Investors favour dollar on diverging economic data

- Go back to blog home

- Latest

The US dollar traded higher against just about every other major currency on Tuesday.

Meanwhile, the European economy continues to suffer as a result of the much stricter lockdown measures in place across almost all of the continent. The bloc’s economy contracted by 0.7% in the final three months of 2020 (-5.1% year-on-year) according to data released on Tuesday. While this was better-than-expected, there is now growing expectation in the market that a ‘double-dip’ recession in the Euro Area could be on the cards, particularly given the very sluggish rollout of COVID vaccinations in Europe.

Tomorrow’s Eurozone retail sales data is for December and therefore runs on a bit of a lag, although it should give us a decent indication as to how well consumer demand is holding up during the period of tight restrictions. Investors will be more interested in Friday’s US payrolls report, which is likely to be one of the biggest market movers in the FX market this week.

RBA turns dovish, AstraZeneca vaccine slowing virus transmission

The worst-performing currency in the G10 yesterday was the Australian dollar. The currency was hit hard by a very dovish turn from the RBA, which increased their bond buying programme by $100 billion, while stating that interest rates could remain on hold until 2024.

Sterling also sold-off in line with its peers, although the market’s generally optimistic view towards the currency means that losses for the pound have been rather limited. News that the Oxford University-AstraZeneca vaccine was having a ‘substantial’ impact on suppressing transmission of the COVID-19 virus provided further hope for a swift way out of the current crisis. According to the study, the vaccine is also now said to be 76% effective after just one dose and 82% after two – at the upper end of the initial efficacy range.

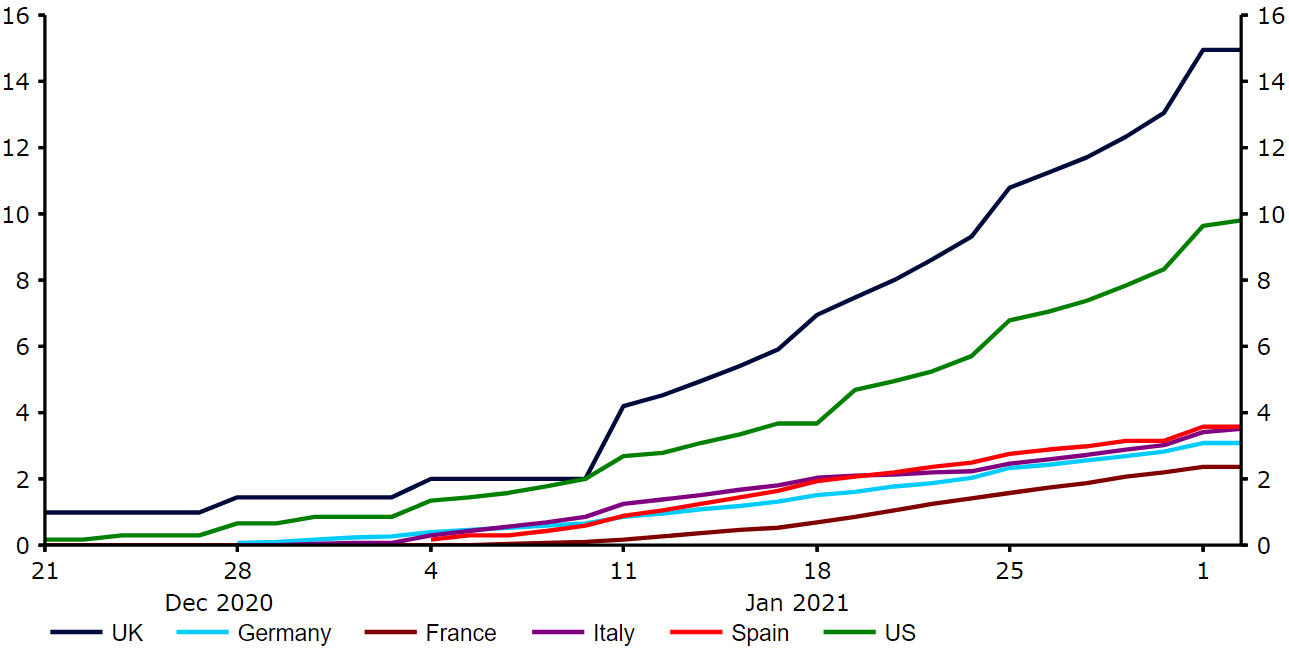

According to the latest data, vaccinations continued to pick up pace in the UK last week, with at least one dose now administered to almost 15% of the total population (Figure 1). This puts Britain on course to reach Boris Johnson’s target of vaccinating the most vulnerable 15 million people by mid-February.

Figure 1: COVID-19 Vaccinations Administered [per 100 people]

Source: Refinitiv Datastream Date: 03/02/2021