Markets shrug off turmoil in Washington

- Go back to blog home

- Latest

The extraordinary events at the US Capitol last week failed to impress financial markets.

As COVID vaccines roll out, backward looking data releases like the weak US payrolls report last week are having less effect on markets, which are more focused on consumer and business confidence numbers as well as lockdown announcements. With the US congress busy with a second impeachment process against Trump, the main scheduled news this week will be the release of US inflation data on Wednesday. It will be very interesting to see if the actual data validates the recent surge in market inflation expectations in the US.

GBP

Now that a UK-EU agreement has been reached, currency markets are shifting their focus from Brexit headlines to the announcements of lockdown measures in the UK.

As this is written, newspaper reports that the UK government is considering imposing even tighter measures than the ones already in place is knocking the pound back in early-Monday Asian trading. On the positive side, vaccinations are proceeding at a faster rate in the UK than in Europe, which bodes well for the prospects of a mid-year economic bounce back in the UK and should offer support to the sterling, in our view.

EUR

The scorching euro rally of the past few weeks is stumbling somewhat, partly on news that the vaccine rollout in most of Europe is lagging both state predictions and the vaccination numbers in the US and the UK.

This rollout is key to our forecast for a faster than expected economic bounceback after the lockdowns begin to be lifted. It is early days yet, but we will be following these numbers very closely, and we suspect financial markets will do likewise. For now, our view on the euro long-term remains positive, though we expect a few weeks of consolidation after its sharp rise of the past few weeks.

USD

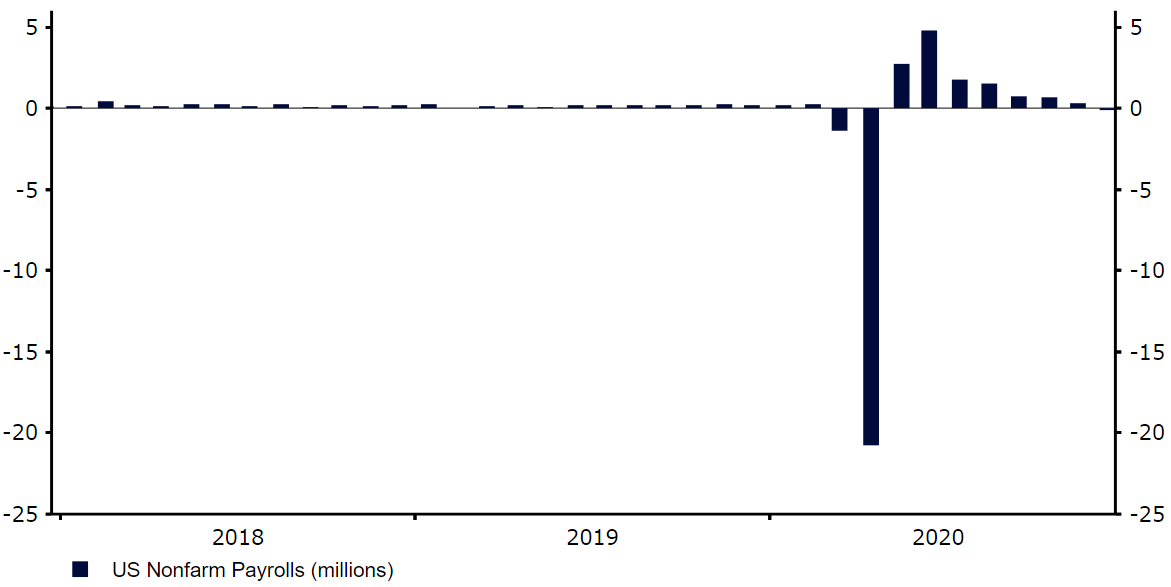

Markets have decided to look forward to the vaccine rollouts and the lifting of the lockdowns in mid-2021. They are looking past the political turmoil in the US, and also the disappointing December labour data published last week. Very weak hospitality and leisure numbers dragged down total job creation, and the US experienced a net job loss for the first time since the pandemic bottom. The magnitude of the contraction in jobs was, however, rather minor, particularly compared to the devastation of April (Figure 1).

Figure 1: US Nonfarm Payrolls (2018 – 2020)

Source: Refinitiv Datastream Date: 11/01/2021

The Democratic victory in both of Georgia’s senate races means that significant further fiscal stimulus is likely. In the near-term, we think that the resulting higher US yields will provide a floor under the US dollar. However, we maintain our long-term bearish view of the greenback.