How the commodity market could impact FX in 2021

( 5 min. )

- Go back to blog home

- Latest

One of the key moves among asset classes during 2021 thus far has been the sharp increase in commodity prices. We outline below how commodities have evolved so far this year, what factors have driven the move higher and the impact that we think it may have on the FX market in the coming months. You can also find our analysis in FX Street.

Commodity prices have risen across the board since the start of 2021, led by a sharp move higher in global oil prices. Brent crude oil futures have risen by approximately 30% from $52 a barrel to $68, which is roughly where they were prior to the outbreak of the COVID-19 virus at the beginning of 2020. Gains in the price of metals have been broad based, with aggressive increases in aluminum (+18%), copper (+28%) and iron ore (+24%) since the start of the year, the latter two to all-time highs. Agricultural prices have also experienced a similarly sharp rally. The standout moves have been a more than 40% year-to-date surge in the price of lumber (+66%) and canola (+40%) to fresh record highs and a 34% jump in the price of corn.

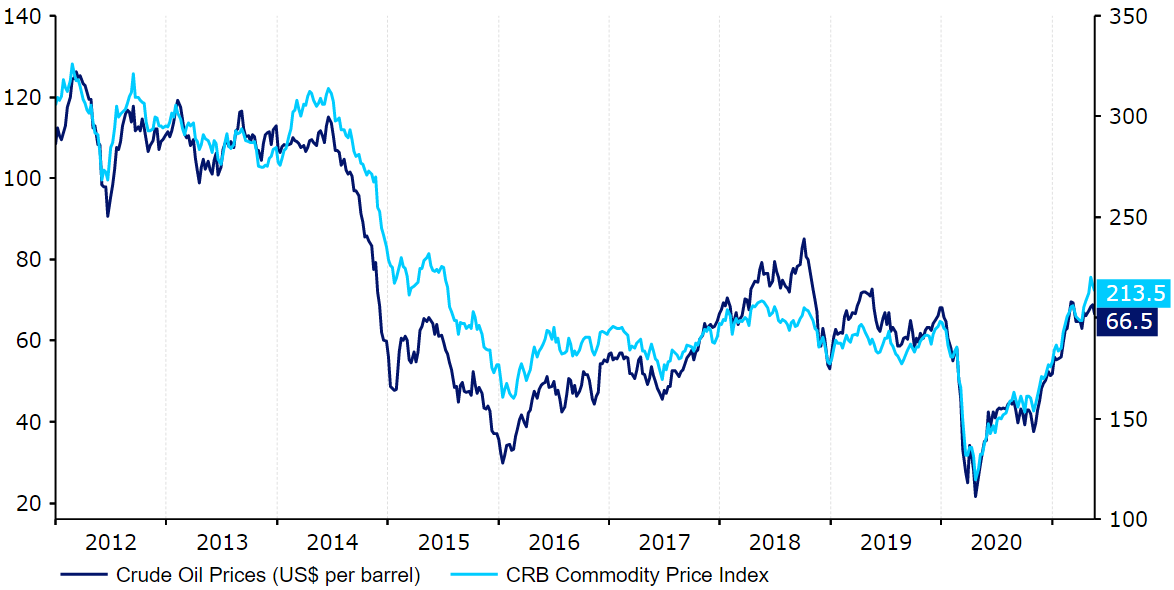

The CRB Commodity index from Refinitiv/CoreCommodity, which represents an arithmetic average of commodity futures prices, is now at its highest level since July 2015 (Figure 1).

Figure 1: CRB Commodity Price Index vs. Brent Crude Oil Futures (2012 – 2021)

Source: Refinitiv Datastream Date: 24/05/2021

What factors have driven commodity prices higher?

Faster-than-expected global economic recovery. The rollout of the various COVID-19 vaccines has taken place faster than anticipated, even as recently as late-last year when the Pfizer, AstraZeneca and Moderna jabs were in the final stages of testing. The US has done particularly well with vaccinations, having now administered at least one dose to almost 50% of the American population. Not only that, but the vaccines have proved highly effective in both suppressing rates of virus contagion and driving down COVID-related fatalities.

The US’s successful vaccination programme has allowed a material unwinding in virus containment measures in recent months, with most major nations expected to be not too far behind. We’ve already seen a sharp rebound in growth in China, one of the world’s largest commodity consumers, which has done a remarkable job in containing the spread of the virus. This rapid removal of restrictions has raised hopes of a swift economic recovery among investors and caused analysts to revise higher their global growth forecasts for 2021. Market participants have subsequently priced in much higher demand for commodities during the remainder of the year. This, in our view, has been the main force driving commodity prices higher in the past few months.

Highly accommodative monetary and fiscal policies. Central banks have slashed interest rates to record lows and government’s around the world have pumped vast amounts of stimulus into their economies in order to support jobs and households during the pandemic period. Moreover, policy is set to remain highly accommodative for the foreseeable future. The Federal Reserve, for instance, is not expecting to raise rates until 2024, despite a sharp increase in inflationary pressures.

Interest rates and commodity prices have an historical inverse relationship. A low-interest rate environment not only supports consumer demand, but also lowers the cost of carry – the physical cost of storing commodities over a period of time. When the cost of carry is low, commodities tend to rise in price.

Low prices since the 2014/5 commodity crash have discouraged exploration and development. Inadequate supply to meet growing demand creates an unhealthy cocktail whereby prices can spiral higher over a prolonged period of time, known as a ‘supercycle’. Fears over a new such cycle have emerged in recent weeks as a number of analysts question whether supply will be sufficient to match booming demand. We think that supply shortages could be a factor in driving commodity prices higher in the medium-term.

What impact have we seen in FX so far?

Unsurprisingly, the rebound experienced in commodity prices has been supportive of currencies of countries that are highly dependent on the primary sector. Two of the best performing major currencies year-to-date have been the Canadian dollar (+5.5% v.s. the USD) and Norwegian krone (+2.2%), the most commodity-dependent currencies in the G10.

Emerging market currencies tend to benefit disproportionately from higher commodity prices, as developing nations generally rely on the production of commodities for a greater share of their GDP than the major nations. The slower vaccination rollout in EM nations has, however, dampened sentiment towards EM currencies – the MSCI emerging market currency index has risen only 1% year-to-date, significantly lagging the move higher in commodities.

Figure 2: G10 FX Performance Tracker (YTD)

Source: Refinitiv Datastream Date: 24/05/2021

How do we expect currencies to react during the remainder of 2021?

We believe that there is room for further upside in commodities during the remainder of the year and think that we could see additional gains in prices once virus restrictions are removed to a greater extent in the developed nations. As indicated above, we think that this would be a conducive environment for rallies in emerging market currencies, particularly commodity dependent ones, at the expense of the US dollar.

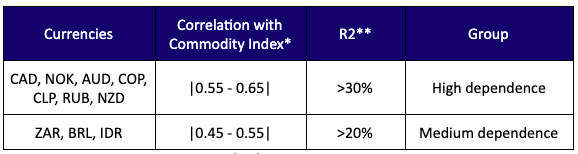

We have picked ten major and emerging market currencies that have historically had the highest correlation with commodity prices and divided them into two groups based on the strength of their correlation with the Bloomberg Commodity Index. We then ran a simple regression to determine how the current exchange rates stack up to that assumed by their historical behaviour in relation to commodity prices. Most of the currencies covered, particularly those of emerging markets, are undervalued based on that assessment^. We are highly optimistic regarding these emerging market currencies, most of which seem rather cheap by a number of metrics, particularly compared to commodities.

Source: Bloomberg, Ebury Date: 13/05/2021

*correlation coefficient between USD/CCY and the Bloomberg Commodity Index

**percentage variation of USD/CCY explained by shifts in the Bloomberg Commodity Index

Time horizon: 12/05/16 – 12/05/21, monthly