GBP tumbles as MPC flags long recession

( 3 min )

- Go back to blog home

- Latest

Sterling fell fairly sharply against its major peers on Thursday afternoon following a very doom and gloom assessment of the UK economy from the Bank of England.

Figure 1: GBP/USD (04/08/2022)

Source: Refinitv Date: 04/08/2022

We’ve run out of fingers and toes keeping track of the number of occasions that the MPC has revised upwards its inflation forecasts. UK headline inflation is now expected to peak at 13.3% in October, and remain just shy of double-digits in a year’s time (9.5%) – policymakers had previously indicated that consumer price growth was set to rise in excess of 11%. The main focus among committee members clearly surrounds controlling inflation at the expense of growth. In his press conference, governor Bailey said that ‘returning inflation to the 2% target remains our absolute priority. There are no ifs and buts about that’. He also justified the larger hike by saying that there were indications that price pressures had become more persistent and broader.

Figure 2: BoE Inflation Projections [August 2022]

Source: Refinitv Date: 04/08/2022

Of particular concern is the bank’s appraisal on the impact of the cost of living crisis crisis on economic activity. Policymakers now expect the UK economy to contract in the final quarter of 2022, and in each quarter throughout 2023. This would mark the longest downturn witnessed in the UK since the 2008 financial crisis, and a peak-to-trough fall of more than 2% according to the BoE. This is a far sharper downturn than investors had accounted for, hence the initial knee-jerk sell-off in the pound.

In our view, this dire prediction feels overly pessimistic, particularly given the current strength of the UK labour market. That said, this view is clearly far from unjustified considering the latest jump in energy prices, and the threat of one of the longest periods of negative real income growth on record.

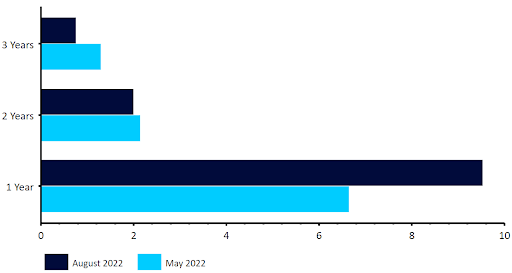

Looking further ahead, we think that the priority for now will remain squarely on reining in inflation. The line from the June meeting that the bank was ready to move ‘forcefully’ if needed was maintained in Thursday’s statement. We think this indicates that another 50 basis point rate hike is possible at one or both of the upcoming MPC meetings in September and November, depending on economic data in the interim. Regardless, additional hikes look likely at all three remaining meetings this year, before a likely pause in the hiking cycle in early-2023. While we see this as bullish for GBP, the BoE’s pessimistic view on the UK economy, and the growing threat of a prolonged recession, clearly presents a significant downside risk to our sterling forecasts.