Portugal – Experience is Worth its Weight in Gold

( 4 min read )

- Go back to blog home

- Latest

This week’s spotlight series takes us to Portugal. A country steeped in global commerce, along with its colonial presence, became the epicentre of trade and exploration beginning in the 15th century and basically lasting until the Carnation Revolution era. Despite a series of setbacks throughout this era and tough economic times, the rebounding economies were relatively strong, improving the lives of many in the country. In 1986 membership to the European Union was granted and the ability to tap EU funding for infrastructure and support was available. A series of agreed fiscal cuts and structural reform, helped by falling interest rates, enabled Portugal to qualify for entry to the EURO.

By 2012, with a lack of both growth and an austerity plan, Portugal found itself in need of an almost 80bn EUR bailout package from its fellow EU members amidst the euro crisis. Bailout concerns were hotly contested by many peers and international agencies, and viewed as a reward for poor planning and expense control. Knowing that default was not an option under the EURO regime, the European Central Bank, the European Commission and the International Monetary Fund provided the bailout. As a result a forced, stinging austerity package was introduced based on deep costing and reduced government spending.

The Comeback Kid

Bailout measures included strict measures to increase working hours, cut holidays and holiday pay as well as deep cuts to wages and pensions. Spending on public health and education were slashed and the newly minted workforce were encouraged to leave the country for employment. This had a dire effect on the spirit of the people of Portugal and the overall economy as consumer spending, new business investment and development waned. By the end of the three-year EU bailout the government, with a clean pallet, recommitted itself to maintaining reforms that would place the country back on track to prosperity, despite acknowledging that there were still obstacles and cultural changes ahead.

By 2015, the Portuguese people and the economy needed a boost and change was on the horizon. A newly elected Prime Minister Antonio Costa was ready to affect change. While Costa’s detractors warned him of rolling back the austerity program previously agreed, he was able to walk the tightrope of growth by investment, slowly rolling back the austerity programs and maintaining fiscal discipline.

By 2017, GDP had a growth rate of 2.7% and an unemployment number of 6.8%, half the previous recorded number. These changes began having a profound impact on the people and economy of Portugal and it became contagious. A rise in consumer spending on capital goods and luxury, along with newfound optimism in the nations businesses. Products and start ups grew as a result of strong nationalism, that improved Portugal’s trade position by more than 50 % since 2008 by nearly 20bn EUR. This has never been more evidenced by its recent tech boom, as Portugal has become an unexpected hub for technology development. The number of professional programmers rose by 16.2 %, the fastest rate in all of Europe. By 2018, that sense of nationalism created a huge demand in tourism, a major revenue generator, which increased by 12%, to 12.7 million people.

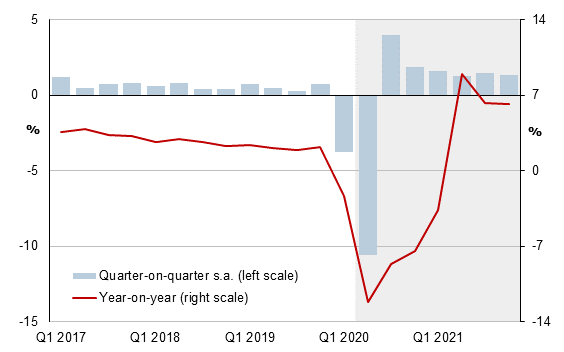

Portugal GDP Q12020

Note: Quarter-on-quarter (s.a.) and year-on-year changes in GDP in %

Source: Statistics Portugal (INE) and FocusEconomics calculations

A Worldwide Pandemic Can Change Everything

As we approached the new decade Portugal’s economy was making strides towards continued growth and even received a long-needed Moody’s upgrade from junk status to investment grade. This good news came despite the fact that Portugal has the 3rd highest debt load in the EU and a steadily increasing aging population from 37.9 in 2000 to 46.2 in 2020. A clear sign that millennials have continued to flee the country for opportunities outside the country, but that was not the only problem on the horizon. Whilst early indications seemed to point to Portugal escaping the brunt of Covid-19, things quickly started to align itself with its European counterparts. In early March, public and cultural events, as well as in-person education, were suspended. Non-essential shops were shuttered and a limitation on public interaction was introduced. As expected consumer and industrial confidence fell significantly in April travel and hospitality was immediately affected, and then the construction industry slowly lost jobs.

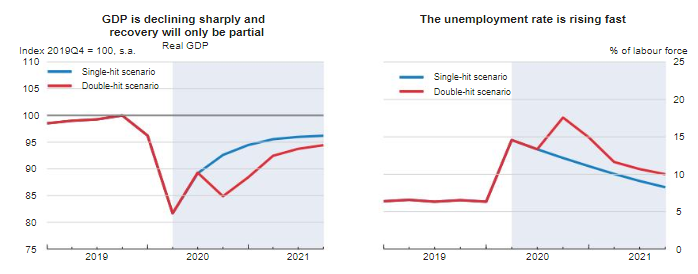

As it became apparent that a 2020 global slowdown was inevitable, and might even eclipse 2008-2011, it is expected once again that the health system in Portugal may become a target for cost cutting and containment. This is perhaps the worst possible outcome given the greater than 60% probability of a second wave looking at what has happened recently in the UK and France. With the overall GDP expected to shrink by 9.4% in a single wave scenario, a second wave would have a projected contraction of 11.3%.

The second wave impact would also push out a recovery to the end of 2021, prolonging export weakness, heightening uncertainty, increasing unemployment and a rise in public debt. The government has indeed acted swiftly to stem some of the challenges consumers and businesses are seeing. A strong economic support plan post-confinement, a shortened work scheme planned to quell unemployment, tax and social security deferrals along with business guarantees are indeed helping. However, as the pandemic continues to slow economic growth, just how many more tools are in the central bank’s tool box before the dreaded deep cuts begin reappearing?

Source: OECD Economic Outlook 107 database

As the economy tries to shrug off this global pandemic it may find its best growth model is what has worked best in the past; an austerity-light program and an overall investment in growth sectors of the economy. With the EUR wind in its face Portugal needs to remain vigilant and set out workable controls that can comfort people that there is a control in place and that the healthcare system is solid to support any additional spike in cases.