Imports from non – EU countries set to outperform EU for second successive year

( 3 min )

- Go back to blog home

- Latest

- In 2021, imports from no – EU countries surpassed EU countries for first time ever

- Imports from no – EU countries higher than EU countries through Q1-Q3

- Exports to the EU also lower despite spike in volumes of LNG being transported to the bloc ahead of winter

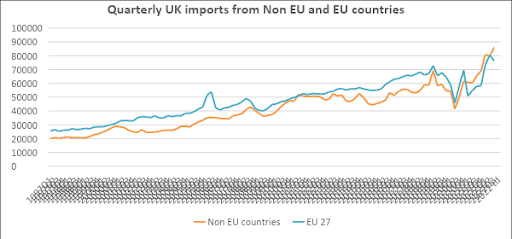

The latest edition of the Ebury Monthly Trade Monitor finds that for a second successive year imports from non-EU countries look set to exceed those from the EU despite having never surpassed annual imports from the EU before 2021.

In 2021, imports from non – EU countries totalled £31.7 billion and volumes from the EU were £22.2 billion. It marked the first time imports from non – EU countries had been higher and represented a major shift in post-Brexit trade following the end of the transition period on 1 January 2021 as the UK government explicitly targeted deeper relationships with global partners in the Pacific.

Despite the unprecedented nature of last year’s trading volumes, 2022 looks set to continue this trend. Through the first three quarters of the year, imports from the non – EU countries have continued to accelerate and reach £24.7 billion compared to £23.0 billion from the EU.

ONS, UK Trade: September 2022,

The growth in imports from Non EU countries has largely been driven by growing volumes from China, the USA and Norway (the UK’s three largest Non EU import partners) and influenced by UK stepping up its efforts to increase LNG supplies to help the country through the current energy crisis.

Four of the five largest EU import partners registered a quarterly decline in imports in Q3 with Germany, Belgium France and Italy exporting less to the UK.

Export volumes to Non EU countries also look set to outperform the UK’s closest trading bloc, despite sending surging quantities of LNG on to the continent to support the EU’s own fuel stockpiling efforts.

Exports total £15.1 billion to Non EU countries to-date in 2022 (Q1-Q3) and £14.5 billion to EU countries.

Jack Sirett, Partner at Ebury, commented: “The saying goes that you wait ages for a London bus and then two arrive at once, and that certainly resonates when it comes to UK importing more in goods from global countries than the EU, its closest trading partner.

“Digging deeper behind the figures shows that the combination of a post-Brexit realignment of trade, supply chain disruption since the COVID pandemic, the growing global dominance of China and the US as well as energy stockpiling is influencing these shifts in the UK’s trading patterns.

“However, it is still striking to see the sudden impact on import volumes at the end of the Brexit transition period when Non EU countries first overtook the EU.

“With trading abnormalities expected to start to balance out next year, albeit fuel imports and exports may remain distorted as the UK looks to guarantee its energy security, it will be interesting to see whether Non EU countries secure a ‘hat-trick’ over the EU.”

ONS, UK Trade: September 2022,

Media enquiries:

Temple Bar Advisory

Alex Child Villiers / William Barker / Sam Livingstone

[email protected]

07827 960151 // 07769 655437