G10 currencies in holding pattern as interest rates march higher

- Go back to blog home

- Latest

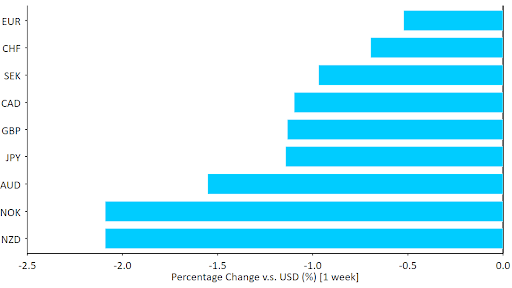

US inflation data came out higher than expected last week, supporting the dollar against most other currencies.

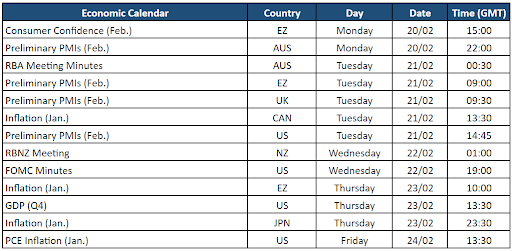

Attention in markets this week remains on macroeconomic indicators. The PMIs of business activity are released worldwide on Tuesday, and we will be paying particularly close attention to continued improvement in the Eurozone. US PCE inflation, the Fed’s preferred measure, comes out on Friday. It will be a light week in terms of central bank communications, save for the minutes of the February Fed meeting released on Wednesday.

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 20/02/2023

GBP

We had a rare positive surprise on the inflation front out of the UK last week. The data on services inflation was particularly encouraging. This is the first sign that UK core inflation may be following the same path as in the US, albeit with a lag, and will now start a gradual downward trend, having peaked in the Autumn of 2022. This is likely to ease pressure on the Bank of England to continue raising interest rates in the coming months, and indeed markets now only see 50bps of additional tightening from the MPC through to the middle of the year.

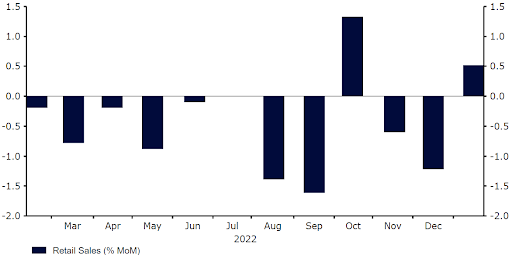

Last week’s inflation report adds to the general positive turn in UK data, in particular from the labour market. Retail sales also surprised positively. All in all, we agree that pessimism around the UK economy is exaggerated, and maintain a positive view on sterling.

Figure 2: UK Retail Sales (2022 – 2023)

Source: Refinitiv Datastream Date: 20/02/2023

EUR

After a quiet week in euro trading, we think that this week’s business activity PMIs have the potential to provide upside risk for the common currency. Consensus is pricing in a very modest increase further into expansionary territory, but this may underestimate the optimistic newsflow coming out of the Eurozone economy on multiple fronts recently, particularly the fading threat of an energy crisis. Of course, this positive surprise would only pile on the pressure for the European Central Bank to make up for lost time in hiking rates, so we remain generally positive on the euro.

This week actually looks set to be a rather eventful one in the Euro Area, with a handful of additional economic data releases likely to be closely scrutinised by market participants. Aside from Tuesday’s PMI prints, the January inflation report (Thursday) may be key in guiding expectations for ECB monetary policy and the euro.

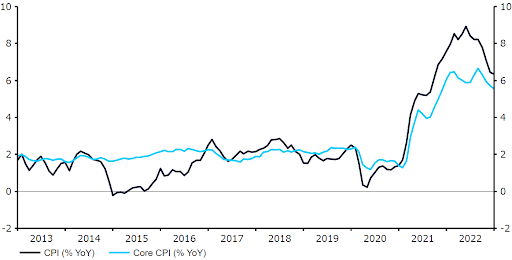

USD

The inflation surprise in the US was not massive, but it was enough to stop the downward trend we have been highlighting in core inflation, the most reliable indicator of future inflation. Core inflation indices seem to be stabilising north of 4%, wages have finally caught up, and it seems that quite a bit of work remains to be done by monetary policy in order to bring inflation back towards Fed targets.

Figure 3: US Inflation Rate (2013 – 2023)

Source: Refinitiv Datastream Date: 20/02/2023

The Fed seems to agree, and is pushing back strongly against any thought that hikes are nearly over or, even less plausible, that the central bank will be in position to cut rates any time soon. We think it is remarkable that the dollar did not rally significantly this week, an indication that perhaps its recent countertrend rally is exhausted.

JPY

The yen was one of the underperformers in the G10 last week, as markets reacted to the appointment of Kazuo Ueda as the new Bank of Japan governor. Investors had initially greeted word of his selection positively a week last Friday, although the realisation that little is currently known about Ueda contributed to a retracement in these gains last week.

Ueda and his two deputies, Uchida and Himino, will be making their first public appearances since their nomination during parliamentary hearings on Friday. This could be a key event for the yen, as it should give markets a clearer indication as to their respective policy stances, notably their view on whether higher rates may be required in Japan later in the year. January inflation data will also be released towards the end of the week, with economists eyeing a fresh multi-decade high in both the headline and core numbers.

CHF

The Swiss franc ended last week lower against a broadly stronger euro, although it suffered only minor losses. Swiss inflation data took centre stage last week. A larger-than-expected increase in consumer prices in January was followed by the slight uptick in producer and import prices, which rose by 3.3%. While Swiss inflation is much lower than almost everywhere else, it remains too high for comfort for the SNB, and that is likely to ensure that further policy tightening remains on the cards in the near term.

Incoming macroeconomic data and comments from policymakers will be key in guiding the market’s expectations for the extent of additional SNB rate hikes. The economic calendar is rather light this week, so focus will be mainly on outside news. That said, January trade data, which will be released on Tuesday, could be worth monitoring.

AUD

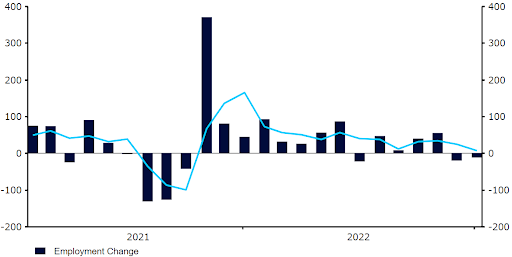

A rather disappointing Australian labour report contributed to the underperformance in the Aussie dollar last week, which traded lower against most of its G10 counterparts. Economists were eyeing up a rebound in job creation last month, though in the end we got a second straight contraction (-11.5k) and a downward revision to the December number (-20k from -14.6k). To make matters worse, the unemployment rate also shot up to 3.7% last month for the first time since May.

The disappointing jobs data may take pressure off the Reserve Bank of Australia when it next meets at the beginning of March. RBA governor Lowe did, however, stay the course during his speech last week, noting that additional hikes are required to bring inflation back down to target. For now, another 25bp move looks likely next month, though the path of policy beyond then is less clear, which could lead to choppy trading in AUD in the coming weeks.

Figure 3: Australia Employment Change (2022 – 2023)

Source: Refinitiv Datastream Date: 20/02/2023

NZD

Wednesday’s Reserve Bank of New Zealand meeting will be one of the key risk events in markets this week. Markets have tempered their expectations for the meeting, and are now only pricing in a 50bp hike from the RBNZ on Wednesday. We think that concerns surrounding the economic impact of Cyclone Gabrielle may prevent a hawkish surprise, with the bill from the natural disaster expected to top A$9 billion.

Indeed, most recent indicators, particularly on the labour market and business activity, have been rather disappointing, which could encourage a shift towards more dovish forward guidance. With this in mind, we think that risks to the New Zealand dollar may be slightly skewed to the downside leading into this week’s RBNZ meeting.

CAD

Bank of Canada governor Macklem continued to strike a hawkish tone during his communications last week. He noted that an overheating economy was continuing to put upward pressure on prices, while failing to rule out the possibility of additional hikes, despite seemingly closing the door to further tightening at each of the past two BoC meetings. This is the type of unclear and muddled communications that market participants despise, so it will be interesting to see whether this is reflected in a weaker CAD in the coming weeks.

Tuesday’s inflation report will be the main focal point of trading in Canada this week. We suspect that a fairly significant upside surprise will be required in both the headline and, in particular, core inflation print in order to bring another rate hike from the BoC into view.

SEK

Data released in Sweden last week showed that high inflation and rising interest rates are starting to weigh on the economy. According to the employment report for January, the unemployment rate rose to 7.6%, its highest level in nine months. This, together with a deterioration in market sentiment that did not favour risk currencies, caused the krona to depreciate against the euro, with the EUR/SEK pair breaking above the 11.2 level.

The minutes of the last Riksbank meeting will be released today. At its February meeting, the bank adopted a more aggressive stance than previously anticipated, as its updated projections now put the terminal rate at 3.33% versus the 2.84% previously pencilled in. Should the minutes confirm the Riksbank’s shift to a more hawkish stance, then the krona could receive some support.

NOK

Lower oil and natural gas prices continue to weigh on the Norwegian krone. Last week the currency depreciated sharply against the euro, falling to its lowest level since November 2020, although it has since recovered some of its losses.

Data released last week showed that Norwegian GDP grew by 0.2% in the final quarter of last year. Despite marking the third consecutive quarter of expansion, it was the slowest pace since Q1 2022, in part due to a slowdown in petroleum activities and contraction in net trade. With growth slowing down, we see it as unlikely that Norges bank will change its dovish stance, despite the recent increase in domestic inflation. With no major data releases this week, we expect the krona’s value to remain dependent on commodity prices and market risk sentiment.

CNY

The yuan ended last week lower against the US dollar, and roughly in the middle of the emerging market currency performance tracker. As expected, both China’s MLF and LPR rates remained unchanged. Instead, the bank focused on liquidity injections, by providing additional cash via 1-year loans and ramped-up short-term reverse repo offers. The PBoC appears determined to ensure funding conditions remain favourable so as not to jeopardise the economic recovery.

While the ‘balloon saga’ could be over, the US-China relationship may be at risk as a consequence of the ongoing Russia-Ukraine war. This can be inferred from comments made by US Secretary of State Anthony Blinken, who met with China’s top diplomat, Wang Yi, on the sidelines of a global security conference in Munich on Saturday. The US appears increasingly concerned about the China-Russia relationship, and the prospect of China providing lethal aid to Russia to aid its war effort.

Economic Calendar (20/02/2023 – 24/02/2023)

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports