FX market jolted after Trump tests positive for COVID-19

( 4 min )

- Go back to blog home

- Latest

Financial markets were jolted this morning on the news that US President Trump had tested positive for the COVID-19 virus.

A concern for markets will be the fact that Trump is in the group deemed as higher risk, due both to his age and that he is considered overweight. UK Prime Minister Boris Johnson, who is eighteen year Trump’s junior, was out of action for around a month after he tested positive in March, having had a spell in the intensive care unit.

It will be interesting to see how the markets react from here. It is plausible that we could see an unwinding in safe-haven flows in the coming days, should the markets perceive the chances of a Biden victory as increased and the possibility of a close, contested election as lessened. Trump will no longer be travelling to Florida for campaigning today – one of the key swings states that he would almost certainly need to win in order to triumph in the election.

That being said, all this will hinge on news regarding Trump’s recovery. Having a president incapacitated for a prolonged period of time would likely further increase safe-haven flows, chiefly we think to the Japanese yen and Swiss franc. This afternoon’s US labour report, which usually steals all the headlines in the markets, may well take a bit of a back seat today.

Pound rallies on Brexit hopes, Euro Area inflation sinks to new lows

News of Trump’s positive COVID test sent reverberations around financial markets. Equities fell, while higher risk currencies such as the Aussie and New Zealand dollar also both sold-off. Sterling also briefly lost ground, although its mover lower was very temporary and the pound actually rallied back above the 1.29 level this morning.

As we mentioned yesterday, significant issues still remain between the EU and UK in the latest round of Brexit discussions, mostly centreing around state aid. Investors have, however, been encouraged by the possibility of compromise in upcoming discussions. The UK’s chief negotiator David Frost will be meeting Michel Barnier today, while Johnson himself will be in talks with European Commission President Ursula von der Leyen on Saturday in order to discuss the next steps in the process.

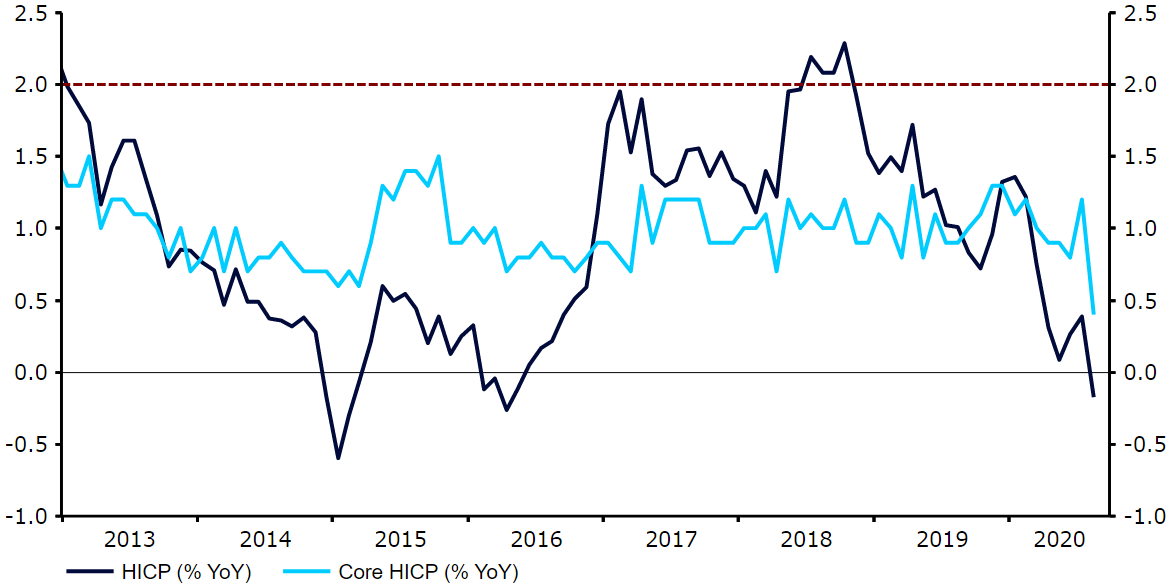

Elsewhere, the euro slipped back towards the 1.17 level versus the dollar following this morning’s disappointing Euro Area inflation numbers. Headline inflation fell further into negative territory (-0.3% YoY), while the core measure sank to just 0.2% from 0.4%, its lowest level on record. This will undoubtedly heap added pressure on the European Central Bank to adopt a more dovish policy in the coming months.

Figure 1: Euro Area Inflation Rate (2013 – 2020)

Source: Refinitiv Datastream Date: 02/10/2020