ECB President Draghi hints at October QE announcement

- Go back to blog home

- Latest

The Euro briefly rose to a ten day high back above the 1.20 level against the US Dollar on Thursday after the European Central Bank’s monetary policy announcement yesterday.

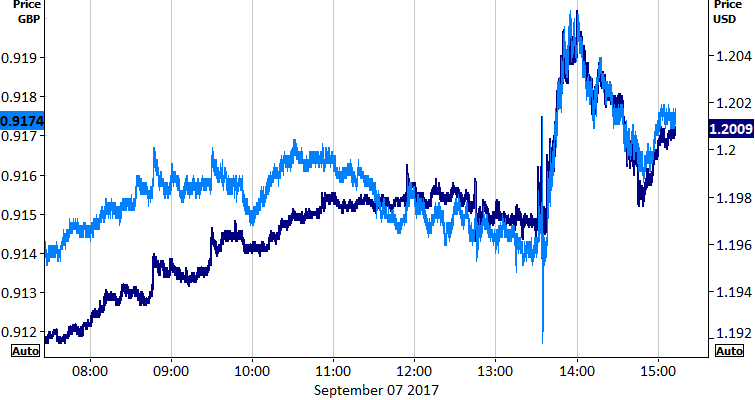

His comments were fairly dovish as he added little new information, saying that the QE programme had not yet translated into stronger inflation dynamics. The Governing Council did, however, revise upwards its GDP growth forecast by a fairly sizeable 0.3% to 2.2% for this year, which could perhaps be attributed to much of Euro’s rally. The currency at one stage traded around one percent higher for the day as Draghi spoke, although trailed off during the press conference to end it effectively unchanged from where it began (Figure 1). Surprisingly, the market reacted in a relatively calm fashion to Mario Draghi’s comments on the strength of the Euro, the risks of which he mentioned on several occasions during the press conference.

Figure 1: EUR/USD & EUR/GBP (07/09/17)

Despite the clear improvement in economic conditions, the ECB’s reluctance to commit to a tightening in policy suggests that policymakers in the Eurozone are clearly wary of continually below target inflation in the Euro-area. We continue to think we’ll need to see an uptick in core inflation before the European Central Bank announces it is ready to announce a tapering in its stimulus measures towards zero.

We now look ahead to the next ECB meeting in October, where Draghi acknowledged the “bulk of decisions” on the stimulus programme will probably take place. We expect Draghi to announce it will extend the QE programme into 2018, with plans to taper it in January dependent on stronger core inflation news. Any tapering that does come is likely to be modest in nature.

Sterling edges higher, US jobless claims spike to five year high

With all eyes on yesterday’s ECB meeting, events elsewhere mostly went under the radar. Sterling edged marginally higher for another day against a broadly weaker USD, touching a fresh one month high. Investors at present continue to appear unfazed by the ongoing uncertainty surrounding the Brexit negotiations. Industrial and manufacturing production numbers this morning could prove a market mover if they surprise consensus when released at 9:30 UK time.

The Dollar itself sold-off across the board for another day, with that latest jobless claims data coming in considerably worse than expected. Claims last week soared by the most since 2012 as thousands of Texans displaced by Hurricane Harvey filed jobless applications to collect benefits. While the 298,000 figure was far and above the 245k consensus, the blip is likely to prove temporary and the US labour market remains, in our view, in good health. FOMC member Harker will be speaking this afternoon, although all in all, it looks like a relatively quiet end to the week for the greenback.