Polls narrow ahead of next week’s US Presidential Election

- Go back to blog home

- Latest

There is now less than a week to go until the US Presidential Election on 8 November and a victory for Republican Donald Trump has become a realistic possibility.

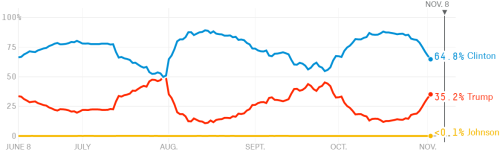

Prediction website fivethirtyeight.com is now placing around a 65% probability of a Clinton win compared to close to 90% as recently as last week (Figure 1).

Figure 1: Fivethirtyeight US Presidential Election Odds (June ’16 – November ’16)

We stick by our prediction for a Clinton election victory

Clinton comfortably came out on top following the three recent TV debates, while we think the Electoral College system should also give the Democrats a slight advantage.

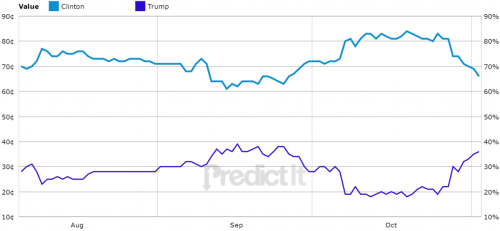

At this point the swings in the polls are also reflecting changes in supporters willingness to talk to pollsters. Historically, almost no one changes their minds this close to an election and even a very close victory for Clinton (<2 points) will probably translate into a comfortable electoral vote majority, given the distribution of the states. The PredictIt website, where users bet on the outcome of various political events, has also more or less tracked the fivethirtyeight.com prediction (Figure 2). Figure 2: PredictIt US Presidential Election (August ’16 – November ’16),

How has this impacted the currency markets?

So far we’ve not seen any massive moves in G10 currencies in response to election news, suggesting either that investors remain confident of a Democrat victory, or they do not see much impact from a Trump victory.

There have been some jitters in the Mexican Peso over the past week, although it has so far only retraced about a half of its rally since the first TV debate.

The moves in the safe-haven Swiss Franc and Japanese Yen in the past few days have also been fairly modest. However, this has changed this week and we saw the first moderate sell-offs in the US Dollar in response to the tightening polls. Risk assets such as equities and commodities have also sold-off.

What is the potential market impact from each result?

In the scenario of a Hillary Clinton election victory, we’re almost certain to see the Federal Reserve tightening monetary policy again when the FOMC next convenes on 14 December. Markets are currently pricing in around a 80% chance of a December hike and we expect this to increase further should Clinton prevail in next week’s election. This, in our view, would put the Fed firmly on course to increase rates roughly once a quarter in 2017 in line with the FOMC’s recent dot plot.

However, there is no denying that the chances of a Trump victory are real and not negligible. Such a result would certainly result in a sharp increase in volatility in the currency markets, together with a significant sell-off in emerging market currencies.

Concerned how these developments may impact your business?

Need to cover your currency exposure?

Contact our expert team