Federal Reserve expected to hike rates for third time in a decade

- Go back to blog home

- Latest

The Federal Reserve in the US is overwhelmingly expected to hike its main interest rate for only the third time since the financial crisis this evening.

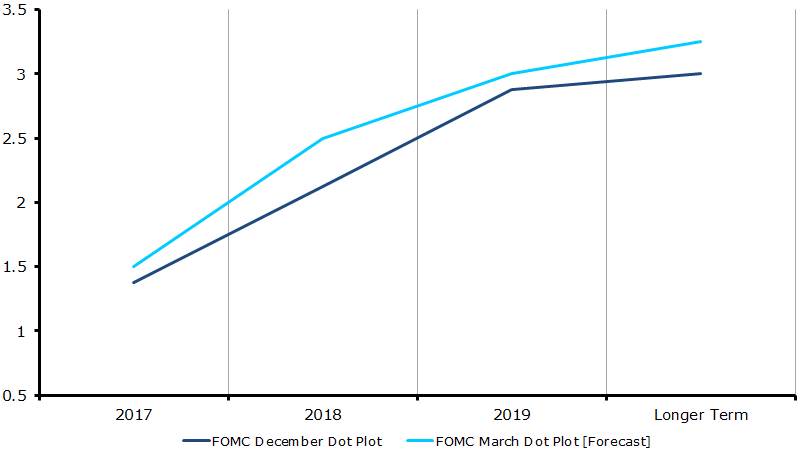

In December, the Fed’s ‘dot plot’ showed that the central bank expected to raise rates roughly 2-3 times in 2017. However, the distinctly hawkish turn in communication from the Fed in the past few weeks means we now expect an upward revision in these projections. We think that the median forecast will be for 4 hikes each year in 2017 and 2018 (Figure 1). We believe investors are fairly unprepared for such an upgrade in rate forecasts and see potential for a sharp US Dollar rally as a result immediately after the release.

Figure 1: FOMC March Dot Plot Forecast

The Netherlands will also go to the polls in its Parliamentary Election today in a particularly busy day of currency market action. Polls will close at 20:00 UK time this evening, with an announcement of the results expected at around 4:00-5:00 UK time on Thursday morning.

A highly fragmented vote is a near certainty. Mark Rutte’s VVD Party goes into the vote marginally ahead in the polls, although it’s very likely that at least five parties will need to team up in order to form a coalition government. The impact on the Euro is likely to be fairly muted, although we could see additional downward pressure on the single currency should far-right PVV leader Geert Wilders perform well. Regardless, we think the chances of his party being involved in any coalition government are fairly remote as things stand.

Major currencies in detail

GBP

Sterling fell to an eight week low against the US Dollar yesterday, although recovered the entirety of its losses this morning.

The prospect of Article 50 being triggered within the next couple of weeks kept the Pound firmly on the back foot yesterday. While Prime Minister Theresa May could start formal talks at any time, it has been reported this may not happen for another couple of weeks. While short term losses for the Pound are fairly likely, we think there remains upside for the Pound with investors facing the prospect of months before any exit terms are agreed.

Meanwhile, the UK labour report this morning showed a modest slowdown in earnings growth and a fall in unemployment. The Bank of England meeting on Thursday will also be in focus.

EUR

The Euro declined 0.2% against the US Dollar during New York trading yesterday evening ahead of today’s Fed meeting.

Industrial production numbers yesterday were fairly disappointing, bucking the recent trend of better-than-expected economic news out of the currency bloc. Output in the industrial sector grew by just 0.6% in the year to January, slightly less than the 0.9% forecast. This was, however, made up by an upward revision in December numbers. Economic sentiment also improved slightly this month, with the index from ZEW increasing to 25.6 from 17.1.

The Euro will be driven almost exclusively by the FOMC meeting today. News out of the Dutch Election could also shift the common currency during Asian trading tomorrow.

USD

The US Dollar was relatively range bound against most of its major peers on Tuesday, with investors reluctant to commit to a position ahead of this evening’s Federal Reserve meeting. The Dollar index rose 0.1% during London trading.

Economic news out of the US remained impressive yesterday ahead of tonight’s Fed meeting. The producer price index came in above expectations, with prices growing 2.2% in the year to February, slightly above the 2% consensus.

The Federal Reserve will undoubtedly dominate trading in the US this evening when it announces its interest rate decision at 18:00 UK time, accompanied by the central bank’s latest economic projections. Janet Yellen’s press conference will follow at 18:30 UK time.