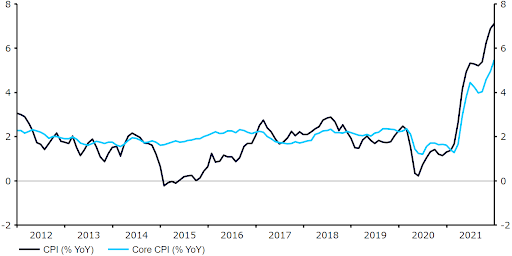

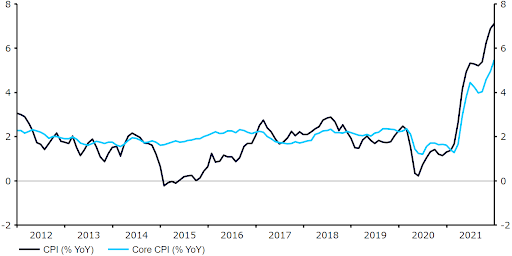

Investor expectations for the pace and timing of Federal Reserve interest rate hikes has been the main talking point in financial markets so far this year.The shift in the FOMC’s monetary policy stance in the past few months has been remarkable. At its September meeting, the Fed indicated that it only expected to raise rates on one occasion in 2022. Since then, however, policymakers have become increasingly more hawkish, as US inflation continues to march to multi-decade highs and price pressures show no signs of abating. At its December meeting, the Fed acknowledged that the spike in prices was no longer seen as ‘transitory’. The bank’s ‘dot plot’ was also revised up significantly, with the median dot suggesting that the Fed is now on course to raise rates at least three times in 2022.The latest data on inflation, the labour market and the omicron variant of COVID-19 further supports the Fed’s hawkish turn. US headline inflation accelerated to 7% in December (Figure 1), its highest level since 1982, with core price growth also jumping to a 30-year high of 5.5%. We believe that the US labour market is also now either at, or close to, levels that can be reasonably deemed as full employment. While the headline payrolls number for December was on the soft side, unemployment has fallen sharply and wages are surging as businesses aim to entice workers. Moreover, the return to the strict lockdowns that have been commonplace since the start of the pandemic also appear unlikely given the low virulence of omicron and sufficient protection provided by booster jabs.Figure 1: US Inflation Rate (2012 - 2022) Financial markets have reacted aggressively to the above, albeit this has not been reflected in a stronger US dollar so far this year. Fed fund futures, which can be used to gauge the extent to which future interest rate moves are priced in by the market, are now fully pricing in a hike in March, and a total of four 25 basis point rate increases during 2022. This has contributed to the sell-off witnessed in Treasuries, which has sent yields sharply higher - the 2 year yield, for instance, has risen to a more two-year high above 1% (Figure 2).Figure 2: US 2-year Treasury Yield (2021 - 2022)

Financial markets have reacted aggressively to the above, albeit this has not been reflected in a stronger US dollar so far this year. Fed fund futures, which can be used to gauge the extent to which future interest rate moves are priced in by the market, are now fully pricing in a hike in March, and a total of four 25 basis point rate increases during 2022. This has contributed to the sell-off witnessed in Treasuries, which has sent yields sharply higher - the 2 year yield, for instance, has risen to a more two-year high above 1% (Figure 2).Figure 2: US 2-year Treasury Yield (2021 - 2022)

Whether an upbeat tone that signals a rather aggressive pace of rate increases in 2022 will be enough to trigger a move higher in the dollar this week remains to be seen. Yet, with markets now fully pricing in a March hike, and doubling down on one move a quarter during the rest of the year, we think that the Fed would have to do something special to trigger any meaningful gains in the greenback this week. One such announcement would be for the Fed to declare an early end to its QE programme, either an immediate one or in February. Given the extent of the inflation overshoot, we see either as entirely possible, particularly given a few committee members were reportedly in favour of a February end date during the December meeting. In our minds, an early QE end would ramp up bets in favour of a 50 basis point move in March and support the dollar on Wednesday, albeit we would still expect a 25 basis point move in such a scenario.Any comments on a balance sheet reduction later this year, known as quantitative tightening (QT), will also be closely watched by investors. We expect the Fed to continue laying groundwork for QT this week, although a formal announcement is still a number of months away, in our view. Higher rates remain the Fed’s primary tool for controlling inflation and we may, therefore, see at least a couple of hikes before a shrinking of the balance sheet commences.The FOMC will announce its latest policy decision at 7pm GMT (8pm CET) on Wednesday, with chair Powell’s press conference to follow 30 minutes later.

Whether an upbeat tone that signals a rather aggressive pace of rate increases in 2022 will be enough to trigger a move higher in the dollar this week remains to be seen. Yet, with markets now fully pricing in a March hike, and doubling down on one move a quarter during the rest of the year, we think that the Fed would have to do something special to trigger any meaningful gains in the greenback this week. One such announcement would be for the Fed to declare an early end to its QE programme, either an immediate one or in February. Given the extent of the inflation overshoot, we see either as entirely possible, particularly given a few committee members were reportedly in favour of a February end date during the December meeting. In our minds, an early QE end would ramp up bets in favour of a 50 basis point move in March and support the dollar on Wednesday, albeit we would still expect a 25 basis point move in such a scenario.Any comments on a balance sheet reduction later this year, known as quantitative tightening (QT), will also be closely watched by investors. We expect the Fed to continue laying groundwork for QT this week, although a formal announcement is still a number of months away, in our view. Higher rates remain the Fed’s primary tool for controlling inflation and we may, therefore, see at least a couple of hikes before a shrinking of the balance sheet commences.The FOMC will announce its latest policy decision at 7pm GMT (8pm CET) on Wednesday, with chair Powell’s press conference to follow 30 minutes later.

Financial markets have reacted aggressively to the above, albeit this has not been reflected in a stronger US dollar so far this year. Fed fund futures, which can be used to gauge the extent to which future interest rate moves are priced in by the market, are now fully pricing in a hike in March, and a total of four 25 basis point rate increases during 2022. This has contributed to the sell-off witnessed in Treasuries, which has sent yields sharply higher - the 2 year yield, for instance, has risen to a more two-year high above 1% (Figure 2).Figure 2: US 2-year Treasury Yield (2021 - 2022)

Financial markets have reacted aggressively to the above, albeit this has not been reflected in a stronger US dollar so far this year. Fed fund futures, which can be used to gauge the extent to which future interest rate moves are priced in by the market, are now fully pricing in a hike in March, and a total of four 25 basis point rate increases during 2022. This has contributed to the sell-off witnessed in Treasuries, which has sent yields sharply higher - the 2 year yield, for instance, has risen to a more two-year high above 1% (Figure 2).Figure 2: US 2-year Treasury Yield (2021 - 2022)

What to expect from the January FOMC meeting?

While all signs suggest that an interest rate hike is coming, we think that the January meeting is too soon for such an announcement - the Fed has already stated it won’t begin raising rates until after the QE programme has ended. Instead, we expect the bank’s communications to pave the way for one at its 15-16 March meeting. There has been speculation that the Fed may decide to front load its hike cycle by raising rates by 50 basis points in March. We think that this is unlikely, and see a 25 basis point move as a more realistic scenario. We expect this week’s communications to provide a clear signal that a move in March is on the way, with multiple rate increases likely to follow during the rest of the year. As things stand, we are pencilling in additional moves in June, September and December, albeit this view remains heavily dependent on upcoming inflation prints. Whether an upbeat tone that signals a rather aggressive pace of rate increases in 2022 will be enough to trigger a move higher in the dollar this week remains to be seen. Yet, with markets now fully pricing in a March hike, and doubling down on one move a quarter during the rest of the year, we think that the Fed would have to do something special to trigger any meaningful gains in the greenback this week. One such announcement would be for the Fed to declare an early end to its QE programme, either an immediate one or in February. Given the extent of the inflation overshoot, we see either as entirely possible, particularly given a few committee members were reportedly in favour of a February end date during the December meeting. In our minds, an early QE end would ramp up bets in favour of a 50 basis point move in March and support the dollar on Wednesday, albeit we would still expect a 25 basis point move in such a scenario.Any comments on a balance sheet reduction later this year, known as quantitative tightening (QT), will also be closely watched by investors. We expect the Fed to continue laying groundwork for QT this week, although a formal announcement is still a number of months away, in our view. Higher rates remain the Fed’s primary tool for controlling inflation and we may, therefore, see at least a couple of hikes before a shrinking of the balance sheet commences.The FOMC will announce its latest policy decision at 7pm GMT (8pm CET) on Wednesday, with chair Powell’s press conference to follow 30 minutes later.

Whether an upbeat tone that signals a rather aggressive pace of rate increases in 2022 will be enough to trigger a move higher in the dollar this week remains to be seen. Yet, with markets now fully pricing in a March hike, and doubling down on one move a quarter during the rest of the year, we think that the Fed would have to do something special to trigger any meaningful gains in the greenback this week. One such announcement would be for the Fed to declare an early end to its QE programme, either an immediate one or in February. Given the extent of the inflation overshoot, we see either as entirely possible, particularly given a few committee members were reportedly in favour of a February end date during the December meeting. In our minds, an early QE end would ramp up bets in favour of a 50 basis point move in March and support the dollar on Wednesday, albeit we would still expect a 25 basis point move in such a scenario.Any comments on a balance sheet reduction later this year, known as quantitative tightening (QT), will also be closely watched by investors. We expect the Fed to continue laying groundwork for QT this week, although a formal announcement is still a number of months away, in our view. Higher rates remain the Fed’s primary tool for controlling inflation and we may, therefore, see at least a couple of hikes before a shrinking of the balance sheet commences.The FOMC will announce its latest policy decision at 7pm GMT (8pm CET) on Wednesday, with chair Powell’s press conference to follow 30 minutes later.

.svg)

.svg)

.svg)