FOMC September Meeting Preview: What’s left in the policy toolbox?

( 5 min )

- Go back to blog home

- Latest

Since the FOMC’s last official meeting in late-July, the Federal Reserve has unveiled one of the most significant changes to its monetary policy strategy in the last few decades.

With such a significant overhaul already unveiled prior to this week’s meeting, we don’t expect any major shifts in policy from the FOMC on Wednesday. We also don’t expect to see any meaningful changes in forward guidance given the acute uncertainty still surrounding the virus and its impact on the US economy. The Fed will likely continue to stress that interest rates will remain at record low levels for the foreseeable future. Currency traders will therefore instead be paying close attention to the Fed’s accompanying rhetoric on the state of the US recovery and the bank’s revised economic projections.

We outline below the key aspects of the Fed’s communications to look out for this week:

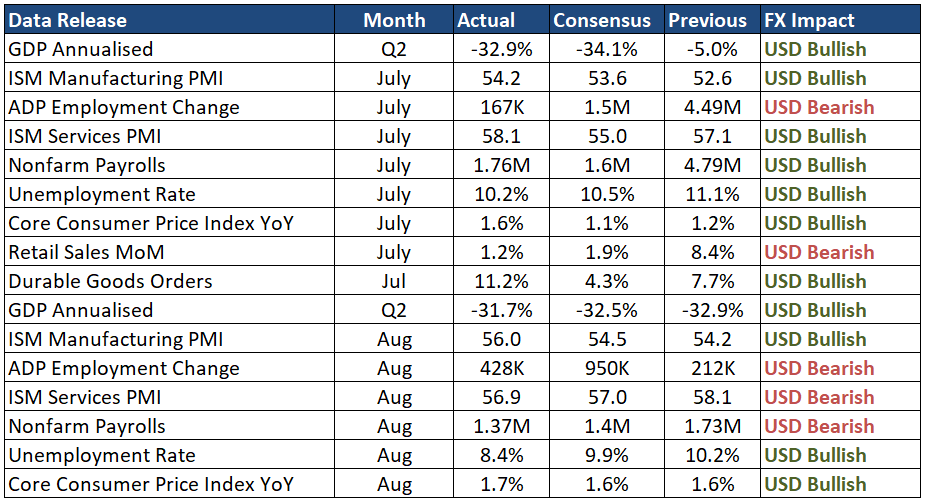

Updated macroeconomic projections

As is customary following every other FOMC meeting, the Fed will be releasing its updated macroeconomic and interest rates projections on Wednesday. Regarding the former, we think that an upward revision to the outlook is likely. At the June meeting, the Fed stated that it expected the US economy to contract by 6.5% this year, with positive growth of 5% to follow in 2021. Since then, the recovery in the global economy has taken place at a generally quicker pace than central bankers had anticipated during the height of the downturn. Notably, the key indicators of business activity, retail sales and employment have all bounced back reasonably strongly following the unwinding of lockdown measures across most US states (Figure 1). We expect the language in the statement to be marginally more upbeat versus July, albeit Chair Powell will acknowledge that their outlook remains highly dependent on the pandemic.

Figure 1: Key US Economic Data Releases (since FOMC’s July meeting)

We think that a rather sharp downward revision to the Fed’s unemployment forecasts is also on the way this week. At 8.4%, the US jobless rate has already undershot the Fed’s 9.3% end of year projection from June. Baring another meaningful tightening in shutdown measures, we think that the jobless rate is likely to continue trending lower in the coming months as industries return to more normal levels of capacity.

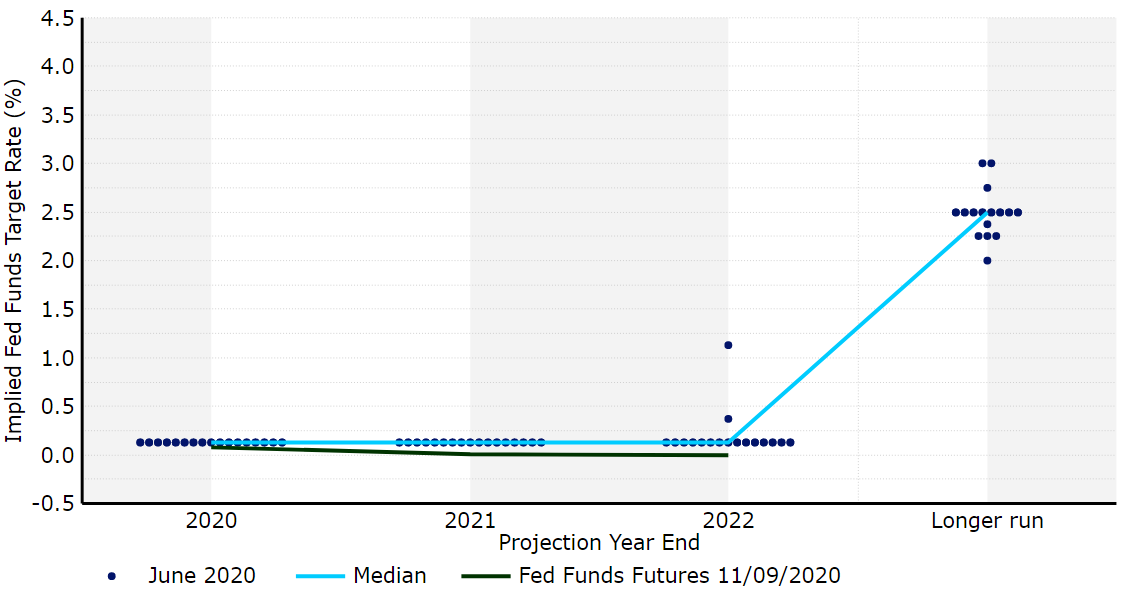

Arguably of greatest interest to currency markets will be the FOMC participants’ revised interest rate expectations (the bank’s ‘dot plot’). We think that the median path for 2022 will remain unchanged at the effective lower bound (Figure 2). The bank will also be forecasting rates through 2023 for the first time this week. While we think that a handful of participants will forecast hikes, we think that the adoption of the Fed’s average inflation target will ensure that the medium dot will also remain at the 0-0.25% range for 2023. This would be in line with market pricing, which has pushed the timing of the next hike all the way out to 2024. At any rate, the FOMC’s view on the potential evolution of rates in 2023 will be the most important single data point to merge from the meeting, in our view.

Figure 2: FOMC Dot Plot [June 2020]

Source: Refinitive Datastream Date: 11/09/2020

What’s left in the Fed’s armoury?

Since the beginning of the pandemic, the Federal Reserve has unpacked just about every tool available in its toolbox in order to support the US economy from the COVID-induced lockdowns. As we noted in our preview report ahead of the July meeting, we think that the well is not completely dry. There has been some speculation in the market regarding the possibility of both negative US rates and the use of yield curve control (YCC), whereby the Fed would buy a particular amount of assets in order to keep bond yields below a certain level.

Recent comments from officials and the Fed itself do, however, suggest that the use of these instruments any time soon appears unlikely. The minutes of the June meeting all but ruled out sub-zero interest rates, while also noting that ‘credible’ forward guidance and asset purchases were sufficient and would limit the benefits from implementing YCC. We think that these comments suggest that the bar is now high for introducing yield curve control, and even higher for the use of negative interest rates. The latter appears almost completely off the table, barring a marked deterioration in economic conditions, which we do not expect.

Overall, we think that the Fed will aim to adopt a largely wait-and-see approach as it pauses for more information on how the spread of the COVID-19 virus is impacting the US economy. We also think that it is likely to wait for more news out of Congress regarding an extension to its unemployment insurance benefit scheme before it makes any significant changes to its forward guidance. As far as the reaction in the FX market is concerned, should the Fed suggest that it is exploring the idea of implementing yield curve control or, far more unlikely, negative rates, we think that investors would be caught completely wrong-footed and sell the dollar aggressively. A more upbeat-than-expected set of macroeconomic projections and/or a surprise median dot that suggests the return to interest rate hikes in 2023 would, by contrast, support the US dollar.

The Fed will be announcing its interest rate decision and releasing its economic projections at 7pm BST (8pm CET) on Wednesday, followed by Powell’s press conference half an hour later.