FOMC May Meeting Reaction: Fed hikes again, but markets underwhelmed

- Go back to blog home

- Latest

The US dollar exhibited classic traits of a ‘buy the rumour, sell the fact’ reaction following Wednesday’s FOMC meeting, as we thought might be the case.

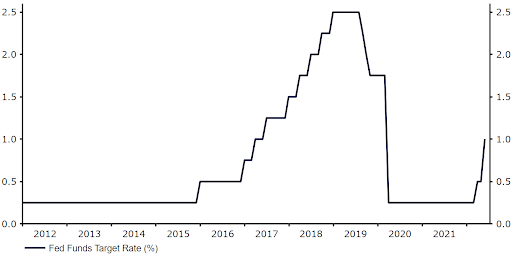

Figure 1: US Fed Funds Rate (2012 – 2022)

Source: Refinitiv Datastream Date: 05/05/2022

On the future path of monetary policy, Powell noted that 50 basis point hikes were likely to be on the table at the next two meetings in June and July. He did, however, say that the Fed did not, and is not, considering larger 75 basis point moves in rates. This was a slight disappointment for some market participants, who had expected the Fed to leave this open as a possibility at future meetings. Powell didn’t go into specifics about why this is the case, although with Fed officials seeing the ‘neutral’ fed funds rate at somewhere between 2-3%, hikes of 50 basis point increments should get them there pretty quickly.

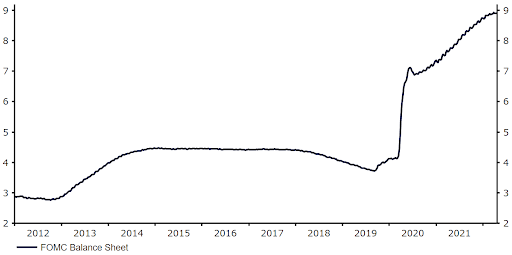

In addition, the FOMC also confirmed its timetable for unwinding the bank’s massive $9 trillion balance sheet, which ballooned during the early stages of the COVID-19 pandemic. The balance sheet runoff, a process known as quantitative tightening (QT), will commence in June at an initial pace of $30 billion a month for Treasuries and $17.5 billion for mortgage-backed securities (MBS). This pace will then double after three months (ie. from September) to $60 billion and $35 billion a month respectively – seen by the Fed as the maximum QT they will do.

Figure 2: Federal Reserve Balance Sheet (2012 – 2022)

Source: Refinitiv Datastream Date: 05/05/2022

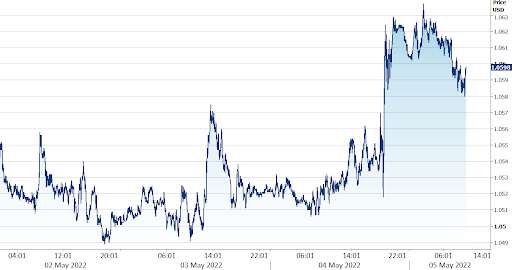

Overall, Wednesday’s communications from the Fed remained hawkish, although market expectations were so high that the only path for the dollar was lower. Leading up to the meeting, fed fund futures were fully pricing in a 50 basis point rate hike, with more than 250 basis points of rate increases seen during the remainder of the year. The Fed’s admission that 75 basis point moves are off the table at upcoming meetings was, therefore, a disappointment for markets, and the main reason why we think the US dollar sold-off following Powell’s press conference. EUR/USD, for instance, rose by over three-quarters of a percent at one stage, with the pair now hovering around the 1.06 level.

Figure 3: EUR/USD (02/05/22 – 05/05/22)

Source: Refinitiv Datastream Date: 05/05/2022

With regards to future policy moves, we think that the Fed will continue to move in 50 basis point increments in at least the next two FOMC meetings on 15th June and 27th July. Beyond then, the size of additional hikes (25 bps vs. 50 bps) will likely be dependent on upcoming US inflation prints. Should inflationary pressures ease more rapidly than the Fed expects, then 25 basis point moves from the September meeting onwards may be sufficient.

Regardless, we continue to expect additional hikes at every FOMC meeting during the remainder of the year, which would take rates towards the upper end of the Fed’s estimate of the ‘neutral’ level. We do, however, again stress that market expectations are very high and, as we witnessed on Wednesday, we think there is much more room for the Fed to fall short of market pricing, rather than exceed it.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports