FOMC June Meeting Preview: Will the Fed hint at QE tapering?

- Go back to blog home

- Latest

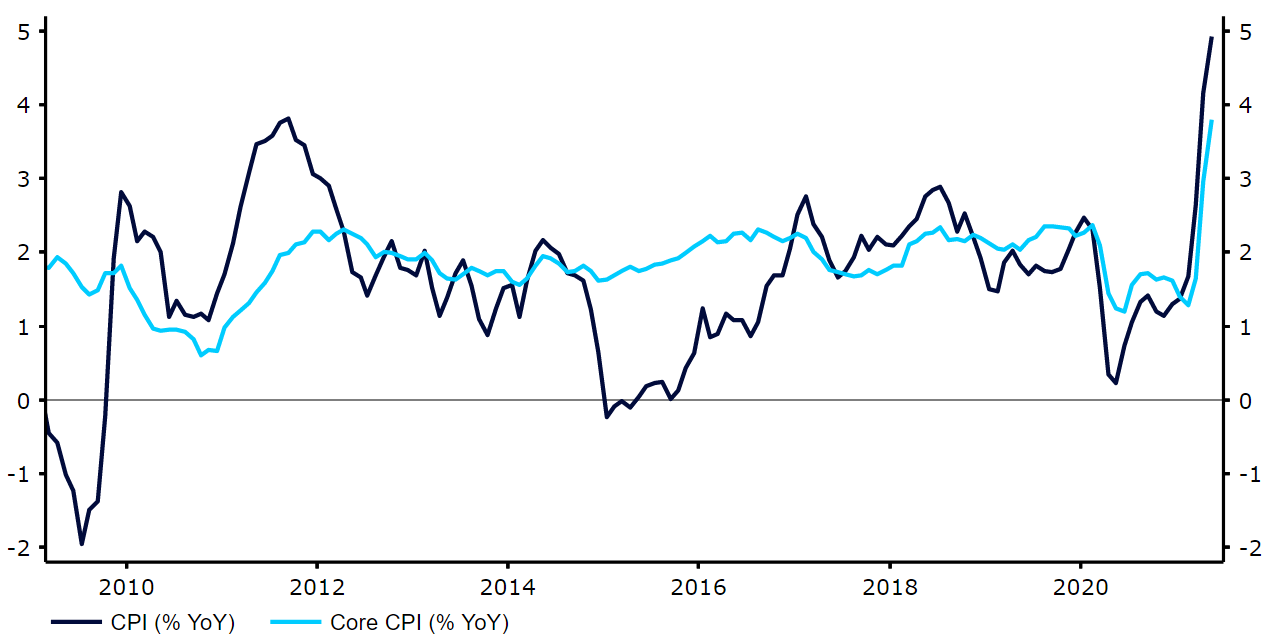

Thursday’s scorchingly hot US inflation reading for May ensures that this week’s FOMC meeting will come under added scrutiny from investors.

Figure 1: US Inflation Rate (2009 – 2021)

Source: Refinitiv Datastream Date: 11/06/2021

So far, FOMC members have taken a relaxed view on the surge in inflationary pressure, with most communicating that the spike in prices will likely prove temporary. That stance will undoubtedly be tested when the bank meets this week. Macroeconomic data out of the US since the last FOMC meeting has been broadly encouraging, which we believe will result in a less dovish assessment than in April. Investors will be on the lookout for any indication that the bank is considering winding down the pace of asset purchases. We see a possibility that Chair Jerome Powell will state that the board has begun discussion on a timetable for tapering, but an official announcement is unlikely until later in the year, possibly September.

In light of the recent upside surprises in inflation, we think that the Fed will also announce a sizable upward revision to its 2021 inflation forecasts on Wednesday, with modest increases in its longer-term projections. Arguably the biggest takeaway of the meeting will, however, be the Fed’s updated interest rate projections – the ‘dot plot’. While we think that most Fed members will be determined to keep rates on hold until they see signs of a sustained increase in prices, we also expect a handful of voting members to upgrade their interest rate projections over the forecast period. This is likely to result in a median dot that shows hikes before the end of 2023, versus the March projections that signalled no hikes until 2024.

Overall, we expect a slightly less dovish tone from the Fed’s statement and Chair Powell’s press conference than in April. As far as the FX reaction is concerned, any indication from Powell that the bank is discussing a timetable for tapering its QE programme could be a dollar positive. Sizable upgrades to the bank’s inflation and interest rate projections could also trigger a USD rally and we therefore go into the meeting seeing risks to the dollar as moderately skewed to the upside.