Renewed trade deal hopes boost risk appetite

- Go back to blog home

- Latest

Optimism surrounding the striking of a possible US-China trade deal swept through financial markets on Thursday, lifting risk assets and triggering a reversal in recent safe-haven flows.

According to commerce ministry spokesman Gao Feng ‘If the phase-one deal is signed, China and the US should remove the same proportion of tariffs simultaneously based on the content of the deal’. This is an encouraging step in the right direction that suggests enough progress is being made towards a full blown agreement early next year.

Currency markets reacted as one would expect, with the safe-haven Japanese yen shedding around half a percent versus the dollar. With very little macroeconomic data on tap on Friday, we are likely to see trade headlines continue to drive the major currencies today.

Bank of England doves send sterling lower

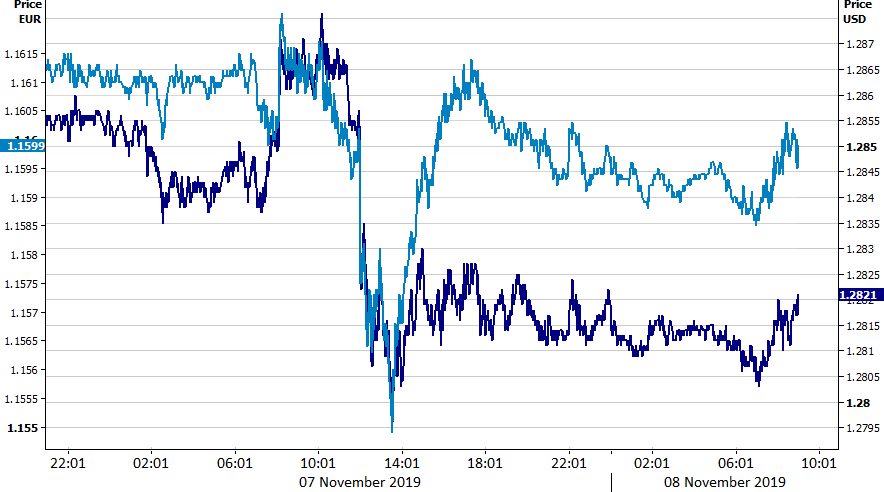

The pound sold-off across the board yesterday, briefly tipping below the 1.28 level against the dollar after the Bank of England sounded a slightly more pessimistic tone regarding the state of the UK economy.

The main surprise and big headline coming out of the announcement was that two of the nine members on the bank’s monetary policy committee unexpectedly voted in favour of an immediate interest rate cut. We mentioned yesterday morning that there was a risk that one or two rate-setters may throw their support behind immediate action. The market itself had, however, braced for a 9-0 unanimous vote and was therefore caught slightly wrong-footed.

Growth forecasts were also revised lower for the next two years, providing additional incentive for investors to dump sterling. The BoE is now pencilling in growth of 1.2% in 2020 (1.3% in Aug) and 1.8% in 2021 (2.3%). During the accompanying press conference, Governor Carney noted that the recent Brexit deal creates the possibility of a pick-up in UK growth, with the risk of a ‘no deal’ reduced significantly. That being said, he did appear more concerned regarding the external situation, stating that ‘all forms of protectionism are becoming more pervasive, persistent and damaging than expected a few years ago’.

The relatively limited nature of the sell-off, which saw the currency recover almost all of its losses versus the euro can, at least to some extent, be attributed to the market’s near-total obsession with Brexit news above almost all else. The two dissents, and suggestion that others could follow suit should the economy worsen does, however, imply that the BoE is keeping its options open to cut rates should a smooth and orderly Brexit not be agreed before the end of January deadline.

Figure 1: GBP/USD (07/11 – 08/11)

Hi, I am a new blog post, you can change me, or even delete me!, it is up to you! 😉