods relatively cheaper, thus boosting exports.

This morning’s construction PMI at 09:30am is expected to slow slightly to 51.8 in October from 52.3. Investor attention will remain on Thursday’s Bank of England meeting.

EUR

The single currency soared by 0.6% on Tuesday, extending its run of gains to nearly 2% in a week and rallying to its strongest position against the US Dollar since 12 October.

With no significant announcements out of the Eurozone due to the All Saints Day holiday, yesterday’s decline was driven almost exclusively by Dollar weakness and a lack of liquidity in the market.

News we had on Tuesday was actually fairly negative. Most notably, the German government’s panel of economic advisors lowered its growth forecast for Europe’s largest economy yesterday from 1.6% in 2017 to just 1.3%.

Tonight’s Federal Reserve meeting will hold the key to the Euro today. In the meantime, German unemployment and Eurozone manufacturing growth could cause additional volatility in the single currency.

USD

Growing concerns over a possible election victory for Donald Trump on Tuesday caused the Dollar to end 0.6% lower against its major counterparts.

Ahead of tonight’s Fed meeting, manufacturing activity in the US provided a pleasant upward surprise. The monthly index from ISM increased to 53.4 from 53.2, while Markit’s manufacturing index increased to a one year high 53.4 from 53.2.

Construction spending, however, proved slightly less encouraging. Spending in the sector fell unexpectedly by 0.4%, its largest decline in nine months.

The Fed’s interest rate announcement and statement will both be released at 18:00pm tonight. There’ll be no press conference from Yellen today so the tone and wording of the statement could prove key for the Dollar.

Receive these market updates via email