Is the UK economy enjoying a ‘V-shaped’ recovery?

( 3 min )

- Go back to blog home

- Latest

The pound leapt back above the 1.32 level versus the broadly weaker US dollar yesterday evening, having spent the entirety of the day below it.

The above news is highly encouraging and, as can be clearly seen in the below chart, evidence that UK consumer spending is (so far) enjoying a V-shaped recovery. The typical stoicism and resilience of the British public in the face of a crisis will, however, be tested in earnest in the next couple of months. Up until now, incomes have been protected by the government’s furlough scheme, a scheme that will come to an end following a gradual unwinding of support at the end of October.

The UK is also now officially in recession, headlines of which may act to warn off consumers. The re-opening of restaurants in July, combined with the apparent success of the government’s ‘eat out to help out’ scheme, could also divert spending to other sections of the economy. For these reasons, investors didn’t get too carried away following this morning’s data – sterling has actually edged lower this morning and is currently trading back around the 1.32 mark versus the greenback at the time of writing.

Figure 1: UK Retail Sales (2015 – 2020)

Source: Refinitiv Datastream Date: 21/08/2020

European business activity eases amid fear of second wave

The move lower witnessed in the dollar on Thursday can be attributed, in large part, to yesterday’s disappointing US initial jobless claims data. New claims for unemployment benefits shot up again last week, unexpectedly rising to 1.1 million versus the 925k consensus – only the third time that weekly claims have increased on the previous week since the peak of the crisis. This is a particularly concerning development in this instance given that the $600 a week additional unemployment insurance benefits from the US government had expired, which in theory may have deterred some Americans from claiming benefits all together.

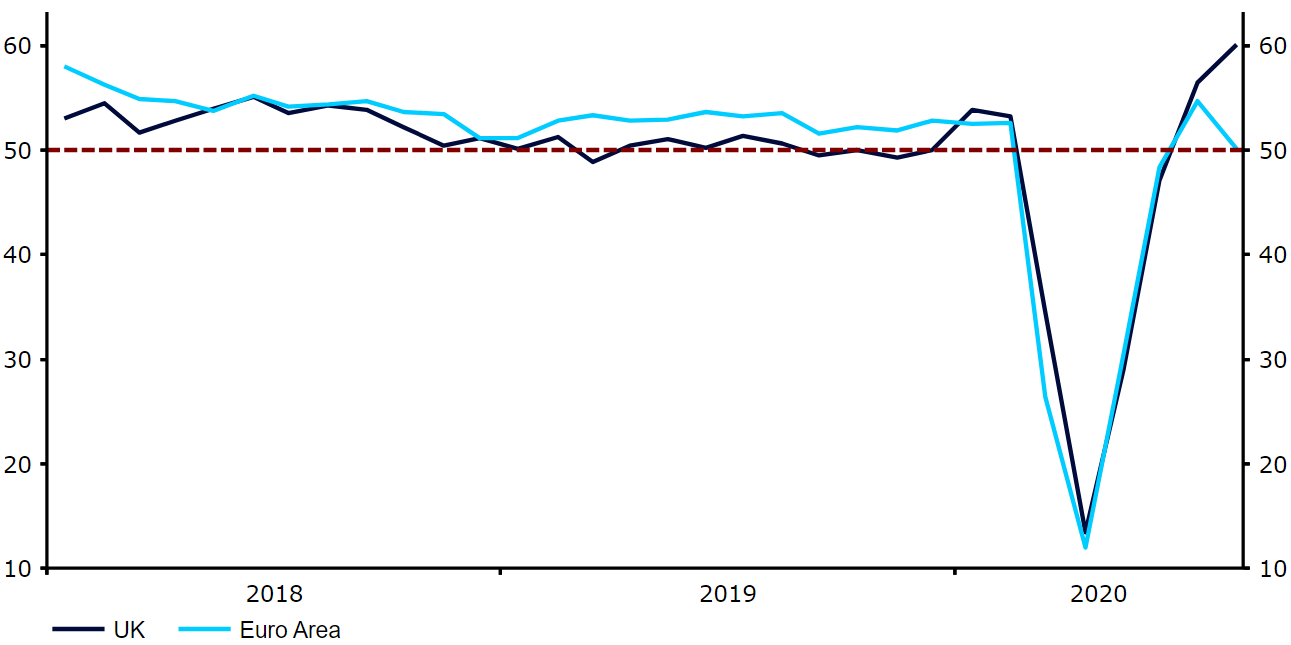

The above sell-off was, however, rather limited, with EUR/USD back on the defensive again this morning following today’s Euro Area PMI numbers – the composite index unexpectedly eased to 51.6 in August from July’s 54.9. This is a sharp contrast to the same data out of the UK, with Britain’s services index seemingly booming last month (60.1 vs. 57 consensus). This divergence, we think, can likely be attributed to concerns surrounding a second wave of virus infection in Europe, during a time in which new UK virus cases have remained remarkably stable. We have seen this reflected in the GBP/EUR exchange rate, which is now at its highest level since early-July.

Figure 2: UK vs. Euro Area Services PMI (2017 – 2020)

Source: Refinitiv Datastream Date: 21/08/2020