Collapse in PMIs points to violent economic downturn

- Go back to blog home

- Latest

The April PMI data made for very grim reading indeed this morning, providing further evidence that the global economy is on course for a very sharp contraction this year.

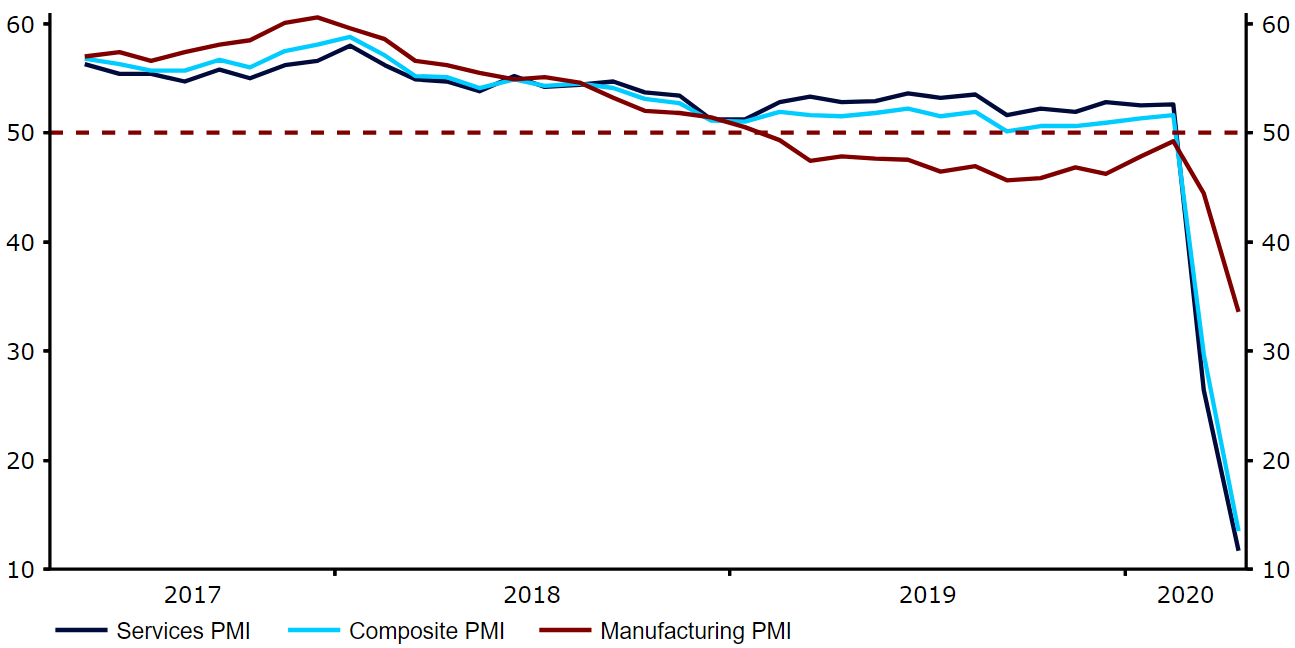

Figure 1: Euro Area PMIs (2017 – 2020)

Source: Refintiv Datastream Date: 23/04/2020

If it wasn’t already blatantly obvious, the Eurozone economy is set to take a massive hit following authorities efforts to contain the virus, with businesses closed and people forced to remain indoors. According to Markit, the body that releases the monthly PMI data, this month’s composite index is in line with quarter-on-quarter contraction of a quite incredible 7.5%. There is, however, some light at the end of the tunnel, with governments in Italy and Spain looking likely to begin easing lockdown measures next month. This could potentially mean that the data has bottomed out.

EUR/USD lost some ground in response to the release of the data this morning, although the move lower was largely contained to less than half a percent, with the common currency finding a bit of support around the 1.08 level.

Sterling unfazed despite dramatic PMI decline

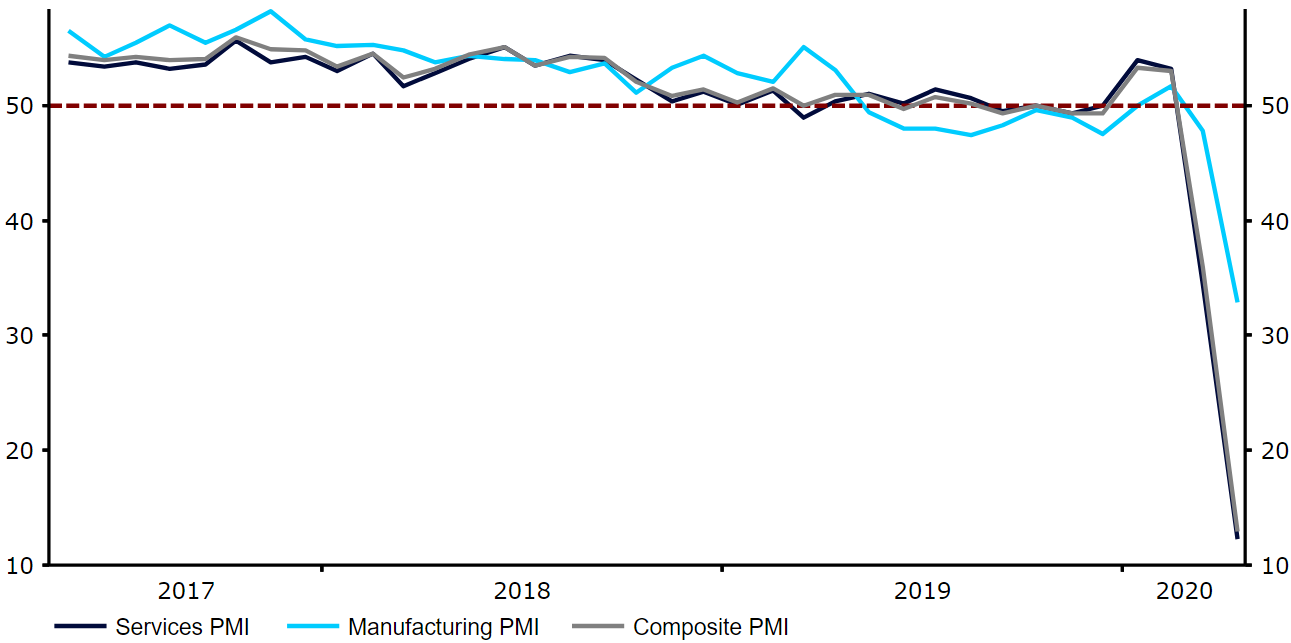

Today’s UK PMI numbers were equally as depressing, also falling to fresh record low levels.

Much like in the Euro Area, the services index collapsed to just 12.3 this month after investors had eyed a reading of 29.0 – way too optimistic given that last month’s data was saved by the fact that the lockdown didn’t begin until mid-way through the month.

Figure 2: UK PMIs (2017 – 2020)

Source: Refinitiv Datastream Date: 23/04/2020

Comments from Markit’s chief business economist Chris Williamson read as follows:

“The UK economy has been hit by the COVID-19 outbreak in April to a degree far surpassing anything seen in the PMI survey’s 22-year history. Business closures and social distancing measures have caused business activity to collapse at a rate vastly exceeding that seen even during the global financial crisis, confirming fears that GDP will slump to a degree previously thought unimaginable in the second quarter”

It’s clear that a big contraction in activity in the UK due to the lockdowns is inevitable, with these numbers in line with an approximate 7% quarter-on-quarter decline in GDP. The issue is, however, that this data just covers just business activity and doesn’t include either the retail sector or those self-employed, which may be hit even worse. Again, the pound was little moved following the data, we think largely due to the fact that we are in uncharted territory with no historical precedent to compare against. Even those PMI forecasts from the top economists were little more than wild guesses.

Going forward, we think that the key to how the currency market performs in the medium-term may not necessarily be how severe each economy contracts during the height of the lockdowns, but how quickly they get back on their feet once the worst of the virus is over. This will, of course, depend heavily on how successful regional governments are in getting their domestic rate of contagion under control as quickly as possible.