Pound hammered as Brexit talks continue to sour

( 3 min )

- Go back to blog home

- Latest

Ongoing market fears surrounding the Brexit process continued to hammer sterling on Thursday.

The key sticking point surrounds Northern Ireland. The UK government is insisting that amendments are required to the Brexit Withdrawal Bill in order to keep the peace with Northern Ireland and the rest of Britain. Legislation that makes this possible, set to be debated for the first time by MPs on Monday does, however, break international law and has been strongly opposed by the EU. To make matters worse, US House Speaker Nancy Pelosi has also warned that there would be ‘absolutely no chance’ of a US-UK trade deal passing Congress should Britain forge ahead with such plans.

As the war of words between both sides continues, investors are now placing a high risk premium on the pound, which has seen the UK currency shed around three-and-a-half percent of its value since the beginning of the week alone. Despite the rather doom and gloom headlines, negotiations will continue today in the hope of breaking the impasse. As things stand, we think that further losses for sterling could be on the cards in the coming days, barring the tone out of discussions taking a rather dramatic turn for the better.

ECB adopts relaxed view on common currency appreciation

The euro briefly rallied above the 1.19 level versus the US dollar yesterday, although quickly gave up all of its gains despite a much less dovish than expected set of communications from the European Central Bank.

During her press conference, President Lagarde stated that near-term price pressures remain subdued, in part due to the appreciation in the euro. Somewhat counterintuitively, the Governing Council’s view on subdued inflation was not reflected in the bank’s updated projections. Instead, the ECB continues to see headline inflation of 0.3% in 2020 (unchanged from the June projections), with price growth expected to accelerate to 1.0% in 2021 (up from the 0.8% previously pencilled in).

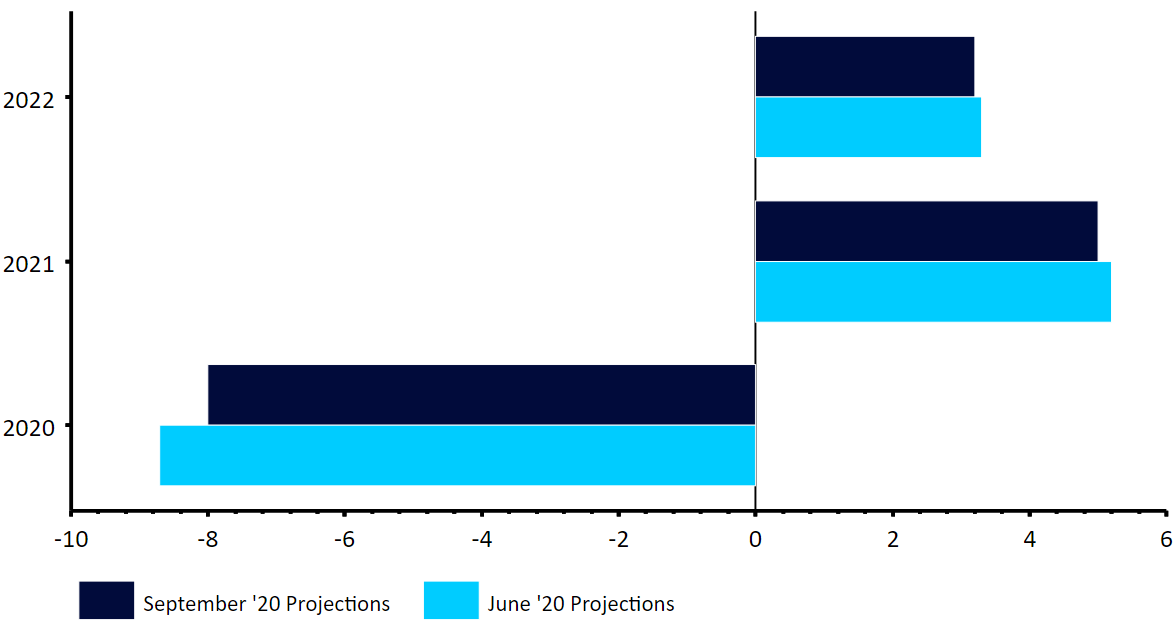

Figure 1: ECB’s GDP Projections [% annual] [September 2020]

Source: Refinitiv Datastream Date: 10/09/2020

Critically, the ECB also appears much more relaxed on the recent strength of the euro than we had anticipated. While Lagarde stated that the Governing Council had extensively discussed the value of the euro during this week’s meeting, there was no clear attempt to talk down the currency’s value during her press conference. Lagarde instead merely noted that the bank would ‘monitor closely’ the euro’s recent appreciation, with ECB officials said to be in agreement that there was no need to overreact to the common currency’s recent gains.

The ECB’s much more relaxed and hands off approach to the rally in the euro was behind the immediate move higher in EUR/USD, although as mentioned these gains proved short-lived. We attribute at least part of this retracement to the ongoing jitters surrounding Brexit.