FOMC November Meeting Preview: Taper time is upon us

( 4 min )

- Go back to blog home

- Latest

The Federal Reserve is all but certain to announce a tapering of its quantitative easing programme at its policy meeting on Wednesday.

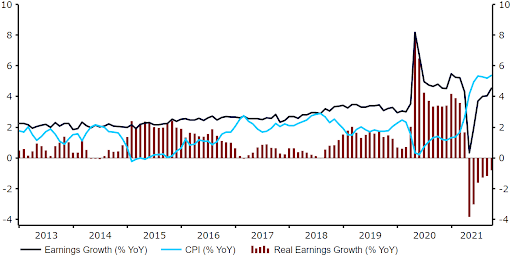

With the easing in inflationary pressures yet to materialise, the case for a tightening in the Fed’s asset purchasing programme is now very compelling. The headline measure of consumer inflation rose back up to a thirteen year high 5.4% in September, well above the Federal Reserve’s 2% target. Energy prices have risen sharply on the jump in global commodity prices, while a host of sectors continue to experience acute supply shortages following the removal of shutdown measures. Of the 26 subindicies, 24 experienced annual price growth of more than 2.5% in September. This surge higher in prices is not only eroding real returns, but also means that real earnings growth remains negative (Figure 1).

Figure 1: US Inflation Rate & Real Earnings Growth (2013 – 2021)

Source: Refinitiv Datastream Date: 28/10/2021

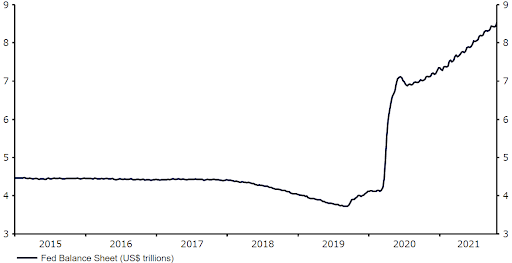

We expect the unwinding in the pace of net asset purchases to be a relatively gradual one – policymakers will certainly not wish to trigger another ‘taper tantrum’, as it was dubbed when the Fed began to remove its financial crisis stimulus in 2013. The Federal Reserve is currently adding approximately 120 billion dollars worth of assets to its balance sheet every month as part of its QE programme, $80 billion in US Treasuries and $40 billion in mortgage-backed securities (MBS). We are in agreement with the general consensus, and think that these net purchases will be reduced by a total of $15 billion a month ($10 billion in Treasuries and $5 billion in MBS). This would be in line with the discussions had by FOMC participants in September, as outlined in the latest meeting minutes. At this pace, net purchases will be wound down to zero in around eight months, or by mid-2022 depending on the start date.

Figure 2: Federal Reserve Balance Sheet (2015 – 2021)

Source: Refinitiv Datastream Date: 28/10/2021

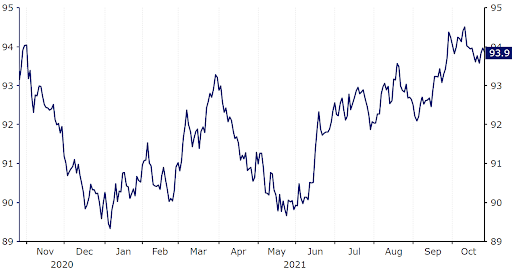

With a taper announcement fully priced in by the market, the US dollar reaction may be dependent on both the pace of the reduction in asset purchases and the timing of when the process will begin. A faster-than-anticipated reduction in net purchases would be bullish for the dollar, as it would bring forward expectations for the first interest rate hike, while a more cautious one would likely trigger a sharp sell-off in the greenback. We think that the process will begin in mid-November, with any material delay to this timetable likely to be perceived as a dollar negative. One of the recent downside risks to the dollar has been the market’s view that the Fed is on course to lag behind most of its G10 peers in raising interest rates. The FOMC has already indicated that it won’t hike rates until after its finished tapering its QE programme, so the longer the tapering process lasts, the greater the delay before the first hike. At the time of writing, futures markets are not pricing in higher US rates until June 2022, later than all but three of its fellow G10 central banks.

Figure 3: US Dollar Index (November ‘20 – November ‘21)

Source: Refinitiv Datastream Date: 28/10/2021

Aside from the QE announcement, Powell’s comments on interest rates and the state of the US economy will also be highly important. Should Powell voice greater concern over rising inflation, and/or indicate that the Fed won’t hesitate to raise rates once it’s done tapering, then the dollar could receive some support on Wednesday. Given the aggressive nature of the recent global inflation spike, we currently go into most central bank meetings thinking that a hawkish surprise is more likely than a dovish one. With that in mind, we think that risks to the immediate reaction in the dollar may be slightly skewed to the upside. Indeed, several participants were said to be in favour of a ‘more rapid moderation of purchases’ according to the September minutes, and we wouldn’t be overly surprised should they make an announcement to that effect on Wednesday.