Hawkish ECB and soaring risk appetite sink dollar

( 4 min read )

- Go back to blog home

- Latest

Both the Federal Reserve and the ECB struck hawkish surprises last week. However, the latter hiked rates while the former did not, and markets chose to believe facts, rather than rhetoric.

The UK will be in focus this week. As in the US last week, the Bank of England meeting on Thursday will be preceded by the release of the May inflation numbers. There is near unanimity that the MPC will hike rates by another 25bps on Thursday and signal that more hikes are likely on the way. Later in the week we get the flash PMIs of business activity worldwide. The week will be uncharacteristically quiet in the US, and the spotlight will be elsewhere, primarily on sterling.

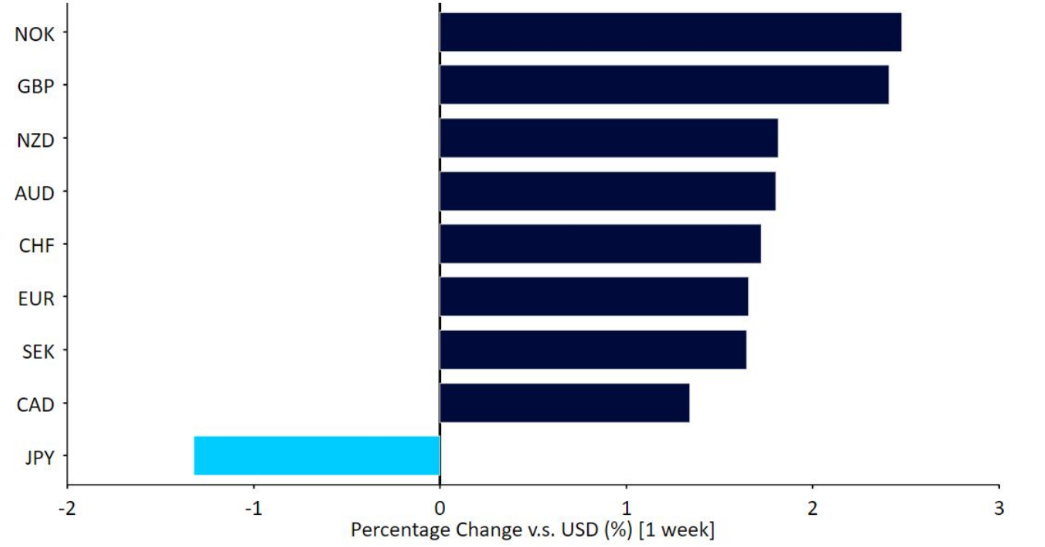

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 19/06/2023

GBP

The combination of persistent inflation, signs of a wage-price spiral and economic resilience is boosting both expectations for the Bank of England terminal rate and the pound. Sterling has been one of our core bets this year, and we are happy to see it at the top of the G10 tables so far – we think it still has more room to run.

In addition to yet another record-high core inflation print, we expect the Bank of England to hike rates this week and sound a hawkish tone. The vote among policymakers has been split 7-2 in recent meetings, but we think there is a possibility that one or both of the doves could join the rest of the MPC in voting for an immediate hike. We believe UK rates are likely to top out above 6% and we maintain our bullish view of GBP.

EUR

Last week’s ECB announcement was undeniably hawkish, with the Governing Council hiking rates and pre-committing to another hike in July. The central bank largely looked past the recent downward surprise in inflation, and no doubt remains focused on the still significant gap between rates and core inflation. The bank noted that there had been some signs of a softening in Euro Area price growth, although there were modest upward revisions to the inflation forecasts through to the end of 2025. Another rate increase in July appears to be a done deal, and we see September as a live meeting as well, absent a serious downward surprise in inflation between now and then. Markets are starting to agree with us, and the common currency is rising towards the top of its recent trading range against the US dollar.

USD

The Federal Reserve went with a ‘hawkish pause’ last week, leaving rates unchanged for the first time in this hiking cycle but trying to communicate to markets that the next move is likely to be another hike via an aggressive ‘dot plot’. The latter implied that most FOMC members still expect two more hikes before the cycle is over.

The inflation data the day before the meeting showed little relief for the Fed. The monthly print for the key core subsindex marked the sixth consecutive month where the number has come at or above 0.4%, consistent with an unwelcome stabilisation of inflation around the 5% level. While markets still don’t believe the Fed will hike two more times, it is worth noting all expectations for cuts have been pushed into 2024, as we expected.

JPY

The yen was the clear underperformer in the G10 last week, as investors reacted to another set of dovish communications from the Bank of Japan. There was no change in rates, nor any adjustments to the bank’s yield curve control policy, though none were anticipated. The BoJ again appeared in little rush to signal that tighter policy was on the way, with the bank noting that inflation was ‘highly likely’ to decelerate towards the middle of the 2023 fiscal year, and that ‘extremely high’ economic uncertainty would warrant a continued easing in policy. Investors were clearly underwhelmed by the bank’s insistence on sticking by its ultra-dovish stance, and expectations for hikes have once again been pushed further into the future – swaps now see only around a one in five chance of a 10bp rate increase by September. We still contest that an adjustment to the YCC could be on the way at the next couple of meetings, although clearly the possibility of this has lessened.

CNY

Last week was a busy one in China. The yuan continued to lose ground in the first half of the week, but reversed course on Thursday and regained all of its losses against the US dollar, helped in no small part by a stronger EUR/USD. However, the trade-weighted CFETS index dropped to its lowest level since April 2021. On Tuesday, the PBiC unexpectedly announced a 10bps cut in a 7-day reverse repo rate (to 1.9%), after which it became quite clear that we should expect a similar cut in its MLF rate, the first in 10 months, which indeed materialised on Thursday (of 10bps to 2.65%). A similar downward adjustment in the 1- and 5-year LPR rates is broadly expected tomorrow.

Widening rate differentials between the US and China is negative for the yuan, but expectations of more economic support are helping to allay investor concerns about the strength of the recovery. Friday’s communication from China’s State Council leaves little doubt that a stimulus package is on the way, and we expect to hear more in the coming days. Last week’s data dump for May bolstered the case for stimulus. Most of the readings came in worse-than-expected and added to the argument that Q2 growth will be much lower than thought a few months ago. In addition to the LPR and stimulus news, markets will digest headlines from Anthony Blinken’s trip to China – the first visit of the US secretary of state in five years. A sense of real progress in the deteriorating relationship between the two countries could help the renminbi turn its fate around.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports