Nigeria’s Current Economic Landscape and Outlook

- Go back to blog home

- Latest

Key Findings:

- Nigeria’s naira devalued above 1,400 against the dollar after the central bank shifts policy stance following failed stabilisation attempts.

- Devaluation closes the massive gap with the parallel market naira exchange rate.

- The Central Bank of Nigeria has raised interest rates to tackle inflation, alongside efforts to bolster the economy through increased oil production.

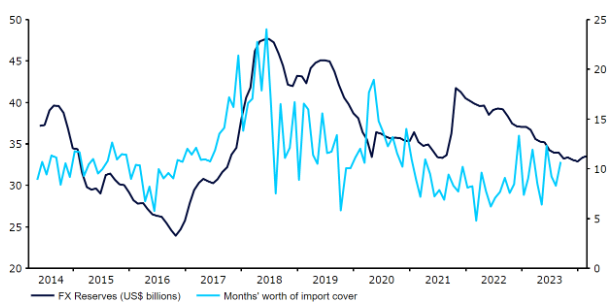

- We see further devaluation as likely, particularly given CBN’s very low FX reserves.

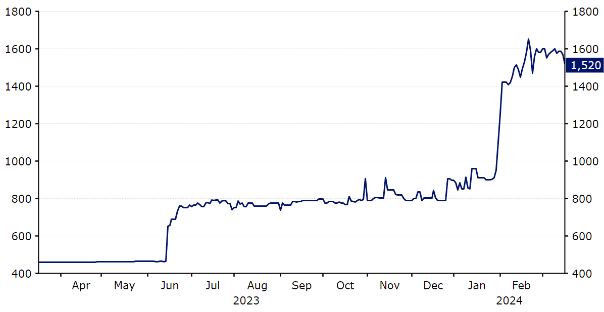

Following the abandonment of the Central Bank of Nigeria’s long-standing peg in June, the spread between the official and black market exchange rates once again diverged significantly. At the end of January, we witnessed another devaluation that brought the USD/NGN rate up to the 1,400 level (a 55% drop in the Naira’s valuation). Since then, the Nigerian currency has depreciated further.

The FMDQ Securities Exchange, which calculates the currency exchange rate, revised the methodology used, in what is seen by many as another technical devaluation of the currency. To recall, in June, President Bola Tinubu removed Nigeria’s foreign currency controls in a move directed towards finding a new market level for the currency. Authorities, however, failed to let the currency trade freely, and attempted to limit the depreciation.

The naira’s exchange rate subsequently remained far apart from the black-market rate. As a result, the naira depreciated sharply following the decision to close the unsustainable gap between the official and parallel USD/NGN exchange rate in January, with the former exceeding the black market rate for only the second time in the last nine years. The NAFEX rate, renamed from the Investors’ and Exporters’ (I&E) FX Window in 2023, has not been liquid for some time, and Nigerian banks themselves are not allowed to have open positions on the dollar.

Figure 1: USD/NGN (March ‘23 - March ‘24)

These domestic banks have also been ordered to limit their foreign exchange exposure – a move intended to cut speculative bets against the naira. Net open positions of foreign currency assets and liabilities ‘should not exceed 20% short or 0% long of shareholder’s funds unimpeded by losses’. Also, the central bank has signalled its intention to allow the naira to trade in wider bands, while seeking to strengthen it by selling short-dated, open-market operation naira notes at attractive yields. Licensed traders are now allowed to share their NGN/USD exchange rates online. All of the above are intended to limit the chaos caused by the split introduced in 2017 between the government transaction rate (pegged against the USD), investors and exporters rate and others (travellers rate, SME rate, etc.), while also leading to a strengthening and stabilisation of the naira.

In order for this stabilisation, or perhaps even strengthening of the naira, to occur, the bank must first solve the long faced problem of the backlog of accumulated forex demand, forcing individuals and businesses to use the parallel market. Matured forex forwards amount to around $5 billion, although more than $2.5 billion has been cleared since the new CBN president took over. The very low level of foreign exchange reserves, which according to JPMorgan are currently at levels much lower than officially declared, were quoted at $33.37 billion in January, just shy of the lowest level since 2017. This certainly does not help matters, as it limits the ability of the central bank to continue intervening in order to protect the naira exchange rate.

Figure 2: Nigeria FX Reserves [$ million] (2014 - 2024)

This backlog is largely a result of a poor trade balance (albeit this has improved lately and the current account balance is now in positive territory) and the country’s weak export position (relative to 2011-2014 levels). In the post-pandemic period, the decline in exports was all too tangible (down by more than 50%), largely due to declining domestic investment and, what could be considered particularly important, lower oil sales volumes, which account for 90% of Nigeria’s export revenue. Imports also weakened only ever so slightly. A decline in foreign investment, including the withdrawal of GDK Plc and Procter & Gamble Co., have not been helped by currency shortages and unstable financial conditions, which created a kind of feedback loop.

Attention now turns towards the Central Bank of Nigeria’s monetary policy decisions. The bank’s monetary policy committee met for the first time in seven months in February, raising the reference interest rate by 400 bp in a move that could be considered as a front-loading strategy. We anticipate that the upcoming months will see the BoN maintain the more orthodox approach, focused on achieving monetary and price stability – a shift to inflation targeting rather than controlling the money supply. This is all the more logical given that inflation rose to its highest level since 1996 in January (29.9%). This stance should be supported by President Tinubu, whose decisions so far look much more coordinated and embedded in the macro framework than those of his predecessor.

Figure 3: Nigeria Real Interest Rates (2014 - 2023)

The planned increase in oil production should help to support exports (domestic oil production has declined since mid-2020, reflecting low investment and significant leakages associated with poor maintenance and theft). The price of oil remains the single most important factor for the Nigerian economy, with petroleum accounting for over 80% of exports, a third of banking sector credit, and half of government revenue. Brent crude oil futures have fallen since the September peaks, although still remain reasonably elevated from a historical perspective, and above the 5- ($72) and 10-year ($68) moving averages. This may help to revive economic growth that, despite standing at positive levels for eleven consecutive quarters, remains at levels that predominantly characterise developed rather than emerging market economies (± 2.5% YoY).

Figure 4: Brent Crude Oil Futures (2023 - 2024)

The reasonable level of growth was largely due to the relatively high oil prices as outlined above. We have, however, seen a pronounced weakness in the industrial sector, where annual output has declined in eleven of the last thirteen quarters. High unemployment remains an issue, albeit this is difficult to interpret on the basis of available data and a change in the definition of the jobless rate. The official unemployment rate dropped to 4.2% in Q2 2023, from more than 30% in Q4 2020, albeit the definition of the latter more closely resembled underemployment, as this was calculated as the percentage of the workforce working less than 19 hours per week. Structural problems stemming from deep historical divisions are also evident, yet these are primarily a constraint to the long-term growth prospects, not the short- or medium-term outlook.

All things considered, we expect the magnitude of any additional naira depreciation to be somewhat less severe than over the past year. Foreign exchange reserves remain at very low levels (particularly when looking at JPMorgan reports), limiting the possibility of intervention. The efforts of the Central Bank of Nigeria and the government to curb the chaos are, however, now much more deliberate and coordinated. The expected frontloading and the anticipated shift towards a more orthodox approach on achieving monetary and price stability should help to some extent (at least in the short-term). Measures aimed at increasing oil production are also meriting attention.

Forward markets are assuming a further depreciation of the currency, currently pricing the USD/NGN exchange rate at around 1,750 in one years’ time. We see further devaluation as possible should the gap between the official and unofficial exchange rates re-establish itself, or should the Central Bank of Nigeria fall short in its efforts to prop up the currency at upcoming policy meetings. Due to the recent devaluation and the move of the official rate closer to the parallel market rate, we are revising our USD/NGN forecasts higher, and are expecting a continued modest increase in the pair over our forecast horizon.

| USD/NGN | EUR/NGN | GBP/NGN | |

| Q2-2024 | 1,600 | 1,730 | 2,015 |

| Q3-2024 | 1,625 | 1,770 | 2,065 |

| E-2024 | 1,650 | 1,815 | 2,110 |

| Q1-2025 | 1,660 | 1,845 | 2,140 |

| E-2025 | 1,700 | 1,940 | 2,245 |

Transact and expand in emerging markets confidently

Finding it difficult to unlock growth opportunities in Africa, MENA, Asia, and Latin America? Our mission is to bridge the payment processing divide between global businesses worldwide and emerging economies.

Our simplified and reliable payment and collection solutions are designed to help you set yourself up for success when transacting in Africa, MENA, Asia, and Latin America. Contact our team to learn more about our emerging market capabilities

Disclaimer

The information provided herein is general in nature and should not be construed as financial or investment advice. The information provided here is not legally binding. The information, data or views expressed here is for the exclusive use of the recipient and is subject to changes without any notice. You may ask the support team or your dedicated relationship manager to provide additional information regarding Ebury products.