Pound jumps after Bank of England cuts rates to 0.1%

- Go back to blog home

- Latest

The Bank of England surprised the market again on Thursday, ramping up its stimulus measures as it attempts to allay the impact of the COVID-19 virus on the UK economy.

Again, it was not necessarily the cut itself that caught the market slightly wrong-footed, or even the QE announcement, but the unscheduled timing of the move. This is, however, becoming all too familiar for market participants. The BoE, Federal Reserve and ECB have all unveiling intermeeting easing packages in the past few weeks.

In its statement, the bank noted ‘the spread of Covid-19 and the measures being taken to contain the virus will result in an economic shock that could be sharp and large, but should be temporary’. The bank is also clearly preparing additional easing measures in the coming days/weeks in order to further support the UK economy, stating that it will issue further guidance ‘in due course’. The next scheduled meeting is set to take place next Thursday (26th March), which is set to go ahead as planned.

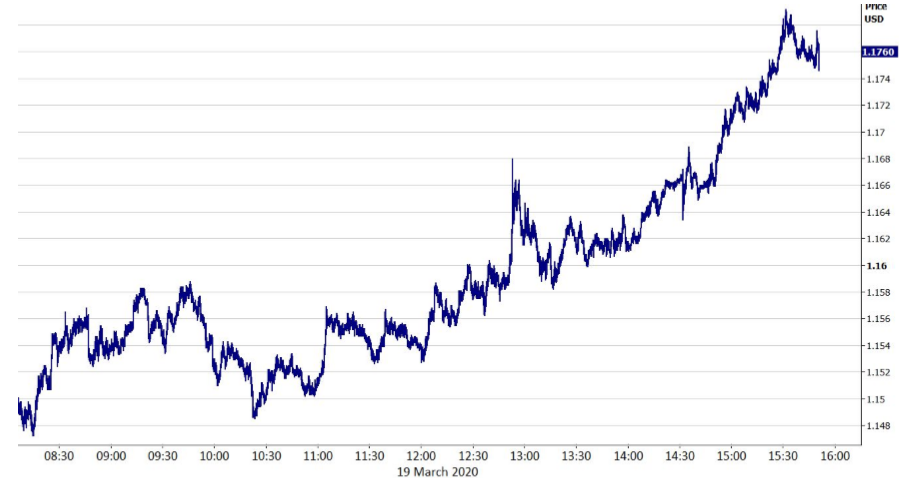

The announcement was greeted positively by the pound, which rallied sharply in the immediate aftermath of the cut, up by over 2% for the day versus the dollar. This would, at first glance, be a counterintuitive reaction. Investors are, however, treating central bank action as a positive development, on hopes that their proactiveness can, at least to some extent, allay the economic impact to the respective domestic economies.

Figure 1: GBP/USD (19/03/2020)