Markets prepare for 50 basis point rate hike

( 3 min )

- Go back to blog home

- Latest

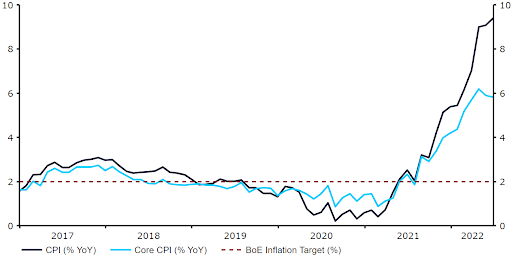

We expect the Bank of England to deliver a 50 basis point interest rate increase at this Thursday’s MPC meeting, though the decision among policymakers on the size of the hike is unlikely to be a unanimous one.

While investors have gradually come around to the view that a 50 basis point hike may well be on the cards this month, it is not yet fully priced in by financial markets. According to swap markets, traders currently see around an 80-85% chance of a 50bp move on Thursday. This would suggest there remains room for an upside surprise in sterling in the event of a half a percentage point hike, and plenty of scope for a sell-off should the committee spring a dovish surprise.

Aside from the decision on rates itself, we expect GBP to also take its cue from the voting pattern among MPC members (which will likely be unanimous in favour of a hike, but split on the magnitude). We think that even a split 5-4 vote in favour of a 50bp move could have bearish implications for the pound, as it would likely lower expectations for large hikes at future meetings. A 6-3 vote may be seen as neutral for GBP, whereas seven or more MPC members in support of a 50bp hike would be seen as bullish.

The BoE will also be releasing its quarterly Inflation Report this week, including its latest GDP and inflation projections. Given the heightened downside risks to UK growth, notably rising inflation and the energy crisis in Europe, we expect a downward revision to the 2022 GDP forecast from May. Dependending on the size of this likely downgrade, this could trigger a bit of weakness in the pound. The reaction in markets to an upward revision in the MPC’s inflation projections is less clear. Should investors perceive even higher inflation as a growing risk to UK growth, then GBP could react in a negative fashion. Conversely, sterling would likely be well supported should the committee use this as rationale for a higher pace of interest rate hikes than markets are currently priced in.

Figure 1: UK Inflation Rate (2017 – 2022)

Source: Refinitv Datastream Date: 02/08/2022

Arguably the key to the market reaction may, however, be governor Bailey’s communications on the likely path of monetary policy beyond this week’s meeting. In light of the fragile global growth outlook, and the MPC’s generally muddled rhetoric in recent months, there is a high degree of uncertainty as to the probable pace of additional hikes during the remainder of 2022. We are of the view that the BoE will keep its options open this week, and follow in the footsteps of both the Federal Reserve and European Central Bank in refraining from providing any clear forward guidance on rates.

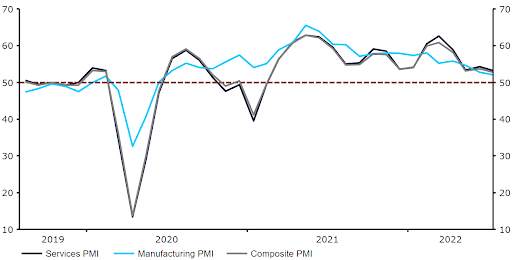

That said, with inflation still showing no signs of abating, and UK activity data (notably the PMIs) holding up rather well, we think there is a reasonable chance that Bailey and co. indicate that at least one further 50bp hike may be on the way at upcoming meetings. In our view, this would trigger a sharp move higher in sterling against most currencies. On the other hand, should policymakers indicate that the larger rate increase is a one-off, then the pound would likely sell-off.

Figure 2: UK PMIs (2019 – 2022)

Source: Refinitv Datastream Date: 02/08/2022

The Bank of England’s policy decision will be announced at 12pm GMT (1pm CET) on Thursday, with governor Bailey’s press conference to follow 30 minutes later.