How will the US Presidential Election impact the FX market?

( 7 min )

- Go back to blog home

- Latest

November’s US Presidential Election is expected to be the major event risk in the currency markets between now and the end of the year.

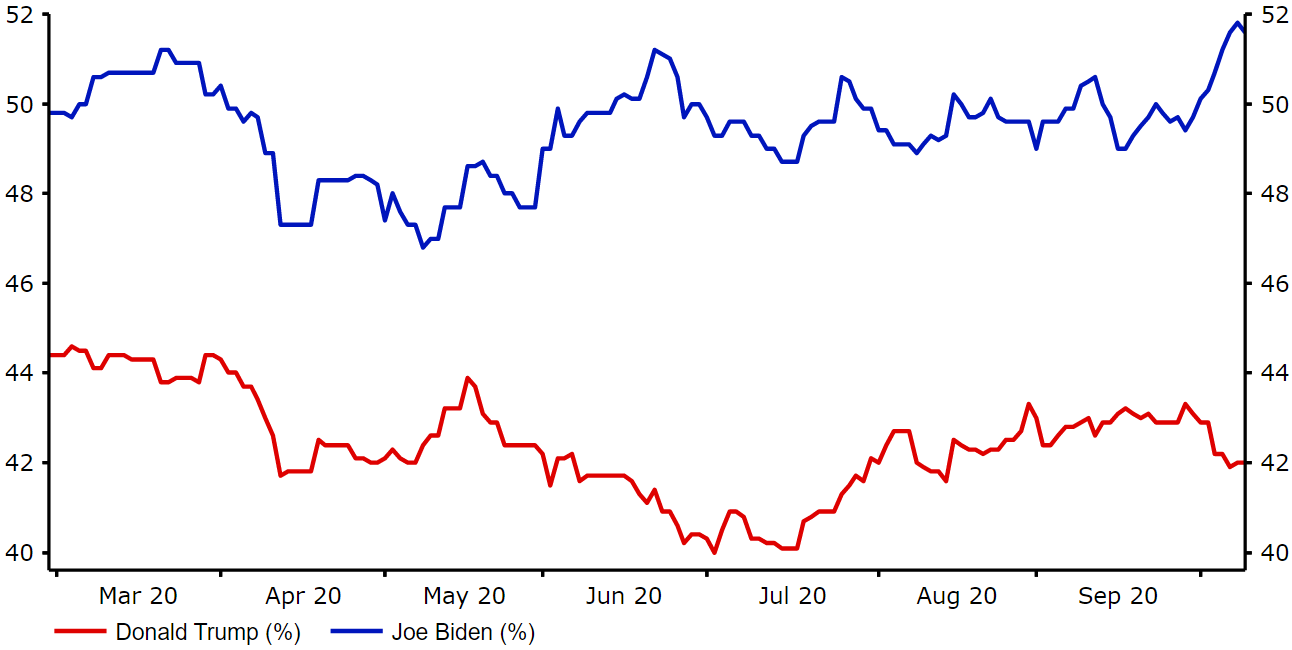

Figure 1: US 2020 Presidential Election Poll of Polls (March ‘20 – October ‘20)

Source: Refinitiv Datastream Date: 13/10/2020

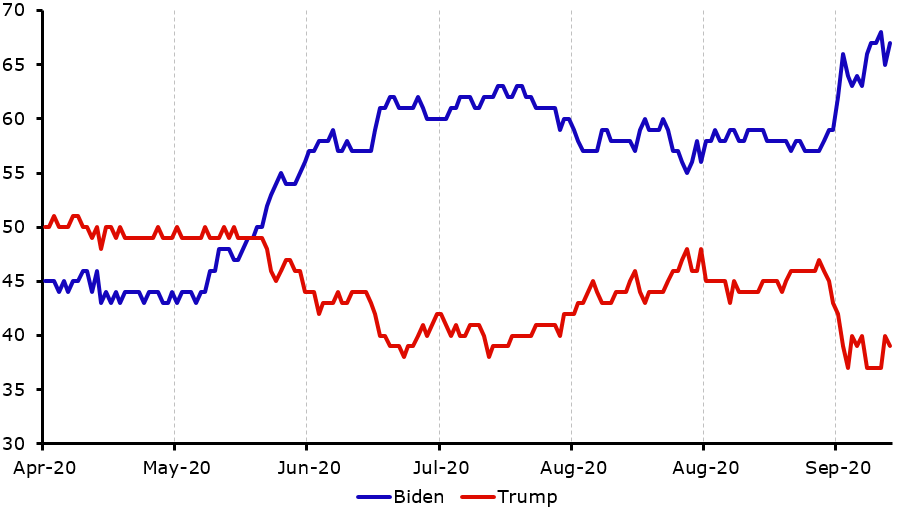

FiveThirtyEight, a US opinion poll website that generates probabilities on the outcome of the election based on simulated voting, now shows an implied 86% chance of victory for Joe Biden. Based on bookmakers odds, the implied probability of a Democrat victory is somewhat less, although at approximately 70% still gives Biden the clear edge, as does a similar measure from political prediction website PredictIt (Figure 2).

Figure 2: Implied Probability of US Election Victory (PredictIt) (April ‘20 – Oct ‘20)

Source: PredictIt/Bloomberg Date: 13/10/2020

Leading up to the first televised debate on 29th September, there was a general expectation that Trump would use the opportunity to close the gap in the polls – as has often been the case during first presidential debates in the past. Instead, the debate turned into a rather unseemly insult match marred by constant interruptions and name-calling, in which sentiment for President Trump declined significantly. The situation has been complicated further by the news of President Trump’s positive COVID test on 1st October, and ensuing hospitalisation. While he appears to be on the path to making a full recovery, his prior carelessness and subsequent lack of campaigning appears to have dented his chances of re-election. Betting markets have reacted to the news by narrowing the odds of a Biden win.

While Trump continues to trail in the polls, it’s worth remembering that the opinion surveys conducted prior to the 2016 election also had him well behind in the months leading up to the vote. Even if Biden were to win the popular vote, his victory is also not guaranteed, given how the US Electoral College system works. Hillary Clinton was the fifth such nominee to win the popular vote only to lose the election four years ago, albeit only the second since 1888.

What is the Electoral College voting system?

The President of the United States is not directly voted for by popular ballot and is instead elected via the “Electoral College” system, where 538 formal electors cast an electoral vote.

Each state in the US is assigned a different number of electors, of which is based on the population within the state. The most populous state, California, therefore has the most electoral seats (55), and no state has fewer than 3. The presidential candidate with the highest percentage of votes in each state will receive all of the seats, with the winning candidate needing to obtain at least 270 votes in order to be elected. An issue with the system is that non-US citizens who are ineligible to vote are taken into account when apportioning delegates. While the system has favoured Democratic strongholds such as California and New York in the past, the overweighting of small rural states and more evenly distributed immigration has mitigated this.

Americans will also be voting on the composition of the US Congress next month. All 435 seats in the United States House of Representatives will be contested, as will 35 out of the 100 seats in the Senate. While the Democrats look highly likely to retain control of the House, the currently Republican controlled Senate appears up for grabs.

Which are this year’s key swing states?

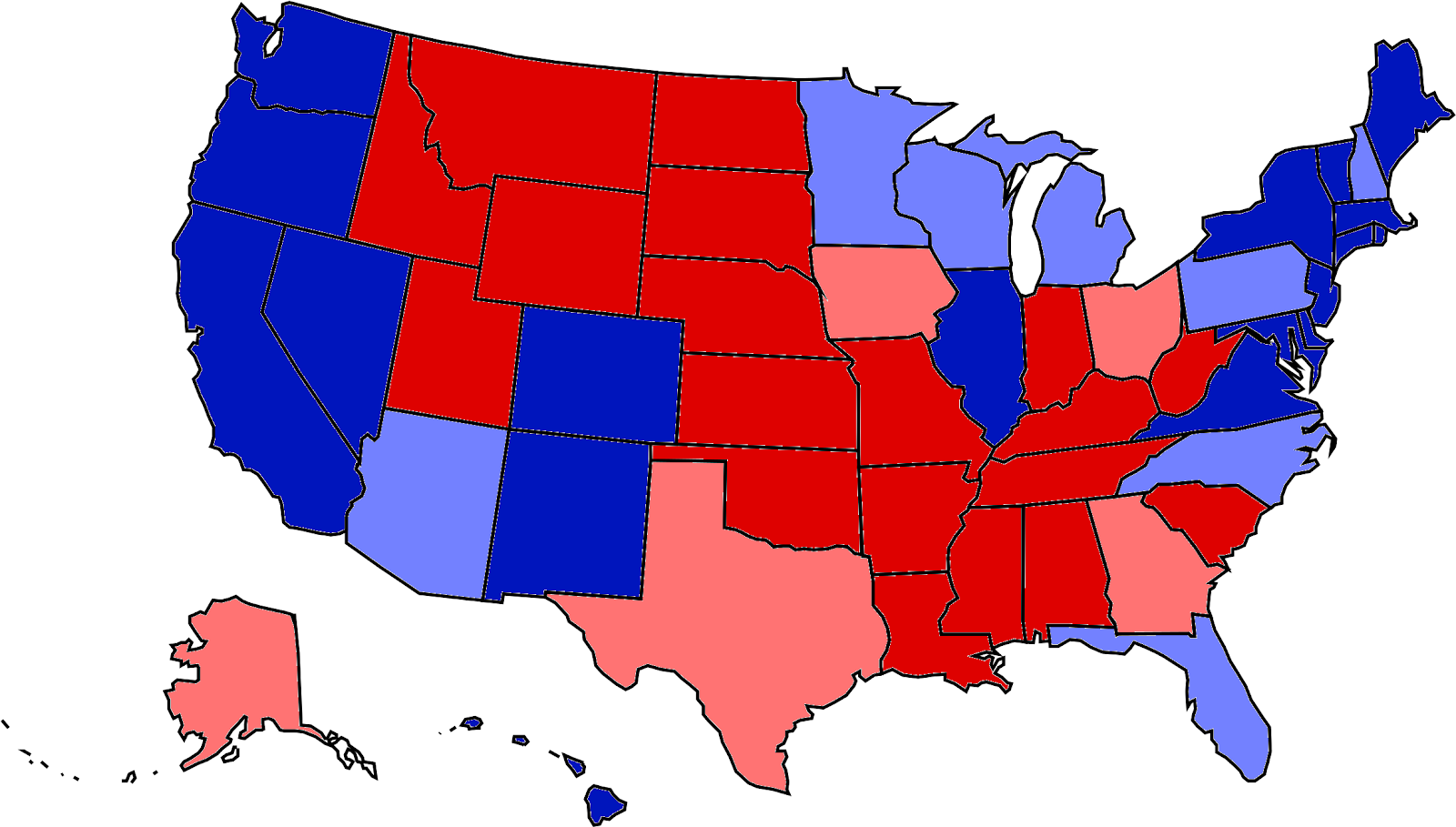

The key battlegrounds in the election, where the campaign will ultimately be won or lost, will be the swing states. These states tend to hold disproportionate sway in the result relative to both the Democratic strongholds (generally the more densely populated east and west coast states) and the staunch Republican territories (largely the more rural south and central states).

Based on the latest opinion polls, and the number of electoral votes available in each state, the crucial swing states this year are likely to be Florida (29 votes), Ohio (18), North Carolina (15) and Arizona (11). Pennsylvania (20), Michigan (16) and Wisconsin (10) will also be closely watched on election night, although Biden appears to have opened up a fairly comfortable advantage in these three states if the latest surveys are to be believed.

Figure 3: US 2020 Presidential Election Voting Map*

Source: Ebury Date: 13/10/2020

*based on PredictIt.org

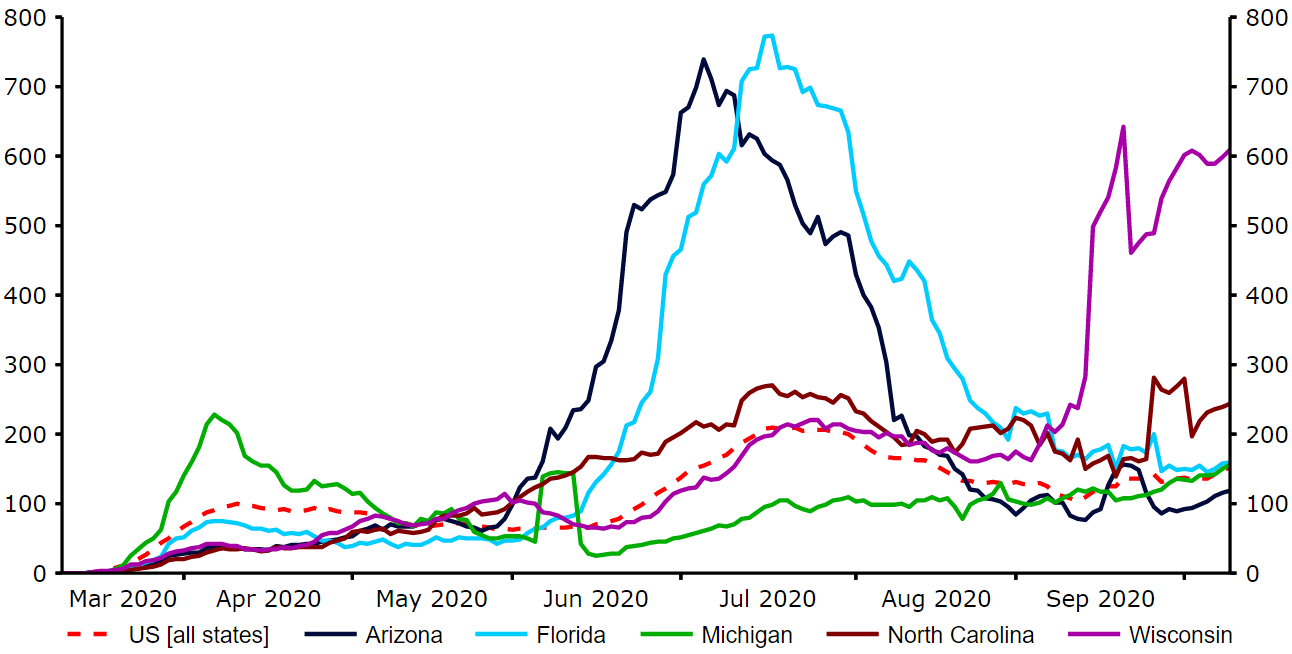

The impact of the COVID pandemic could be a key determinant in these swing states. States such as Florida (34 cases per 1,000 people vs. a 24 national average) and Arizona (31 cases per 1,000) have been particularly badly affected by the pandemic (Figure 4). Trump’s overall handling of the virus has also been widely criticised, which could favour Biden. The US currently accounts for around 20% of all global COVID deaths, despite only accounting for approximately 4% of the world’s population. The relative lack of job protection policies has also triggered a much sharper increase in unemployment in the US relative to most of the developed world, which again may hurt the incumbent president. The initial response of sharply increasing unemployment payments did alleviate the economic crisis, and further aid may be forthcoming before the election, but it seems the public is crediting bipartisan efforts more than the president for these successes.

Figure 4: New COVID-19 Cases per 1M people [Key US Swing States] (March ‘19 – Oct ‘20)

Source: Refinitiv Datastream Date: 13/10/2020

Of the seven states that we mentioned above, Biden is currently polling higher in all but one of them, albeit the most recent poll of polls has his advantage at 3.3% or less in three of them. As we saw in the last election state-level surveys are, however, often relatively inaccurate in predicting political outcomes and can quickly change in the few weeks leading up to the vote. Markets will be paying increasingly close attention to these polls in the coming days for any signs that Trump’s quarantine period, and subsequent lack of campaigning, is further damaging his chances of victory.

How have financial markets reacted?

For the most part, financial markets have so far largely taken the political event risk in its stride. We’ve seen a relatively muted reaction in FX to both the latest opinion surveys and the live televised debate, albeit the recent widening of the polls has weighed on the dollar and supported risk assets, including the euro (Figure 5). This is a bit of a contrast to four years ago. EUR/USD was mostly stuck in a range in the weeks leading up to election day in anticipation of a fairly comfortable Clinton victory, only to explode into life once the results began to reveal otherwise.

Figure 5: EUR/USD (October ‘19 – October ‘20)

Source: Refinitiv Datastream Date: 12/10/2020

We expect this lack of volatility to change in the coming weeks as we approach voting day, particularly should the polls in the swing states either remain close or narrow. As far as the reaction in FX to the vote is concerned, we think that a Biden victory would be largely positive for risk assets, with a Trump win likely to support the safe-havens, including the dollar. While there appears no clear consensus as to whose administration will best fix the US economy, it is worth remembering that the ability of either candidate to push through new legislation as President will be determined by whether or not their party has full control of Congress. The very high likelihood that the Democrats maintain control of at least the House means that of the two, Biden will likely have less trouble in forcing through a larger fiscal package. Biden plans to adopt an expansionary fiscal policy, funded partly by raising taxes on corporations, while Trump would maintain the status quo, avoiding corporate tax hikes but risking greater trade uncertainty.

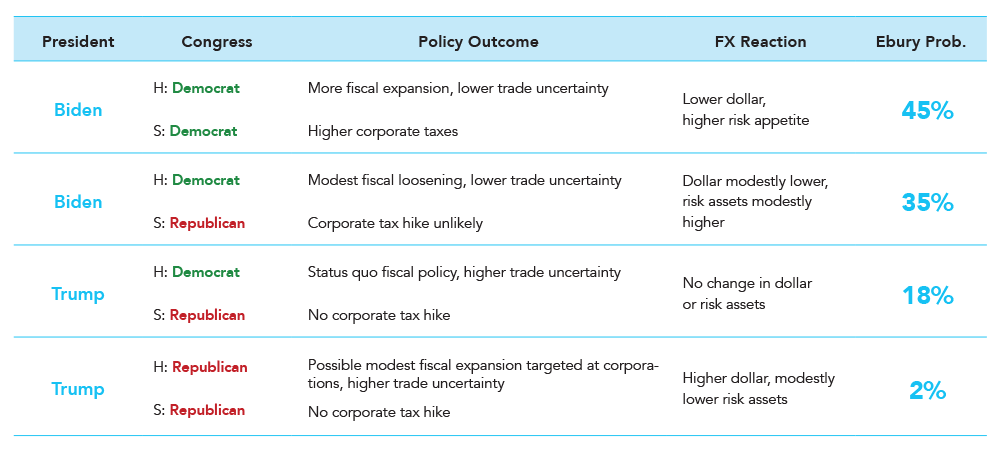

We outline below the potential policy outcomes under the four most plausible scenarios, the probability that we would assign to each and the reaction that we would expect in the FX market.

What would a contested vote mean for FX?

In our view, the biggest risk to the market doesn’t necessarily lie with which candidate emerges as president, but whether or not we see a contested vote. An added complication relative to past elections is that the COVID pandemic will almost certainly lead to many more voters mailing in their ballots. According to a recent survey conducted by Pew Research Center, roughly 40% of participants stated that they expected to vote by mail, up from 20% in 2016. This surge in postal voting greatly increases the chances of the election results not being immediately available, in our view, particularly in those key swing states where the margins may well be very small. President Trump has been increasingly vocal in his dislike of postal voting, recently opposing additional funds to the postal service and making so far baseless claims that mail-in ballots had ‘tremendous fraud involved’. It just so happens that the majority of these mail-in votes are expected to be for the Democrats. Of the first 2.1 million Americans to vote by post across the seven early voting states, 55% were Democrat, 24% Republican, while 20% were said to have no party affiliation.

We see it as highly likely that Trump will refuse to accept defeat and will likely contest the election result come what may should his margin of defeat be anything other than a complete demolition. He has already repeatedly stated that the Supreme Court could be involved in deciding the victor. This, we believe, is one of the biggest uncertainties going into the election. A contested result that drags out the process long after election night will be a concern for investors and would lead to a very uncertain period of currency trading. The recent widening in the opinion polls does, however, lessen the chances of this coming to pass.

*omits negligible chance that House and Senate both change hands, and also Trump winning and Democrats capturing both houses

In a situation where the vote is contested we think that this would be an initial dollar positive in the short-term as investors flock to the safe-haven currencies and sell higher risk assets. In the long-term, we view this as a dollar negative, particularly if not resolved in a swift fashion, given that it would raise serious concerns surrounding institutional quality.

What to expect leading up to the election

One of the best gauges of global market uncertainty is the Japanese yen, arguably the world’s chief safe-haven currency. As per Figure 6, the measure of one-month implied volatility in the USD/JPY cross has jumped with a month to go until polling day, suggesting that the market is wary of a possible sharp shift in risk sentiment following the election. However, because of Biden’s current comfortable lead in the polls the measure has only risen to its highest level since August.

Figure 6: USD/JPY One-Month Implied Volatility (July ‘20 – October ‘20)

Source: Refinitiv Date: 13/10/2020

Leading up to the election, we expect to see both an increase in market volatility and heightened levels of risk aversion as investors remain wary of both a contested vote and delayed result. We therefore see a bit of room for a short-term move higher in the safe-havens prior to the election, including the US dollar. We also see scope for weakness in the higher risk currencies, most notably emerging market ones.

Americans will go to the polls on Tuesday 3rd November, with results from each state expected to begin filtering through from around 19:00 eastern time (01:00 BST).