FOMC December Meeting Reaction: Fed accelerates taper, dollar gives up gains

( 3 min )

- Go back to blog home

- Latest

The Federal Reserve announced it will accelerate the wind down of its QE programme, while FOMC members now expect a total of eight rate increases in the next three years, with three of these coming in 2022. Somewhat surprisingly, the dollar sold off after the event, while risk assets rallied.

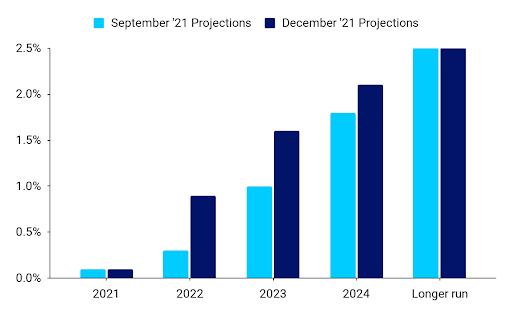

The bank’s latest ‘dot plot’, which shows where each committee member expects rates to be at the end of each year, was revised significantly higher from September. The market was particularly focused on the median dot for 2022, and we expected it to show at least two rate increases compared to a 50/50 split on whether we’re going to see even one interest rate increase that year. In fact, the median now suggests that we may get three increases in 2022, with all 18 members forecasting rates will rise from the effective zero bound. Further expectations moved up as well indicating members foresee three hikes in 2023 and two in 2024 (Figure 1).

Figure 1: FOMC December ‘Dot Plot’ Median Projection [December 2021]

Source: Federal Reserve Date: 16/12/2021

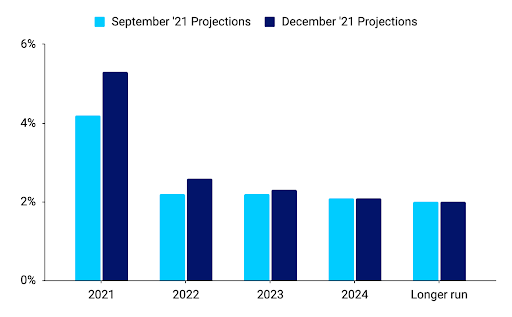

Bank’s economic projections have also undergone some significant changes. The PCE inflation projection for 2021 was revised up with Fed members now seeing price growth of 5.3% compared to 4.2% in September. Most of that increase is expected to come off the back of non-volatile components, as indicated by the shift in the core PCE inflation forecast (up to 4.4% from 3.7% in September). Looking further ahead, PCE inflation is foreseen to decrease to 2.6% in 2022 and 2.3% in 2023, remaining more elevated than previously anticipated, particularly in 2022 (Figure 2). Policymakers expect continued progress in the US labour market, forecasting the unemployment rate to decline to 4.3% in 2021 compared to 4.8% in September and 3.5% in 2022 compared to 3.8% from the previous projection. GDP growth projections were the least affected, with members foreseeing somewhat weaker growth in 2021 and 2023, while slightly boosting up the 2022 projection. All in all, the US economy is expected to grow by approximately 0.5% less at the end of the forecast horizon than under the September projections.

Figure 2: FOMC PCE Inflation Projections [December 2021]

Source: Federal Reserve Date: 16/12/2021

Both the statement following the decision as well as Powell during the press conference acknowledged the risks associated with the new virus. Nevertheless, Powell’s tone was quite upbeat as he said that the economy can handle faster taper even with Omicron. . Importantly, the Fed also moved away from calling inflation ‘transitory’, cutting the word from the statement. Powell later mentioned that indeed, ‘there’s a real risk now that inflation may be more persistent’.

Market expectations regarding hikes in 2022 initially increased, but have largely normalised since, particularly looking at next year-end. Overall the market is almost fully pricing-in three hikes for 2022 but seems split on whether rate hikes will start in March or May.

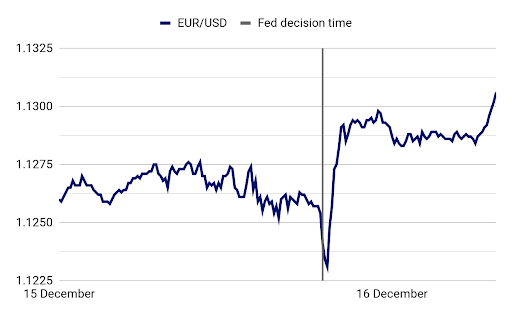

The FX market reaction to the news was quite puzzling as after an initial appreciation following the decision, the dollar gave up its gains selling off during the press conference. The EUR/USD ended the day 0.3% higher, returning above the 1.13 level early the next day (Figure 3). It most likely indicates that the market positioning going into the meeting was quite one-sided and we had a case of ‘buy the rumour, sell the news’. Behaviour of other asset classes (particularly EM currencies and US equities) seems to confirm this was indeed the case as both have rallied following the news from the Fed.

Figure 3: EUR/USD [15/12/2021 – 16/12/2021]

Source: Bloomberg Date: 16/12/2021

Wednesday’s decision day turned out to be quite an interesting one. All in all, it confirms our expectations of relatively rapid monetary policy tightening in the US in the face of stubbornly high inflation. As things stand, we continue to foresee the first rate hike to take place in May, with two or three to follow in 2022.