FOMC September Meeting Reaction: Fed goes big again, with more hikes on the way

( 3 min )

- Go back to blog home

- Latest

The Federal Reserve raised interest rates by another 75 basis points on Wednesday, as expected, while indicating that it still has some way to go before it considers bringing its hiking cycle to a close.

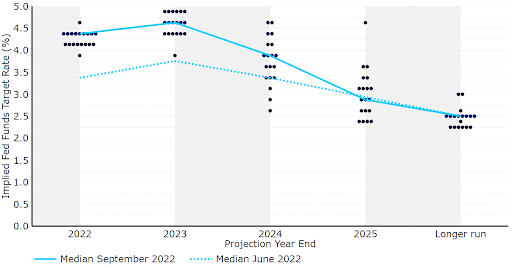

The vote on interest rates was unanimous, no real surprises there. The Fed’s ‘dot plot’ was, however, shifted much higher than investors had anticipated. Policymakers now see the Fed funds rate at 4.4% at the end of 2022, a considerable upward revision to the 3.4% indicated in June. With just two Federal Open Market Committee meetings left this year, this effectively signals another 75bp move in November, followed by a 50bp hike in December. Most economists, including ourselves, had expected the year-end median dot to fall around the 4% mark, or perhaps just above, so this is clearly much more hawkish than anticipated. There also appears to be strong consensus in favour of this hawkish stance among FOMC voting members.

Perhaps of even greater intrigue was the Fed’s view on interest rates in 2023. According to the ‘dot plot’, FOMC members believe that additional tightening will likely be required next year. The median dot for 2023 was raised to 4.6% (from 3.8% in June), effectively seen as the Fed’s view on the terminal rate. This is also higher than most economists had expected, and above market pricing prior to the meeting, which had rates rising to just below 4.5%. While this doesn’t necessarily rule out interest rate cuts at some point next year, it does at least send a signal to markets that a reversal in the hiking process is less likely than many investors had previously believed. Looking further ahead, the Fed is pencilling in a Fed funds rate of 3.9% in 2024 (from 3.4%), 2.9% in 2025 and 2.5% in the longer run (from 2.5%).

Figure 1: FOMC ‘Dot Plot’ [September 2022]

Source: Refinitiv Datastream Date: 22/09/2022

The Fed’s ultra-hawkish stance is a clear signal that it remains concerned about persistently high US inflation, which has proved far more sticky and broad-based than the central bank had expected. Chair Powell’s comments on the US economy were actually rather downbeat, seemingly acknowledging that a recession is on the way, but that the Fed must prioritise bringing down inflation, even if that means a lot of near-term economic pain.

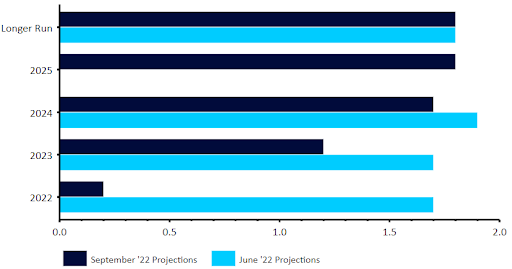

In Powell’s own words ‘no one knows whether this process will lead to a recession or if so, how significant that recession would be’, although he did warn that the chances of a soft landing ‘are likely to diminish’ due to policy being more restrictive for longer. While the Fed’s updated macroeconomic projections do not explicitly point to an outright contraction, the GDP forecasts were revised down significantly. The FOMC lowered its year-end GDP projection to 0.2% (from 1.7%), and now expects growth of just 1.2% in 2023 (from 1.7%) and 1.7% in 2024 (from 1.9%).

Figure 2: FOMC US GDP Projections [September 2022]

Source: Refinitiv Datastream Date: 22/09/2022

The surprise to the hawkish side in the Fed’s interest rate projections caught investors off guard on Wednesday, with the US dollar rallying across the board in the immediate aftermath of the announcement. EUR/USD crashed to fresh two decade lows below the 0.99 level, with sterling also tumbling to fresh 1985 lows around the 1.125 mark on the dollar. That said, the greenback did reverse some of these gains during the press conference, perhaps given the already rather aggressive market pricing for rates in 2023 and Powell’s comment that he believes rates are already at restrictive levels. US bond yields also pulled back following an initial move higher, with the 10-year Treasury yield ending roughly unchanged on Wednesday.

Figure 3: EUR/USD (21/09/2022 – 22/09/2022)

Source: Refinitiv Date: 22/09/2022

n light of Wednesday’s announcement, we are once again likely to be revising our US dollar forecasts higher in the coming days, with US rates set to go much higher than we, and indeed the market, had pencilled in. The Fed remains wholly committed to bringing down inflation, and another 75 basis point interest rate hike seems highly likely at the November FOMC meeting. The magnitude of the hike in December will depend on upcoming US inflation prints but, barring a marked easing in price pressures in the interim, we think we’re likely to see at least another 50bp rate increase, before the hiking cycle is perhaps brought to an end in February. The indication from the Fed that rate cuts may not be on the way until late-2023 at the earliest may, however, continue to keep the dollar well bid, at least in the near-term.