FOMC December Meeting Reaction: No rate cuts on the horizon

- Go back to blog home

- Latest

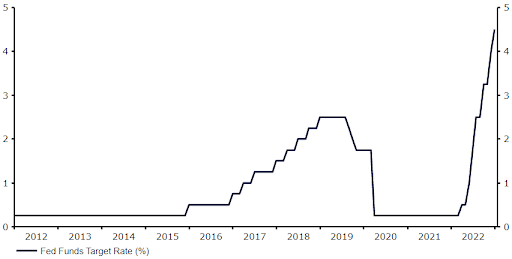

The Federal Reserve took its first baby steps towards ending its aggressive interest rate hike cycle on Wednesday, although it failed to deliver a clear dovish pivot.

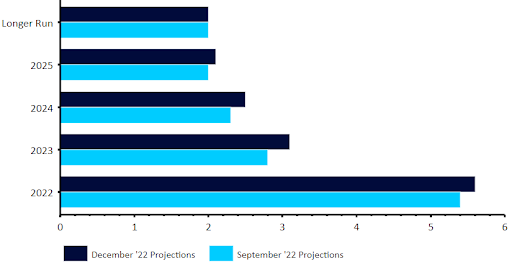

As we mentioned in our FOMC preview report, investors were fully focused on the bank’s updated ‘dot plot’, which shows where each member of the committee expects rates to be at the end of each year. As expected, the median dot for 2023 was revised higher from the previous set of projections in September – a common theme this year. Fed members now expect rates to end 2023 at 5.1% (up from 4.6%), before being lowered to 4.1% by the end of 2024 (from 3.9%) and 3.1% in 2025 (from 2.9%). The vast majority of members (all but two) now see at least 75bps of hikes next year, which is slightly more than markets had priced in prior to the meeting. While there remains no clear consensus on rates in 2024, the majority see at least 100bps of cuts.

Figure 1: Fed Funds Target Rate [%] (2012 – 2022)

Source: Refinitiv Datastream Date: 14/12/2022

Despite the downside surprises in each of the last two CPI reports, the Fed is not ready to claim victory over inflation just yet. Chair Powell noted during his press conference that the bank would need to see ‘substantially more evidence’ of a decrease in price pressures. Once again, the bank’s PCE inflation forecasts were revised higher, with the Fed’s preferred measure of price growth now not expected to return to the 2% target until after the end of 2025. As expected, the 2023 GDP growth forecast was also revised lower to 0.5% (from 1.2%), with Powell saying that the US economy had slowed ‘significantly’ from last year.

Figure 2: FOMC PCE Inflation Projections [December 2022]

Source: Refinitiv Datastream Date: 14/12/2022

We believe that the key takeaway from the announcement was, however, the Fed’s apparent lack of appetite for interest rate cuts. Crucially, the dot plot suggested that FOMC members don’t expect to begin cutting interest rates until 2024, which was confirmed by Powell during his presser. Powell also stressed that he didn’t expect the committee to consider rate cuts until the FOMC was confident that inflation was moving down ‘in a sustained way’. The Fed has failed to clarify exactly what this would entail, although clearly the two softer than expected CPI reports in October and November are nowhere near enough to warrant a change in course.

We see Wednesday’s FOMC announcement as mildly hawkish relative to the market’s expectations, insofar as it failed to deliver a clear dovish pivot. The dollar initially traded modestly higher, although these advances were quickly erased following Powell’s press conference. In our view, the Fed is keeping its options open. We suspect that it will deliver either a 25 or another 50bp move in February, before ending the tightening cycle with a quarter of a percentage point hike in March – this will depend entirely on inflation prints in the interim. Either way, the bottom line is that the Fed doesn’t expect to begin cutting interest rates at all next year, which is slightly more hawkish than priced in by markets.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports