FOMC February Meeting Preview: Time to pause and take stock

- Go back to blog home

- Latest

The Federal Reserve is widely expected to slow the pace of its interest rate hike cycle on Wednesday, but the key question is whether it will hint that a pause may be on the way following its subsequent meeting in March.

Leading into Wednesday’s announcement, financial markets are fully pricing in a 25bp move, with an additional hike of the same magnitude in March more than 80% priced in. We believe that this has been relatively well telegraphed by Fed officials during their pre-blackout period communications. For the most part, FOMC members have taken on a more dovish tone of late, with a handful, most recently the likes of Waller and Brainard, acknowledging that progress had been made on inflation and that the time was right for a slowdown in the pace of hikes. At its most recent meeting in December, the Fed raised rates by 50bps, although it refrained from delivering an explicit dovish pivot.

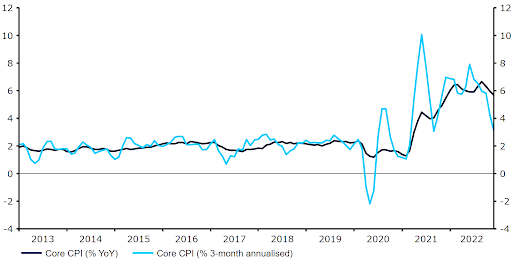

Clearly the main factor behind the Fed’s dovish shift has been the cooling in US inflationary pressures. While we view the recent move lower in headline inflation as encouraging, we see this largely as a consequence of the sharp drop in energy prices. In our mind, the downtrend witnessed in core inflation is a far more meaningful development, and one that we believe FOMC members will assign greater significance to. Our favoured metric, the three-month annualised rate of core CPI inflation, dropped to just 3.1% in December, its lowest level since September 2021. The December print for the Fed’s preferred measure of price growth, the core PCE index, also ticked lower to 4.4%, which is an equally encouraging step in the right direction.

Figure 1: US Core Inflation Rate (2013 – 2022)

Source: Refinitiv Datastream Date: 30/01/2023

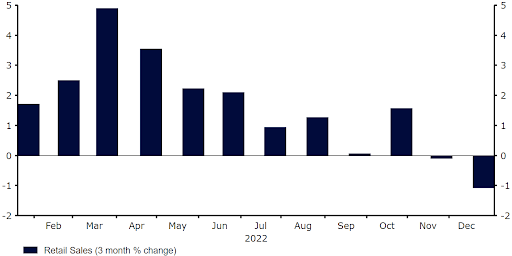

We expect chair Powell to recognise this easing in price pressures on Wednesday, and cite it as a key rationale for a less aggressive approach. The Fed may also acknowledge the slight deterioration in a handful of indicators of economic activity, particularly on consumer spending, while again hinting at the possibility of a recession – some officials may see this as a prerequisite to bring inflation down in a sustainable manner.

We still contend that any downturn will be rather mild, particularly in light of the resilience in the US labour market, which continues to be characterised by solid job creation levels and low unemployment. This assumption was supported by last week’s strong fourth quarter GDP print (+2.9% annualised), December durable goods orders (+5.6% MoM) and weekly initial jobless claims (an eight month low 186k), all of which beat expectations.

Figure 2: US Retail Sales [3 month % change] (2021 – 2022)

Source: Refinitiv Datastream Date: 30/01/2023

The Fed will not be releasing any macroeconomic or interest rate projections this week, with the next ‘dot plot’ not due until the bank’s March meeting. We believe that the reaction in the US dollar will, therefore, be almost entirely dependent on the Fed’s accompanying rhetoric, including chair Powell’s press conference. The key question will be whether the Fed hints that a pause in hiking is near. Should the bank tweak its language surrounding the need for ‘ongoing increases’ in the fed funds rate, then this could hint at a pause in the hiking cycle after the March meeting. In our view, this would be seen as bearish for the dollar, and could extend the currency’s recent move lower against most currencies.

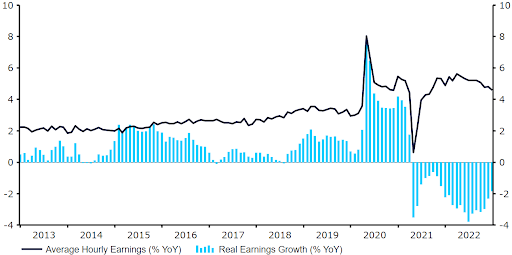

That said, the Fed may once again keep its options open, as it did in December, and potentially leave the door ajar to an additional, final 25bp hike in May, should upcoming data dictate. While this would be in line with the Fed’s December ‘dot plot’, we think that this would likely be perceived as bullish for the US dollar, as it is more aggressive than currently priced in by financial markets. At the very least, we think that Powell will stress that there remains work to be done, as Fed members may wish to see a more prolonged easing in wages before taking their foot off the pedal completely.

Figure 3: US Average Hourly Earnings (2013 – 2022)

Source: Refinitiv Datastream Date: 30/01/2023

For the time being, we once again expect Powell to push back against expectations for interest rate cuts any time soon. At the time of writing, futures markets are pricing in the first cut in November, which we contest, even at this early stage, appears somewhat hasty, though not entirely out of the question. Following the Fed’s December meeting, chair Powell noted that he didn’t foresee any policy loosening until the committee was ‘confident that inflation is moving down to 2 percent in a sustained way’.

We suspect that Powell will reiterate this view during this week’s press conference, though we think that the Fed’s stance on future hikes will be more significant for currencies, for now. As things stand, we are pencilling in a final 25bp hike in March, though this could change should US inflation not moderate as anticipated.

The FOMC will announce its latest policy decision at 6pm GMT (7pm CET) on Wednesday, with chair Powell’s press conference to follow 30 minutes later.