G3 FX Forecast Revision 2021

( 13 min )

- Go back to blog home

- Latest

News on the COVID-19 pandemic has been largely positive so far in 2021, creating a bullish environment for risk currencies and a negative one for safe-havens.

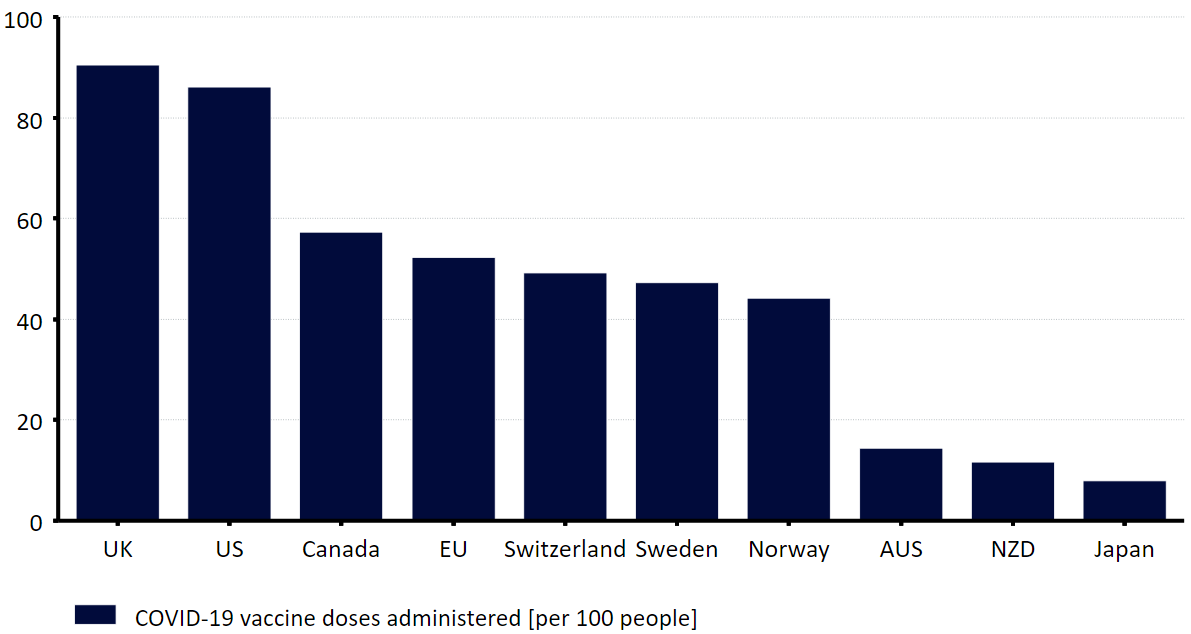

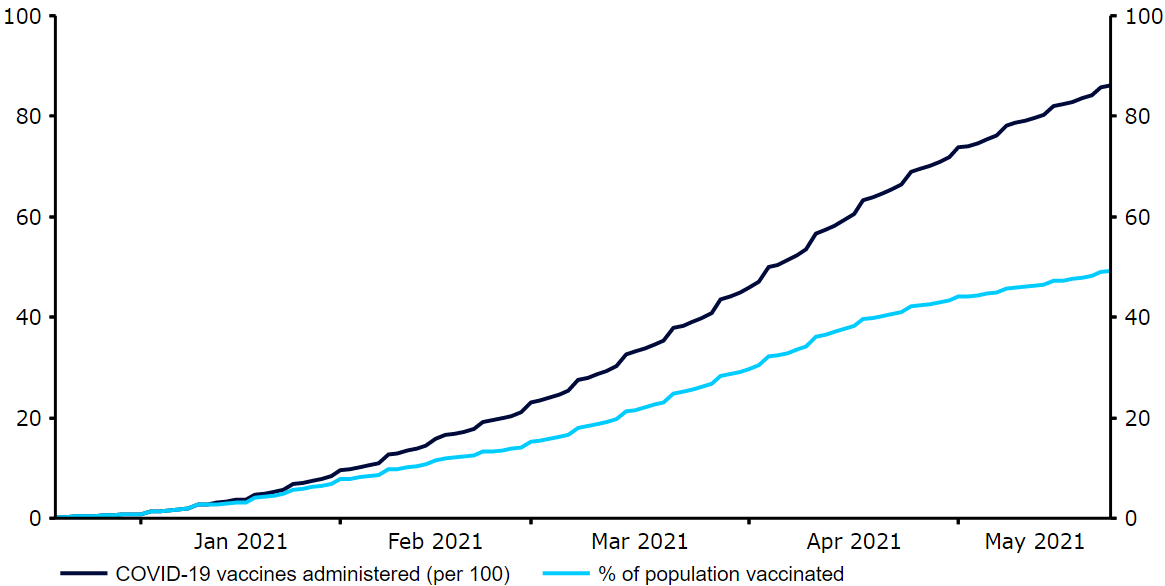

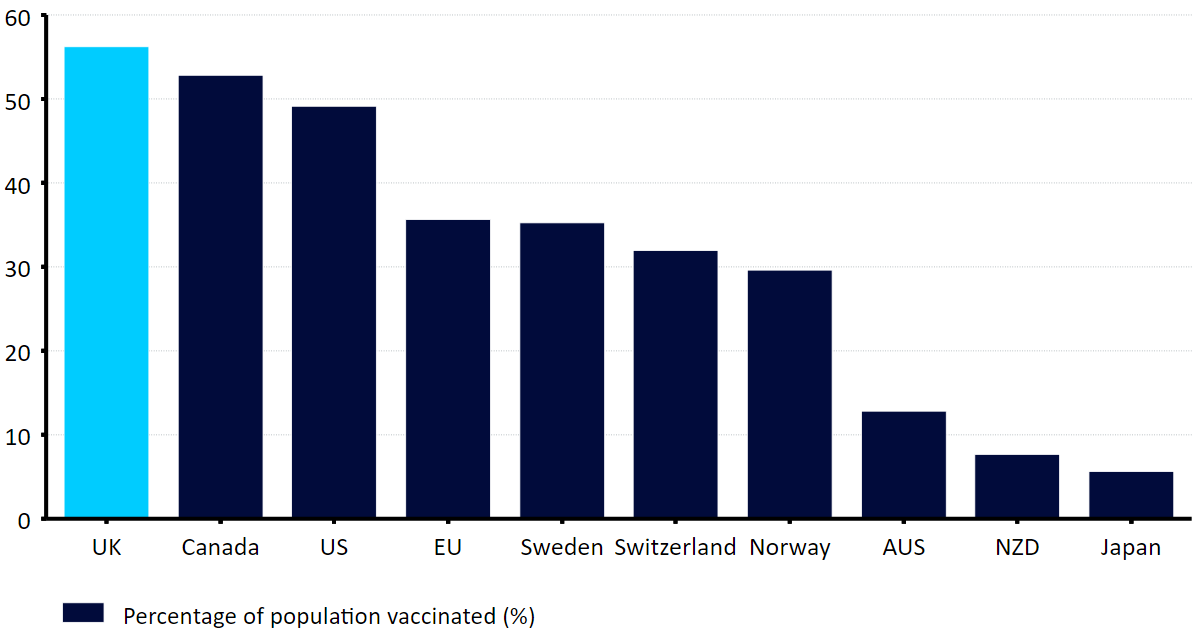

Figure 1: G10 COVID-19 Vaccines Doses Administered (per 100 people)

Source: Refinitiv Datastream Date: 26/05/2021

A combination of the immunity levels built up through vaccinations and a sharp decline in rates of virus contagion has allowed a fairly material unwinding of containment measures in the UK and, to an even greater extent, the US. This is evident in the COVID-19 Government Response Stringency index, which is currently around the lowest that it has been in both countries since March 2020 (Figure 2). The US economy has, in particular, managed to power ahead of most of its major peers in the past few months, expanding at a very healthy clip again in the first quarter of the year. This has raised a few concerns among market participants that the US economy may be at risk of overheating, particularly given the extraordinarily accommodative policy stances adopted by both the Federal Reserve and the US government.

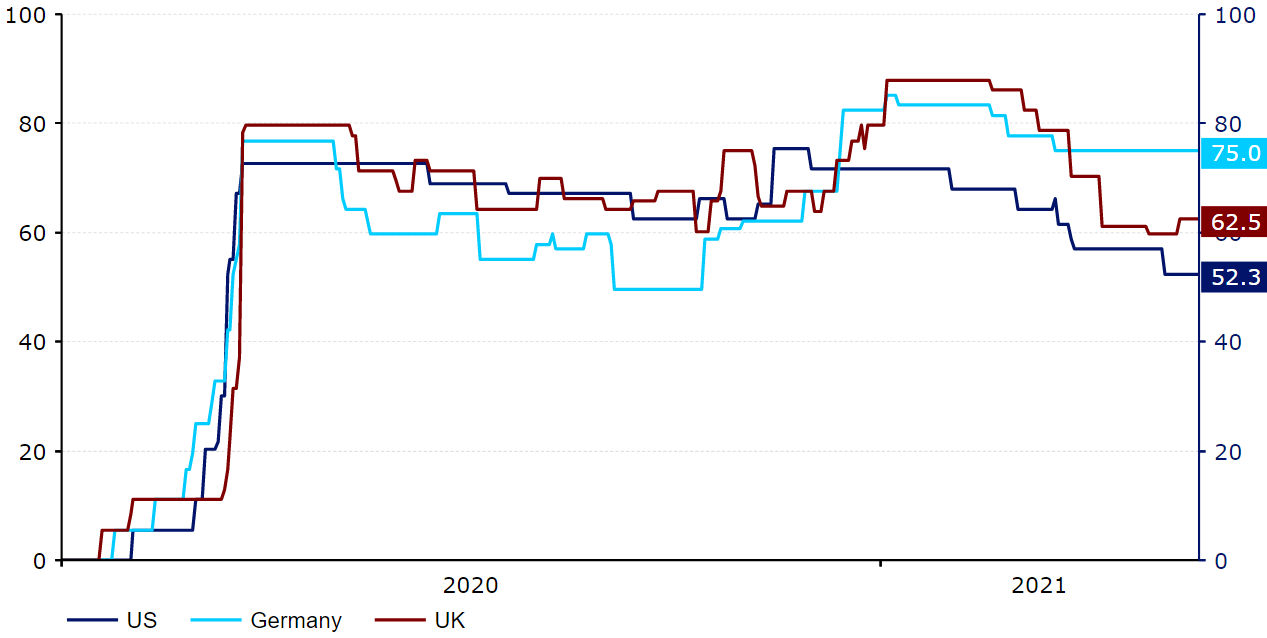

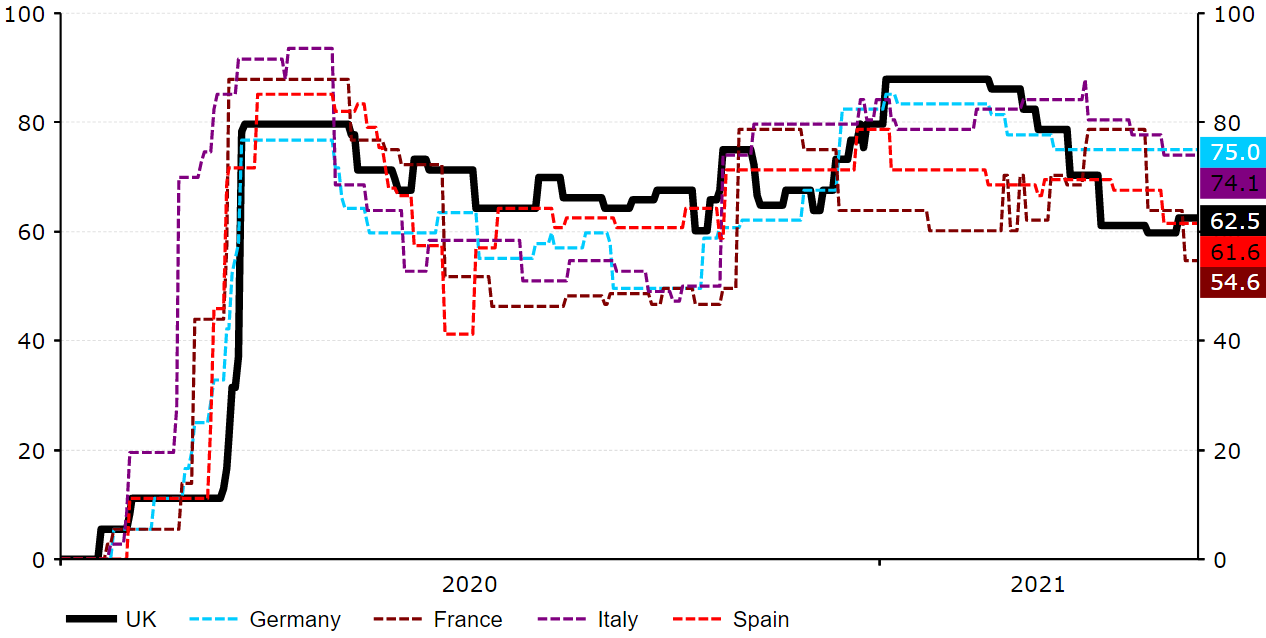

Figure 2: G3 COVID-19 Government Response Stringency Index (March ‘20 – May ‘21)

Source: Refinitiv Datastream Date: 26/05/2021

By contrast, the Euro Area economy contracted again in Q1, entering into a ‘double-dip’ recession for the first time since 2012. Virus restrictions remain rather strict in much of Europe following the third wave of virus infection that swept throughout the continent in March and April. New daily virus cases have eased in the bloc in the past few weeks, although the slower vaccine rollout has delayed reopening. That being said, we are optimistic that we’ll see a strong recovery in the second and third quarters that will close the gap in economic performance between the US and Euro Area.

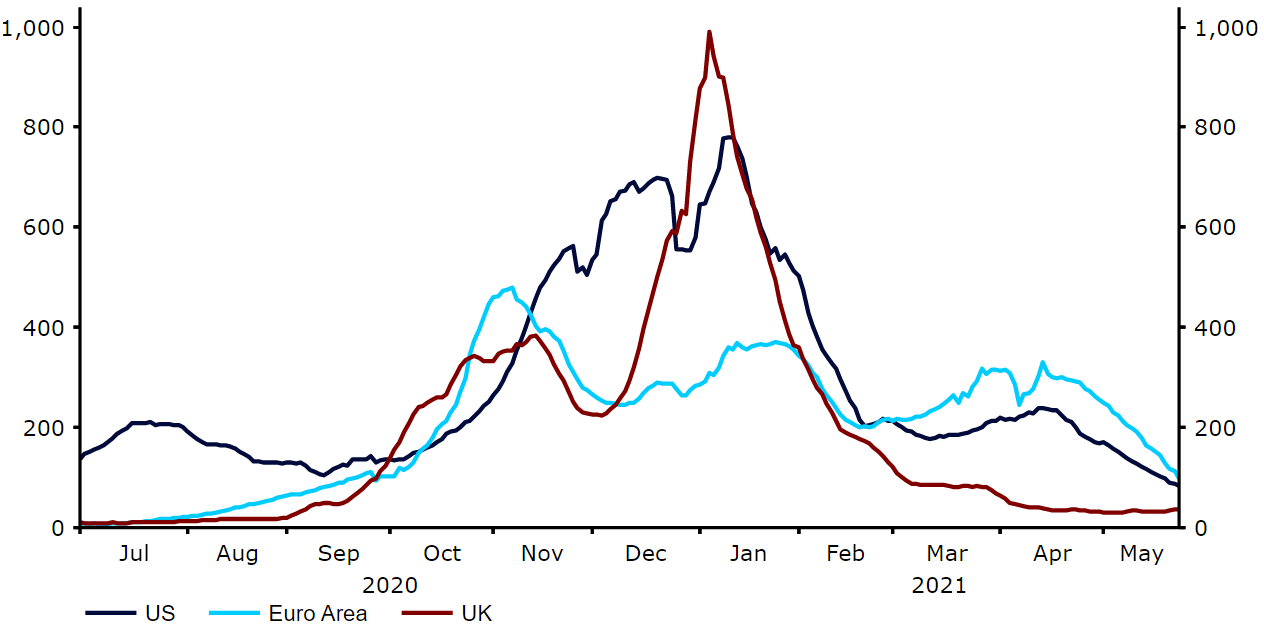

Figure 3: G3 New COVID-19 Cases [per 1M people] (March ‘20 – May ‘21)

Source: Refinitiv Datastream Date: 26/05/2021

Vaccination progress has been one of the most important determinants of exchange rates so far in 2021. We do, however, think that we are now at a stage where the reopening of economies has made vaccination numbers much less relevant in the eyes of investors. Market participants have instead shifted their focus back towards the relative performance of the G3 economies and the response of central banks to both the rebound in economic activity and sharp increase in global inflationary pressures.

US Dollar (USD)

The US dollar recovered some of its losses versus its major peers in the first quarter of 2021, having been on the back foot throughout the majority of the final quarter of last year.

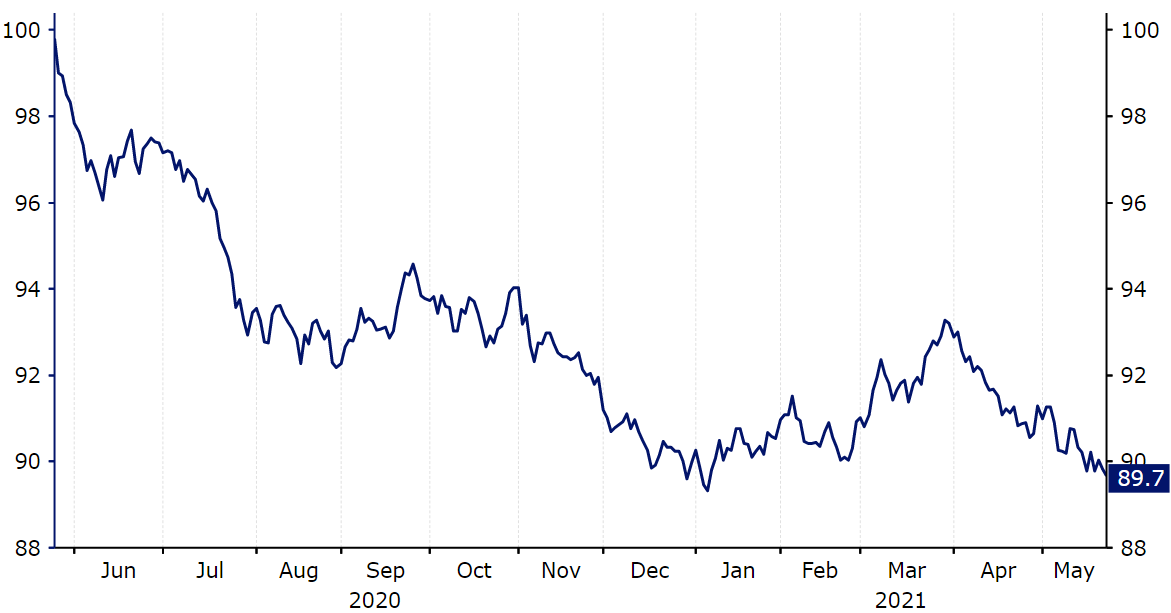

Investors flocked to the dollar during the peak of the market panic induced by the COVID-19 crisis in early-2020, although the US currency spent most of the year on a downward trajectory as risk sentiment improved. This trend reversed in the first quarter of this year, with the US dollar index touching its strongest position in almost five months at the end of March (Figure 4). We attribute the bulk of this outperformance in the dollar to the impressive rollout of the various COVID-19 vaccines in the US, which drove yields higher and allowed the economy to open up at a faster rate than much of the developed world. This rally has, however, since reversed aggressively, in large part due to a general improvement in global risk sentiment, the underwhelming April nonfarm payrolls report and concerns over rising US inflation.

Figure 4: US Dollar Index (May ‘20 – May ‘21)

Source: Refinitiv Datastream Date: 26/05/2021

The US was one of the first countries in the world to begin mass vaccinations in December using the Pfizer-BioNTech vaccine. Since then, two further jabs have been both approved and rolled out, those from Moderna and Johnson & Johnson, albeit the latter was temporarily suspended in April. The US has now administered around 86 doses per 100 people to its population at the time of writing, the sixth highest per capita ratio in the world, and has delivered at least one vaccine dose to approximately 50% of its population. Encouragingly, the US has seen a sharp decrease in both new virus cases and deaths since the latest peak in January. This general decrease in caseloads and fatalities has been in large part attributed to the increased immunity built up through vaccinations. Regardless, the US still has one of the highest COVID death rates in the world according to Worldometer (more than 1,819 per 1 million people) and a cases per capita ratio that far outstrips almost every other developed nation (approximately 102,000 per 1M).

Figure 5: US COVID-19 Vaccinations Administered [per 100] (Dec ‘20 – May ‘21)

Source: Refinitiv Datastream Date: 26/05/2021

By contrast to Europe, virus restrictions have already been unwound meaningfully in the US, partly due to the country’s impressive vaccination programme and the generally more relaxed approach to enforcing said measures adopted by the US government. The US COVID-19 Government Response Stringency index, courtesy of Oxford University, dropped to 52.3 in May, far below that of most of Europe and its lowest level since 13th March 2020. We note that even this indicator likely underestimates the extent to which measures have been unwound, given that it represents the most stringent restrictions in place and is therefore less useful for larger countries that have not enforced national shutdowns. Many states, notably the likes of Texas, Michigan, Louisiana, and Mississippi have already entirely rescinded executive orders designed to slow the spread of the virus.

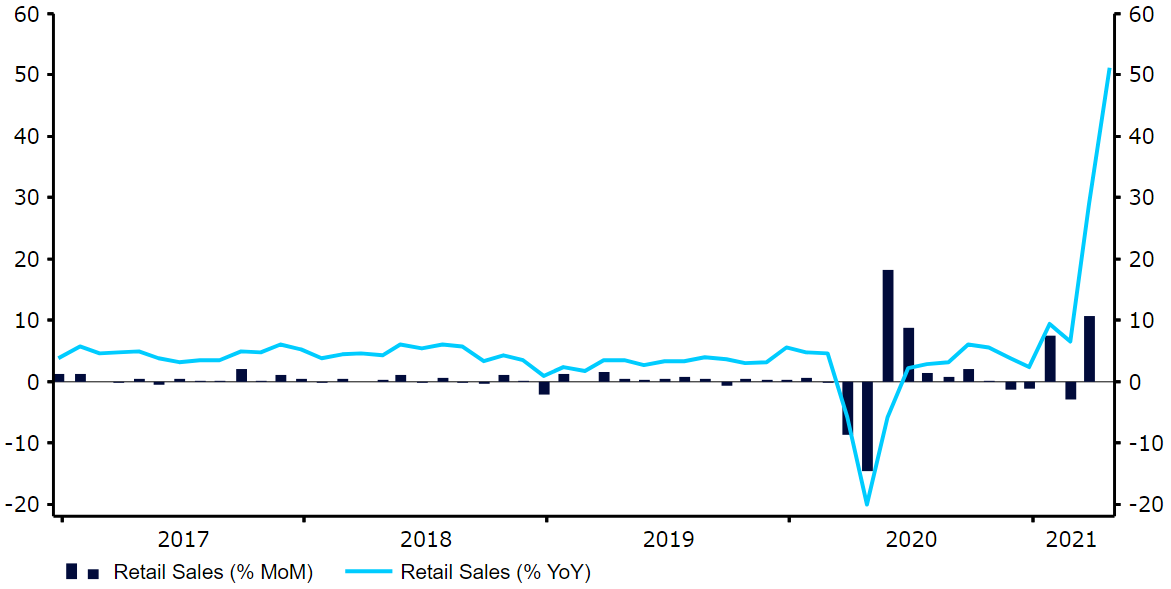

Following the rapid removal of shutdown measures across much of the US, we are increasingly confident in our view that the US economy remains on course to continue outperforming most of its major peers in the near-term. Macroeconomic data out of the US has largely surprised to the upside in the past few months. The economy expanded by 4.3% annualised in the final quarter of 2020, with expansion of 6.4% annualised following in Q1. We have so far been particularly encouraged by the robust rebound in consumer spending activity. Retail sales soared by 10.7% month-on-month in March and, despite coming in flat in April, the moving average of sales growth remains very healthy. This boom in consumer spending has a lot to do with the disbursement of the US government’s $1,400 stimulus cheques. President Biden’s massive $1.9 trillion fiscal rescue package, which passed through Congress without a hitch in early-March, should continue to support domestic demand in the coming months. Business activity data has also continued to trend in the right direction. Markit’s composite PMI rose to a fresh all-time high 68.1 in May, with perhaps the most pleasing aspect of recent reports the sharp upturn in new orders.

Figure 6: US Retail Sales (2017 – 2021)

Source: Refinitiv Datastream Date: 26/05/2021

We have also witnessed an improvement in labour market conditions since the peak of the shutdowns last year. The economy added a net 770,000 jobs in March, the most in seven months, and a further 266,000 in April. While the latter was considerably lower than expectations, we attribute this to the impact of enhanced unemployment benefits deterring job seeking and the inability of parents to find childcare given that some schools remained closed. This means the US has now recovered approximately 63% of the jobs lost since the start of the crisis in the nonfarm sector. The official rate of unemployment has also continued to trend downwards, coming in at 6.1% in April from almost 15% at the peak of the crisis, with the U-6 rate of unemployment also declining to 10.4% from almost 23%. Initial jobless claims, which provide the most timely measure of the health of the US labour market, also dropped sharply in April and early-May as restrictions are lifted and individuals return to the workplace.

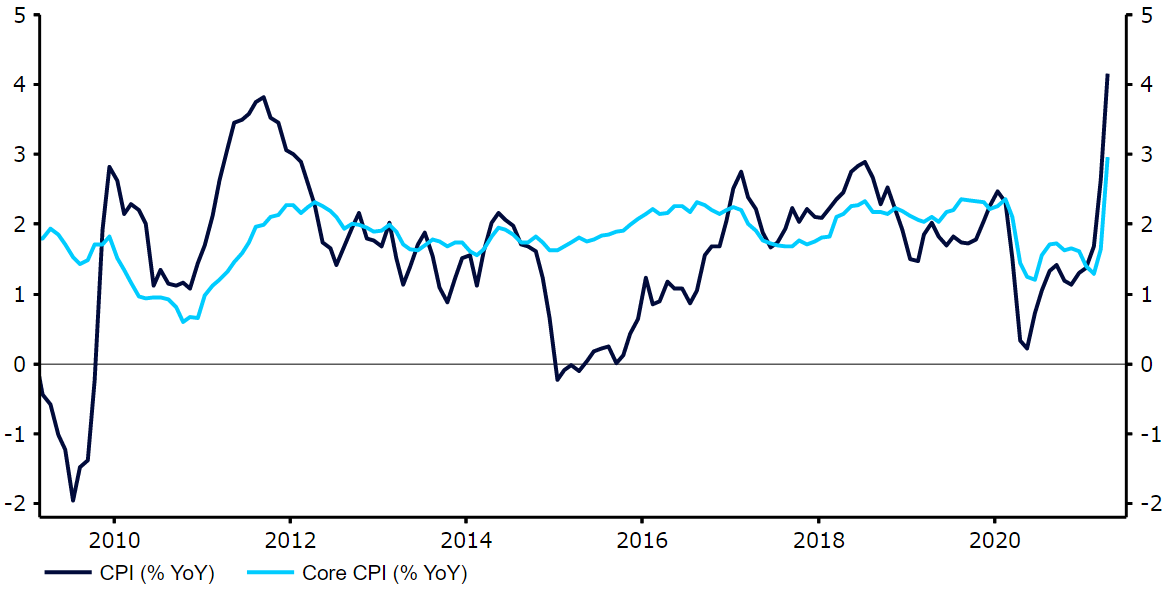

Meanwhile, the impact of Federal Reserve policy on the US dollar this year has been mixed. On the one hand, FOMC chair Jerome Powell has taken a relaxed view on the increase in US bonds yields since the start of 2021, which saw the 10-year Treasury yield jump by around 85 basis points to 1.78% at one stage. On the other, however, the bank has continued to stress that it will look through temporary increases in US inflation above the central bank’s 2% target. Headline CPI inflation surged to 4.2% year-on-year in April (Figure 7), increasing at its fastest monthly pace since June 2009 (+0.8%). The core measure, which strips out food and energy components, also rose sharply to 3% YoY and experienced its largest monthly jump since 1981 (+0.9%).

Figure 7: US Inflation Rate (2017 – 2021)

Source: Refinitiv Datastream Date: 26/05/2021

While inflation is running considerably hotter than expected, we don’t think that the Fed is overly concerned just yet. The latest communications from FOMC members have remained dovish and we think that the bank will await additional inflation prints before considering adjusting its ultra-accommodative policy. The Fed now targets 2% inflation on average over time, so won’t be rushed into raising rates should the bank’s preferred measure of price growth, the PCE index, rise above this level for a brief period of time. The FOMC’s ‘dot plot’, which shows where policymakers expect rates to be at the end of each year, was little changed in March, albeit this was released prior to the April inflation data. While an additional two members saw the first rate hike by the end of 2023 (taking the total to seven), the median dot remained unchanged in favour of no hike over the forecast horizon. We believe that the Fed will wish to leave a reasonable amount of time in between tapering its QE programme and hiking rates, with the former not looking likely to take place until late-2021 at the very earliest.

We remain bearish on the US dollar over our forecast horizon. While we think that the US economy will continue to outperform its major peers in the near-term, this already appears almost entirely priced into the value of the dollar, as does the country’s impressive vaccine rollout. The return to more normal levels of global economic activity in 2021 brought about by the vaccines should support risk sentiment and weigh on the safe-haven currencies, including the dollar. The Federal Reserve’s insistence that it will look through temporary increases in US inflation also presents a downside risk to the USD and reinforces our view that the US currency will depreciate versus most major currencies over our forecast horizon.

Euro (EUR)

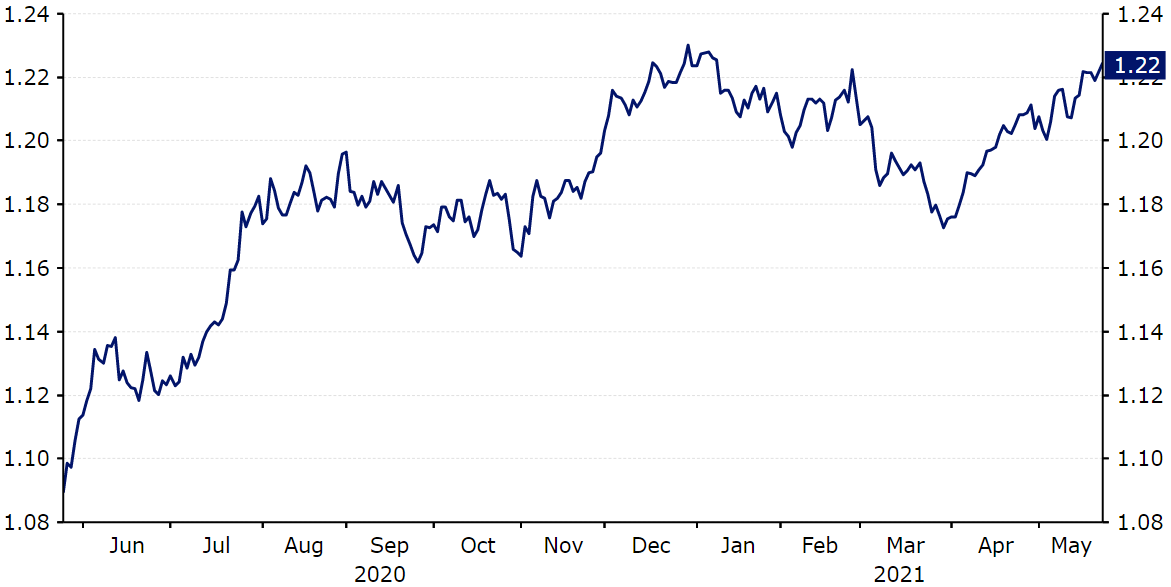

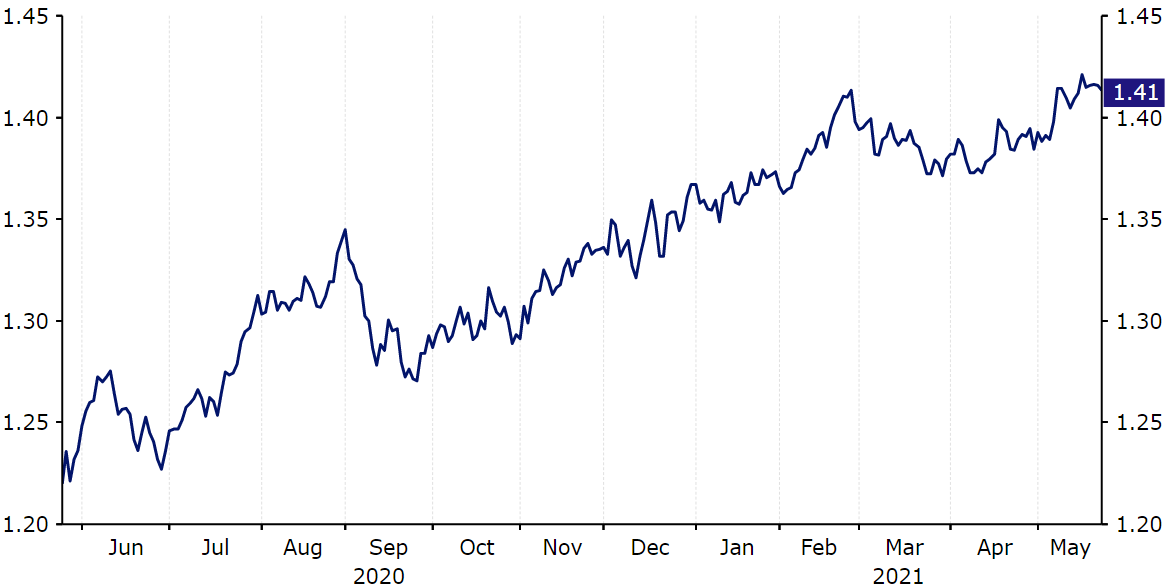

The euro has rebounded against the US dollar since the start of April, having sold-off throughout most of the first quarter of 2021.

While the sell-off witnessed in EUR/USD in Q1 was partly a result of a broadly stronger US dollar, the euro also underperformed most of its G10 peers in the first three months of the year. We attribute much of this underperformance to a combination of the disappointingly slow rollout of vaccines in the EU, the third wave of virus infection in Europe and the European Central Bank’s opposition to both higher yields and a stronger euro. The common currency fell to its weakest position versus the dollar in five months at the end of March, although it has since recovered almost all of its year-to-date losses as the bloc’s vaccination programme finally begins to kick into gear.

Figure 8: EUR/USD (May ‘20 – May ‘21)

Source: Refinitiv Datastream Date: 26/05/2021

The European Union has struggled to roll out the various COVID-19 vaccines at anywhere near the pace of either the US or UK throughout most of 2021 so far. The programme has faced a number of significant challenges, notably supply issues of both the Pfizer and AstraZeneca vaccine and fears that the latter may lead to the formation of rare blood clots. So far, around 51 vaccine doses per 100 people have been administered in the EU, significantly less than across the Atlantic. We have, however, seen an acceleration in the pace of vaccinations so far in the second quarter as more supply is made available. The EU is now set to receive approximately 400 million vaccine doses in Q2, having only administered around 76 million in Q1. That being said, the suspension of the AstraZeneca vaccine for younger age groups and the generally higher vaccine skepticism in a number of European countries, notably France, may prevent a more speedy rollout.

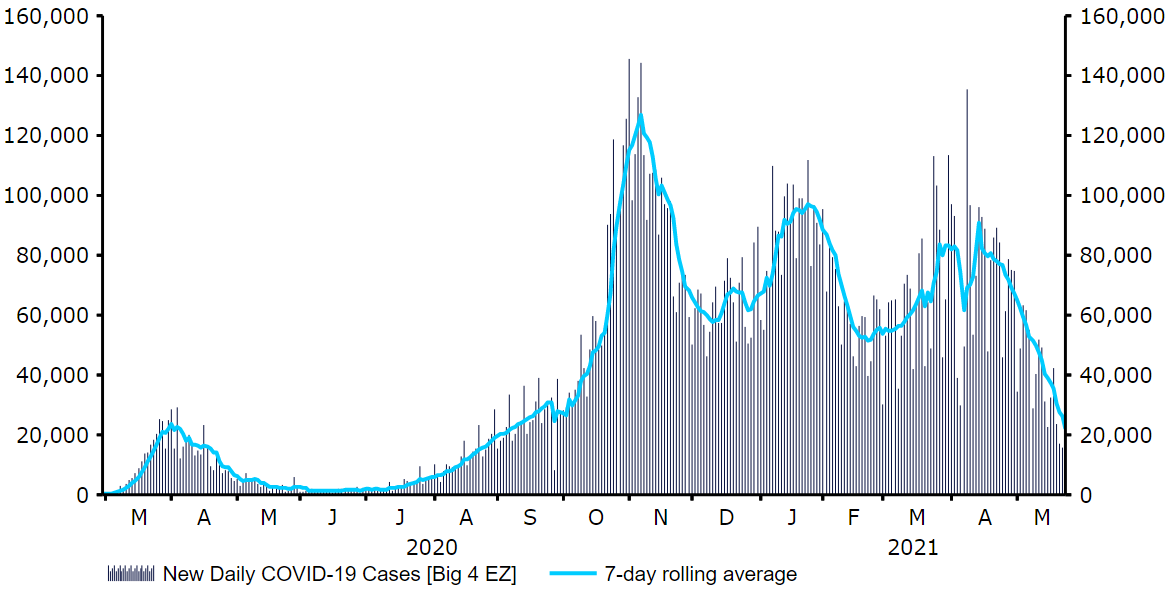

The third wave of virus infection in the Eurozone has also delayed reopening of the economy and slightly soured sentiment towards the common currency. New cases have eased since peaking in mid-April, with a handful of exceptions, and lockdown measures are being gradually unwound at the time of writing. We are confident that the Euro Area economy will rebound in the second quarter, although the slower pace of vaccinations and higher rate of new per capita virus cases suggest that this rebound will be of a delayed and more gradual nature than in both the US and UK.

Figure 9: New COVID-19 Cases [Big 4 EZ] (March ‘20 – May ‘21)

Source: Refinitiv Datastream Date: 26/05/2021

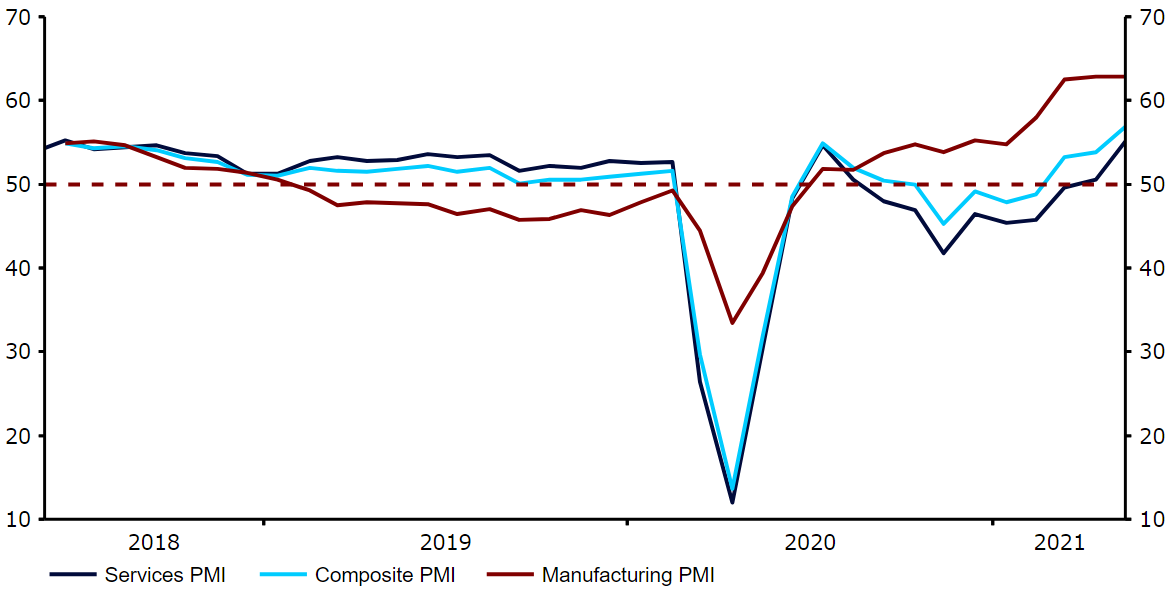

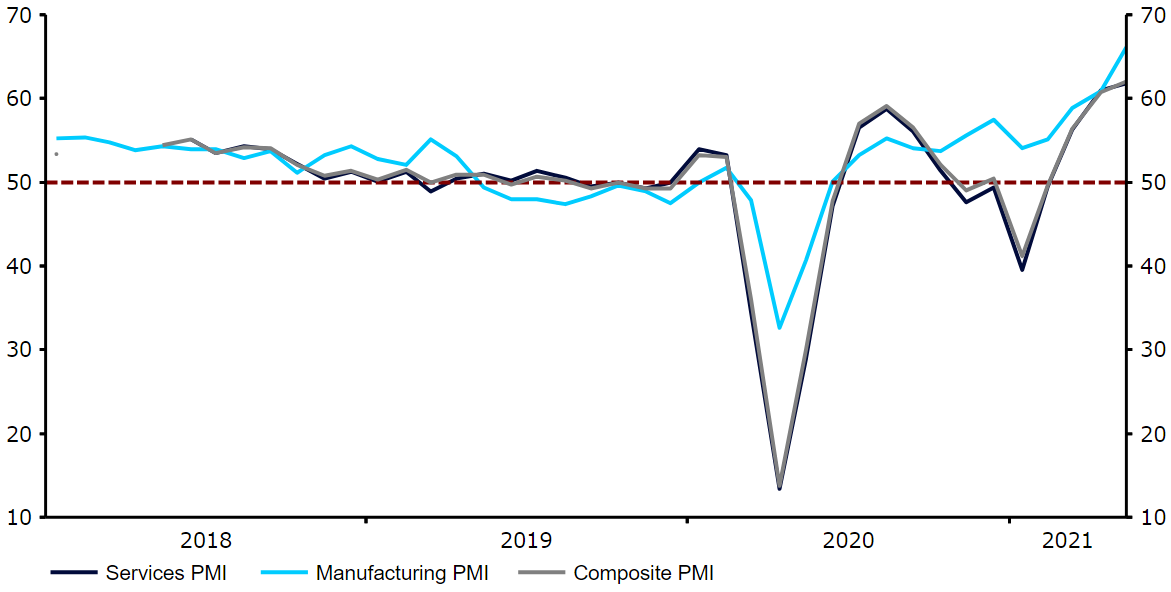

An extension of many of the lockdown measures into 2021 caused the Euro Area economy to enter into a ‘double-dip’ recession in Q1. The economy contracted by 0.7% quarter-on-quarter in the final quarter of last year and by another 0.6% in the first three months of 2021. Most of the major countries in the bloc experienced downturns, with the notable exception of France that posted modest growth in Q1. We have already begun to see signs of a recovery in economic activity in the common area so far in Q2, including a move higher in the PMIs of business activity. The services index rose above the level of 50 that denotes expansion for the first time in eight months in April, while the manufacturing index has gone from strength to strength, remaining just shy of its highest ever level in May (62.8).

Figure 10: Euro Area PMIs (2018 – 2021)

Source: Refinitiv Datastream Date: 26/05/2021

Consumer confidence has also risen to its highest level since the beginning of the pandemic, which bodes well for domestic demand once the current restrictions are removed. European nations should also begin to receive disbursements of funds from the EU’s COVID support package in the second half of the year, almost a year after leaders agreed to issue debt in order to support the bloc’s economic recovery. The EU will make available an unprecedented €750 billion fiscal rescue package to those nations most in need of financing, which will see €360 billion made available in loans and €390 billion in grants. We were hopeful that the aforementioned fiscal support would be made available sooner, but the process of EU member states ratifying the programme has been a rather lengthy one.

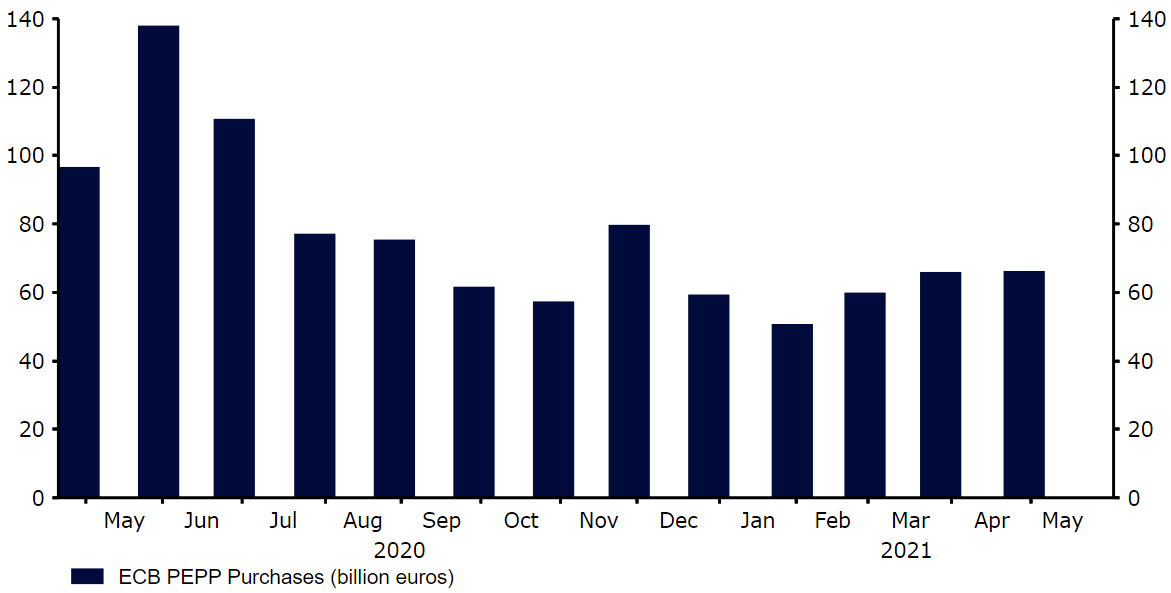

Given the ongoing downside risks faced by the Euro Area economy, the European Central Bank has remained committed to maintaining its accomodative monetary policy stance since our last G3 update. The Governing Council has had no room to cut rates during the crisis, but has pledged to inject vast sums of stimulus into the economy via various instruments, particularly its asset purchase programmes. The bank’s Pandemic Emergency Purchase Programme (PEPP) was expanded and extended again in December, with the ECB committing to purchasing a total envelope of assets worth €1.85 trillion at least through to the end of March 2022. There was very little new information to report out of the April meeting. President Lagarde largely reiterated the message from the March communications, when the bank announced that it would be modestly increasing the pace of weekly asset purchases to combat the rise in bond yields. She also noted that it was too premature to begin discussions around ending the programme – we certainly don’t expect any word on that front until at least September when the bank will have a much clearer idea as to the state of the health crisis and its impact on inflation. It remains the case that Euro Area inflation is still well short of the bank’s ‘close to, but below 2%’ target, coming in at just 1.6% in April. We think that the ECB will, therefore, be in no rush whatsoever to unwind its accommodative policy stance.

Figure 11: ECB Asset Purchases under PEPP (2020 – 2021)

Source: Refinitiv Datastream Date: 26/05/2021

We have been encouraged by the acceleration in the pace of vaccinations in the EU and are confident that the bloc’s economy will rebound strongly once restrictions are unwound. We think that the rebound in global economic activity brought about by vaccines should be supportive of risk sentiment, and is one of the main reasons why we continue to envisage a rally in the euro versus the dollar over our forecast horizon. The ECB’s more vocal opposition of both higher yields and a stronger EUR/USD exchange rate relative to the Federal Reserve does, however, present somewhat of a downside risk to the common currency, in our view.

UK Pound (GBP)

The pound rally in 2021 has stalled somewhat in the past few weeks, although the currency still remains one of the best performers in the G10 so far this year.

Sterling had rallied by almost 10% versus the US dollar between late-September and the end of February, buoyed by news of a post-Brexit trade agreement and the UK’s rapid vaccine rollout. After rallying to its strongest position against the dollar in three years the pound did, however, give back the bulk of its year-to-date gains. We attribute this partly to a stalling in the pace of daily vaccinations in the UK and the various negative headlines surrounding the AstraZeneca vaccine, of which Britain relies heavily on for its inoculation programme. This uptrend in sterling has since resumed as investors grow increasingly optimistic over the UK’s economic outlook.

Figure 12: GBP/USD (May ‘20 – May ‘21)

Source: Refinitiv Datastream Date: 26/05/2021

Britain was the first country in the world to begin mass vaccinations on 8th December last year and has since administered more doses per capita than every other major nation – around 90 per 100 people. The UK’s approach to leaving twelve weeks in between vaccinations, rather than the three or four adopted almost everywhere else, also appears to be paying dividends. More than 56% of the UK population have now received at least one vaccine dose, which is higher than the US (49%) and comfortably more than the EU (36%). The vaccine rollout has not been without a number of high profile hiccups, notably the marked drop in supply of the AstraZeneca jab in early-April and the various concerns surrounding its safety. The rollout of the Moderna vaccine has, however, made up for much of the supply shortfall and the UK remains on course to have offered at least one dose to the entire adult population by the end of July.

Figure 13: G10 Percentage of Population Vaccinated [at least one dose]

Source: Refinitiv Datastream Date: 26/05/2021

A combination of the UK’s strict national lockdowns, and the successful rollout of vaccines, have significantly suppressed contagion numbers and Britain looks on course to remove restrictions quicker than its European neighbours. New virus cases have fallen by more than 95% since peaking in January, while COVID-related deaths have declined by more than 99% despite an opening up of the economy since the beginning of March. The UK’s test positive rate has also dropped markedly and, at 0.2%, is considerably lower than almost every other country in the world. We see it as more likely than not that the UK government will be in a position to remove all lockdown measures in England as planned on 21st June, which should allow for a significant rebound in economic activity in the second half of 2021. According to Oxford University’s COVID-19 Government Response Stringency index, restrictions in the UK are already around the most relaxed that they have been since the start of the pandemic in March last year (Figure 14).

Figure 14: COVID-19 Government Response Stringency Index [UK vs. Big 4 EZ] (2020 – 2021)

Source: Refinitiv Datastream Date: 26/05/021

While the UK economy contracted by 1.5% quarter-on-quarter in the first quarter of the year, a ‘double-dip’ recession has been avoided and we are confident that a strong rebound is on the cards for Q2. Macroeconomic data out of the UK that covers the period of looser restrictions has so far been limited, but indicators of activity in the past few weeks have largely surprised to the upside. Consumer spending has picked up following the sharp downturn in January. Retail sales jumped by 9.2% month-on-month in April, more than double economists’ expectations. This is all the more impressive considering that high street retail outlets remained shut until 12th April. This rebound makes us confident that another sharp recovery in consumer spending is likely in May.

The PMIs of business activity have also increased markedly since the start of 2021. Most encouraging has been the boom in activity witnessed in the UK’s dominant services sector, with the services PMI rising to 61.8 in May – its highest level since October 2013. The UK government’s heavy focus on job retention has also continued to provide support for the country’s labour market. An extension of the furlough scheme through to the end of September has been particularly welcome for employers, with the programme highly successful in limiting layoffs during the crisis period. The UK’s jobless rate peaked at just 5.1% in December and has begun falling again, dropping to 4.8% in the three months to March.

Figure 15: UK PMIs (2018 – 2021)

Source: Refinitiv Datastream Date: 26/05/021

On the monetary policy front, the Bank of England struck an upbeat note over the UK economy at its May meeting. Policymakers noted that GDP would bounce back sharply in the second quarter and return to its pre-COVID size over the remainder of the year. The GDP forecast for 2021 was also revised up to 7.25% from February’s 5% estimate, with growth set to moderate in 2022 to 5.75% from the previously envisaged 7.25%. Sterling bulls were, however, left slightly disappointed by the bank’s apparent lack of appetite to tighten policy in light of the improving economic backdrop. Outgoing committee member Andy Haldane was the only member of the MPC to vote for an immediate reduction in the asset purchase target, while Governor Bailey struck a dovish note on rates, suggesting that the bank was unconcerned and would not react to a spike in UK inflation. We think that the BoE is following in the footsteps of the Federal Reserve and is in no rush whatsoever to think about raising interest rates. A tapering in the QE programme is also now unlikely at the June meeting, although we may see a gradual unwinding of stimulus when the next set of macroeconomic projections are released in September.

The ongoing successfulness of the UK’s vaccination rollout, and the impact that the vaccines have had on suppressing contagion numbers, make us increasingly confident in our call for a sterling appreciation against the US dollar this year. Barring an aggressive spread of the so-called Indian variant of the virus, we see no other reason why the UK government won’t be in a position to remove all virus restrictions in England as planned on 21st June. This, in our view, should allow for a more rapid rebound in economic activity in the UK than almost every other European nation in the second quarter of the year.

In our view, the pound is well placed to benefit from the return to near-normal economic capacity, given that the UK economy has been one of the worst affected from the strict lockdown measures enforced during the crisis period. The Bank of England’s lack of appetite to tighten policy any time soon may, however, cap gains for the pound, particularly versus those currencies whose central banks have already begun the process of normalising monetary policy.

Listen to our latest FX Talk episode for a 20-minute market update: