Sterling rattled as General Election polls continue to narrow

- Go back to blog home

- Latest

Yesterday’s updated GDP numbers also did little to support the Pound. Growth in the UK economy dipped to a paltry 0.2% in the first quarter of the year, with the country’s key services sector grinding to a near halt. This marks the joint lowest rate of quarterly economic growth in the UK since 2013.

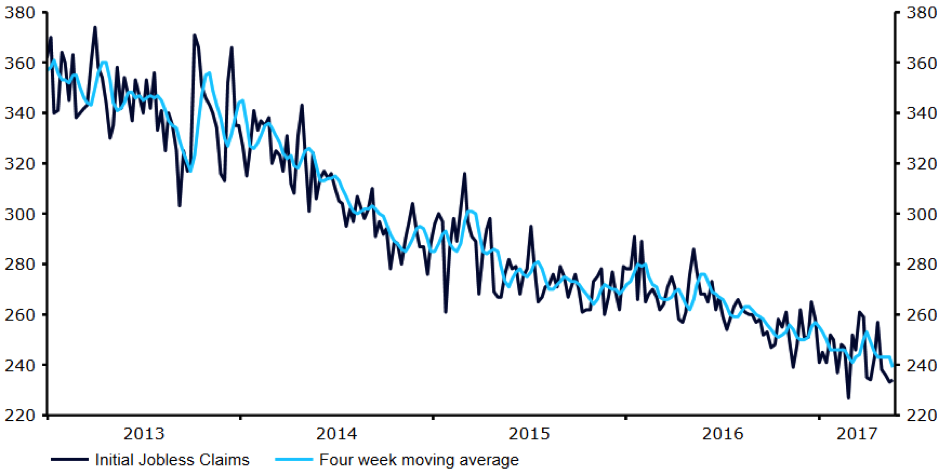

The Dollar recovered some of its losses against the Euro yesterday after initial jobless claims in the US came in at just 234,000, around its lowest level in 40 years (Figure 1). The greenback was also supported by comments from Federal Reserve member John Williams who claimed three interest rate hikes this year remained appropriate.

Figure 1: Initial Jobless Claims (2013 – 2017)

, Meanwhile, oil prices took a dive by over 5% for the day on Thursday after the latest OPEC agreement disappointed the markets. Both OPEC and non-OPEC members agreed to maintain cuts for an additional nine months, although the failure to announce deeper cuts sent oil tumbling to a two week low, dragging commodity driven currencies with it.

This afternoon’s revised GDP numbers out of the US will be the main economic release today. The flash estimate came in at a very underwhelming 0.7% annualised for the first quarter, calling into question the possibility of a June interest rate hike by the Federal Reserve. Any positive surprises could alleviate concerns of a pause in the easing cycle and provide decent support for the Dollar today.