FOMC March Meeting Preview: How will Fed react to rising yields?

- Go back to blog home

- Latest

This Wednesday’s FOMC meeting will be the main event risk in the FX market this week.

We outline below what we think will be the three biggest talking points from this Wednesday’s meeting, and the impact it could have on the FX market.

Powell’s comments on the bond market sell-off

In contrast to his peers at the ECB, Powell has adopted a relaxed stance on the sharp sell-off in global bond markets so far in 2021, which has seen the US 10-year Treasury yield jump to a more than one-year high above 1.6% (Figure 1). Speaking at the beginning of the month, Powell noted his view that the sell-off was not yet disorderly, although he also stated ‘if conditions do change materially, the committee is prepared to use the tools that it has to foster achievement of its goals.’

Figure 1: US 10-Year Treasury Yield (March ‘20 – March ‘21)

Source: Refinitiv Datastream Date: 15/03/2021

Unlike ECB President Lagarde, we do not think that Powell will attempt to forcefully talk down bond yields this week. We think that he will likely instead use language that both tempers inflation expectations and calms bets in favour of both higher rates and an imminent unwinding in asset purchases. He will no doubt reiterate that the Fed remains in a holding pattern, while pointing to significant slack in the economy and stressing that any increases in inflation will be temporary. We expect him to once again state that the Fed remains a long way off achieving its goals of full employment and inflation averaging 2% over time.

Updated GDP and inflation projections

Market participants will also be closely watching the release of the FOMC’s revised growth and inflation projections on Wednesday. Macroeconomic data out of the US economy has largely surprised to the upside in the past few weeks, with an easing in virus restrictions and the country’s impressive vaccine rollout causing investors to price in higher growth in the coming months. President Biden’s recently approved $1.9 trillion stimulus package, which will include a direct payment of $1,400 to Americans, will also support activity this year and could be set to trigger meaningful employment gains before the year is out. We therefore expect to see a fairly significant upward revision to the 2021 growth forecast from the 4.2% pencilled in back in December, and a downward revision to the unemployment projection.

On inflation, there is a general view that an overshooting of the Fed’s 2% target is on the cards in the coming months, so an upward revision to the 2021 forecast is likely this week. US core inflation surprised modestly to the downside in February, falling to an eight-month low 1.3% year-on-year. This downtrend is, however, expected to reverse in April, twelve months on from the strict shutdowns that closed the economy and halted consumer spending activity. The big concern for investors will not be whether inflation exceeds the Fed’s target, but for how long. We expect both the Fed’s projections and accompanying communications to stress that this is likely to prove temporary and driven, at least in part, by one-off increases in energy prices.

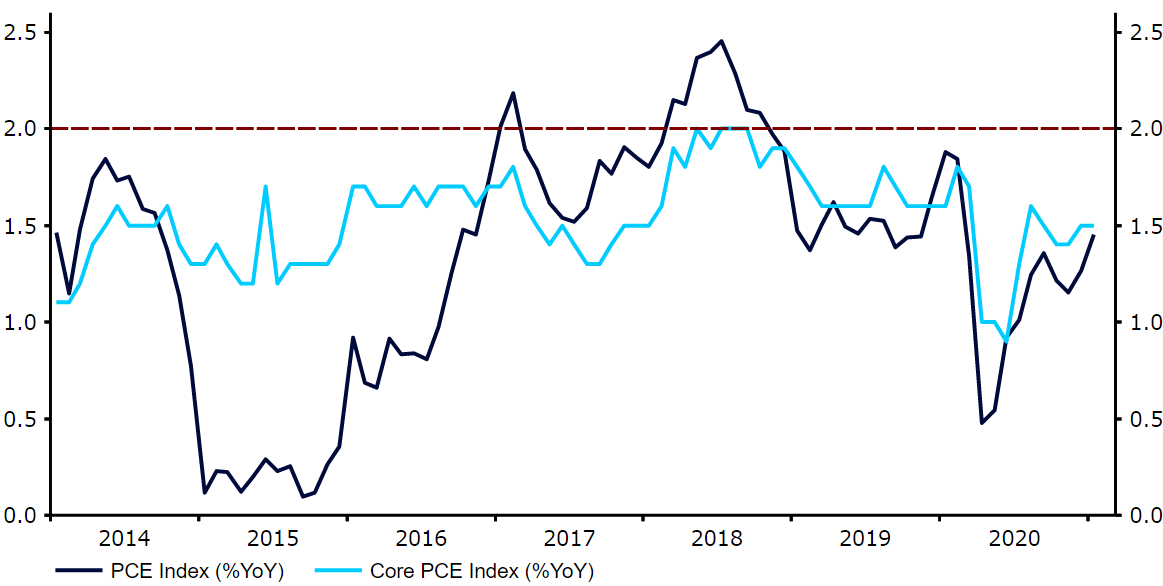

We think that the Fed will be comfortable with inflation running higher than the central bank’s 2% target this year, provided they view it as merely transitory. It’s worth remembering that the bank’s preferred measure of inflation, the PCE index, has undershot 2% in every month since October 2018 (Figure 2). This ensures that a fairly prolonged period of above-target inflation would be required for this measure to average more than 2% over time.

Figure 2: US Inflation Rate (2014 – 2021)

Source: Refinitiv Datastream Date: 15/03/2021

Revised interest rate projections

In tandem to its macroeconomic projections, the FOMC will also be releasing its quarterly interest rate forecasts (its ‘dot plot’) at this week’s meeting. At the December meeting, only one of the seventeen Fed members expected a rate hike in 2022, with five seeing rate increases by the end of 2023 (Figure 3).

Figure 3: FOMC ‘Dot Plot’ [December 2020]

Source: Refinitiv Datastream Date: 15/03/2021

While we see it as unlikely that the median forecast will show the first hike in 2023, we do at least expect a handful of additional members to pencil in higher rates over the next three years. A shift to the median dot to show hikes before 2024 would be more in line with current market pricing that has one full hike priced in for Q1 2023. This would, however, go against the recent narrative from Chair Powell, who has insisted that rates will remain unchanged for the foreseeable future.

How could the US dollar react?

Overall, we think that the Fed will try to not rock the boat too much at this week’s meeting and will leave any meaningful alterations to its forward guidance to the summer. The key is instead likely to be whether Powell can convince investors that the central bank will overlook temporary increases in US inflation. If he can successfully do so, then bond yields would likely fall, as would the US dollar. By contrast, a set of communications that show a complete lack of concern for higher long-term Treasury yields would probably lead to another sell-off in fixed income. Historically, one would expect the latter scenario to be positive for the US dollar, but it is not entirely clear to us that an openly inflationist Federal Reserve should be bullish for the greenback.