Optimism on inflation buoyes financial markets, emerging markets

( 2 min read )

- Go back to blog home

- Latest

Last week brought some relief on the inflation front on both sides of the Atlantic.

Attention this week turns to the all important CPI inflation report in the US, out on Thursday. Market optimism that the peak of inflation is behind us leaves little room for error here. Strategists and economists are mostly revising upwards their forecasts for the euro on the back of a sense that the impact of the energy crisis will be less than expected and that any recession there will be short and shallow – which has been our view throughout. UK monthly GDP figures for November and a slate of major central bank speakers, led by Fed chair Powell on Tuesday, will round out the week’s events.

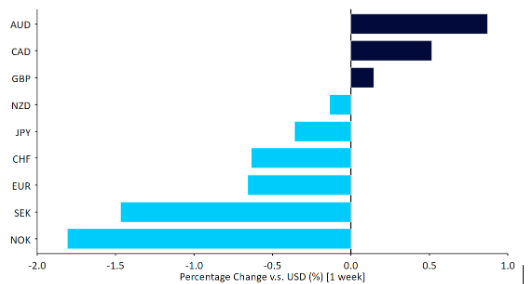

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 09/01/2023

GBP

Sterling had an unremarkable start of the year, but still managed to put in a decent performance near the top of the G10 performance rankings. The pound is now viewed as a risk asset and was buoyed modestly by strong markets.

This week, the November GDP data stands out as we look for confirmation that the UK is in a mild recession. Consensus expectations are for a 0.3% shrinkage in economic output, but these economist forecasts have tended to be overly pessimistic in the past few months. Sentiment around the UK economy is quite bearish and a positive surprise here could lead to a significant sterling rally, in our view.

EUR

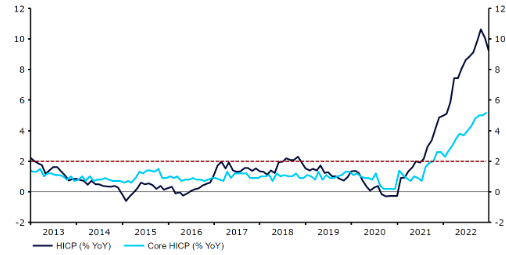

Sentiment surrounding the Eurozone economy has improved remarkably over the past few weeks, on the back of a mild winter, lower energy prices and what looks to be a meaningful improvement in headline inflation. We caution against reading too much into last week’s inflation surprise. It was caused by direct state intervention on electricity prices, particularly in Germany and Spain, rather than a meaningful rebalancing between supply and demand. The more persistent core inflation number continues to increase and there is no sign that it has reached a peak yet.

ECB officials seem to agree with us, and the tone of their communications is much more hawkish than is suggested by current market pricing of future rate increases. We maintain a positive view of the common currency based on our expectations of higher terminal rates from the ECB.

Figure 2: Euro Area Inflation Rate (2013 – 2022)

Source: Refinitiv Datastream Date: 09/01/2023

USD

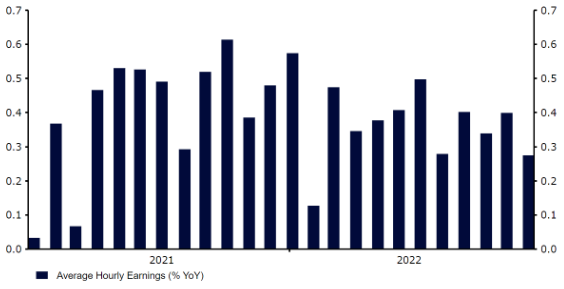

The US labour market report for December must have been pleasing to the Federal Reserve, as it was neither too hot nor too cold. Jobs continue to be created at a steady though moderating pace, and while unemployment remained near its lows, wage increases seemed to cool. Overall, the numbers are consistent with moderating inflation as well as a growing economy. In other words, a soft landing.

The signs that inflation may have peaked for the short-term are more convincing in the US than in Europe, but the Fed shares the ECB’s healthy scepticism and commentary from FOMC officials remains hawkish. The dollar seems unsure of where to go, weighed down by optimism on inflation but supported by the tone of the Fed’s communications. The upcoming inflation report should provide some clarity.

Figure 3: US Average Hourly Earnings [% MoM] (2021 – 2022)

Source: Refinitiv Datastream Date: 09/01/2023

JPY

The yen put in a middling performance during the first trading week of 2023. The Japanese currency was actually one of the better performers in the world in the final couple of weeks of last year, as the Bank of Japan delivered a dramatic U-turn on its monetary policy stance. The BoJ, which was undoubtedly the most dovish central bank in the G10 in 2022, unexpectedly lifted the upper limit of its cap on 10-year government bonds from 0.25% to 0.50% during its 20th December meeting, triggering the largest upward move in Japanese bonds since 2003.

CHF

The Swiss franc traded within a narrow range against the euro last week, ending it around the middle of the G10 currency performance dashboard. Mirroring the Eurozone, Swiss inflation fell in December, surprising to the downside. A decline to 2.8% from 3% is a welcome sign, but the inflation fight in Switzerland is not yet over. Core inflation remains uncomfortably high and, surprisingly, trended in the opposite direction to the headline number, increasing back to 2% from 1.9% in the previous month. Moreover, January may see an increase in the headline rate itself, as utility providers adjust prices.

We are pencilling in another interest rate hike from the SNB in March, albeit the size of the move and possibility that this could be the end of the hike cycle are not yet set in stone. In this context, we’ll keep an eye on upcoming data from Switzerland, especially inflation prints for January and February. This week’s calendar, however, is largely empty, therefore, the attention should be on outside news.

AUD

The Australian dollar was the best performer in the G10 last week, largely a consequence of the growing optimism surrounding the Chinese economy. China effectively ended its zero-covid strategy in December, which has been a clear bullish signal for the economic areas heavily reliant on trade or tourism flows from Asia’s largest economy. After a two year ban, reports that China is considering resuming imports of Australian coal have also buyed AUD, which opened trading this morning above the $0.69 level and its strongest position since August.

A number of data releases are on the docket in Australia this week, which may lead to a rather volatile few days for the dollar. We will be paying closest attention to the November inflation and retail sales data (both on Wednesday). Stronger prints here should support AUD, and would support our view of an outperformance in the Australian economy relative to expectations.

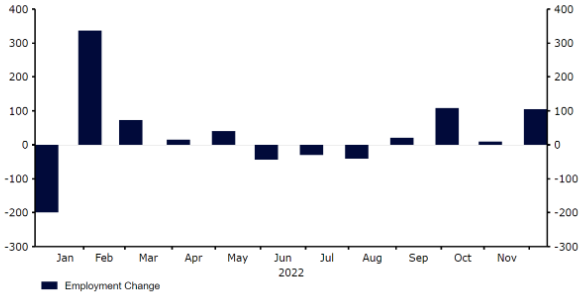

Figure 4: Canada Net Employment Change (2022)

NZD

We witnessed another underperformance in NZD relative to its Australian counterpart last week, which has been a theme since mid-December. News of China’s reopening is a highly positive development for the New Zealand economy, which relies on the country for more than one-quarter of its overall export revenue, though the New Zealand dollar has struggled to post any meaningful gains since zero-covid was abandoned. While a previous outperformance may partly be to blame, we are somewhat surprised we’ve not seen a more significant rally. This week is light on data in New Zealand, with consumer confidence data on Tuesday the only real data release of any note. With that in mind, we suspect that NZD will be driven by events elsewhere.

CAD

Aside from the Japanese yen, CAD has been the best performing currency in the G10 in the past month. This may partly be due to valuation, as the Canadian currency underperformed most of its peers in the second half of last year. Global oil prices have also stabilised in the past few weeks, while economic data has held up reasonably well in Canada, opening the door to an additional rate hike from the Bank of Canada at either its January or March meetings.

Last week’s strong labour report supported the view that further tightening may be on the way. A further 104k net jobs were added in December, well above the 8k expected, while the unemployment rate also dropped to 5% from 5.1%. This is a scorchingly hot report, and we now think that another hike at some point in Q1 is more likely than not.

Figure 4: Canada Net Employment Change (2022)

Source: Refinitiv Datastream Date: 09/01/2023

SEK

In a shorter-than-usual trading week in Sweden, with no major economic data releases, the krona ended the week lower against the euro, with the EUR/SEK pair trading around the 11.2 level. Better-than-expected eurozone data pushed EUR/SEK to trade at its highest level since 2020 at the end of last week, although the krona has since recovered some of its losses.

Inflation data for December will be released this Friday. The inflation rate is expected to fall back slightly from the previous month, but a higher than expected number could boost the krona, as it would support our argument that the Riksbank will likely need to keep raising interest rates in the coming meetings in order to bring down high inflation.

NOK

With no major economic news out in Norway last week, NOK was driven largely by events elsewhere. In line with the Swedish krona, the Norwegian krone ended the week lower against the euro, with the pair EUR/NOK trading around the 10.6 level. We were slightly surprised by the underperformance of NOK last week, which ended at the bottom of the G10 performance tracker. News of China’s reopening should be supporting global oil prices, and the krona, though this doesn’t yet appear to be fully reflected in the value of the commodity.

Norwegian inflation data for December will be released on Tuesday. The headline print is expected to increase from the previous month, which may support the view that Norges bank still has some way to go in its fight against inflation. In addition, the recent slight rebound in oil prices may also offer some support to the Norwegian currency.

CNY

The Chinese yuan rallied by approximately 1% against the US dollar last week and jumped even more in trade-weighted terms. While this can partly be attributed to improving risk sentiment, we have little doubt that China’s reopening is leading to a change in investors’ approach toward the currency.

The latest PMI data from China confirmed that business activity was muted in December. With the country expected to deal with additional waves of covid in the first quarter of 2023, we’ll likely need to wait sometime until the economy picks up again. Yesterday’s easing in travel rules is, however, supporting optimism as it appears to be a final nail in the coffin of the zero-covid policy. Looking ahead, we’ll keep an eye on the CPI and PPI data for December, out on Thursday. Early next week, the PBoC will set the rate on the one-year medium-term lending facility (MLF). A change there would be a surprise and instead the market focus will likely be on the rollover.

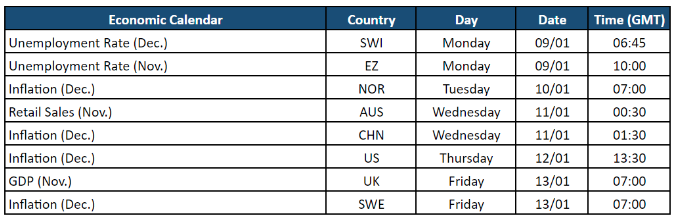

Economic Calendar (09/01/2023 – 13/01/2023)

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports