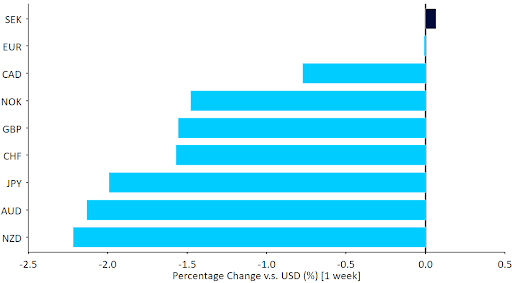

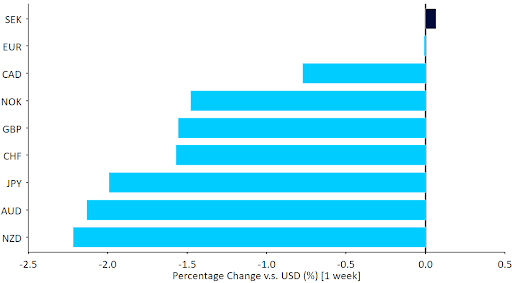

The relentless march towards higher rates in the US continued last week.The key 10-year Treasury rate rose another 6 basis points to end the week above 2.90%. The sell-off in US fixed income is now spreading to other markets, with European yields moving higher as the long-awaited (by us, at least) hawkish turn in ECB communications begins to take place. On the back of this shift, the euro managed to hang on to the dollar and rally against all other G10 currencies, save the Swedish krona. Commodity and emerging market currencies had a rough go of it as the massive increase in rates worldwide begins to take its toll on risk assets and dent the rally in commodity prices.  Over the weekend, Emmanuel Macron was re-elected as French president which, together with reports that the ECB is ready to move more aggressively in response to inflation, should be supporting the common currency. We have, however, seen a sharp sell-off in risk assets so far this morning at the expense of the safe havens, particularly the US dollar and Japanese yen. Investors are fretting over the possibility of a slowdown in global growth in response to fresh concerns over additional lockdowns in China and tighter monetary policy globally. Investor risk appetite looks likely to remain the main driver of currencies in the coming days. On the data front, the April flash inflation report in the Eurozone on Thursday is shaping up to be a key event of the trading week, though we will also see a slew of growth and inflation data points out of the US. An upward surprise in Eurozone inflation could see the headline number dangerously close to 8%. We think that this would help the case for a July hike, forcing further repricing of European rates and helping the common currency along.Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Over the weekend, Emmanuel Macron was re-elected as French president which, together with reports that the ECB is ready to move more aggressively in response to inflation, should be supporting the common currency. We have, however, seen a sharp sell-off in risk assets so far this morning at the expense of the safe havens, particularly the US dollar and Japanese yen. Investors are fretting over the possibility of a slowdown in global growth in response to fresh concerns over additional lockdowns in China and tighter monetary policy globally. Investor risk appetite looks likely to remain the main driver of currencies in the coming days. On the data front, the April flash inflation report in the Eurozone on Thursday is shaping up to be a key event of the trading week, though we will also see a slew of growth and inflation data points out of the US. An upward surprise in Eurozone inflation could see the headline number dangerously close to 8%. We think that this would help the case for a July hike, forcing further repricing of European rates and helping the common currency along.Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

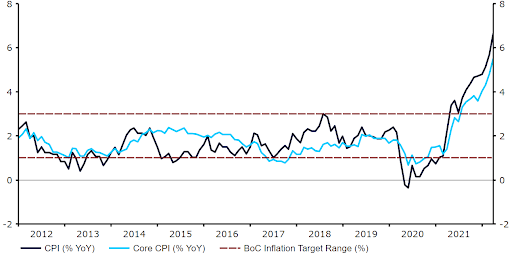

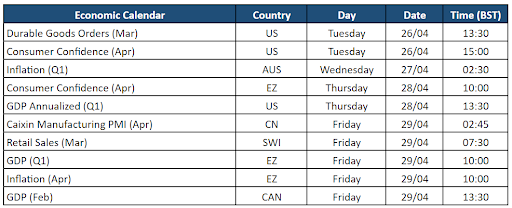

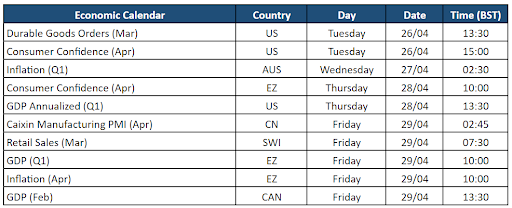

Several BoC member speeches are scheduled for this week, including Governor Macklem. Aside from that, February GDP will be published on Friday.

Several BoC member speeches are scheduled for this week, including Governor Macklem. Aside from that, February GDP will be published on Friday.

Over the weekend, Emmanuel Macron was re-elected as French president which, together with reports that the ECB is ready to move more aggressively in response to inflation, should be supporting the common currency. We have, however, seen a sharp sell-off in risk assets so far this morning at the expense of the safe havens, particularly the US dollar and Japanese yen. Investors are fretting over the possibility of a slowdown in global growth in response to fresh concerns over additional lockdowns in China and tighter monetary policy globally. Investor risk appetite looks likely to remain the main driver of currencies in the coming days. On the data front, the April flash inflation report in the Eurozone on Thursday is shaping up to be a key event of the trading week, though we will also see a slew of growth and inflation data points out of the US. An upward surprise in Eurozone inflation could see the headline number dangerously close to 8%. We think that this would help the case for a July hike, forcing further repricing of European rates and helping the common currency along.Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Over the weekend, Emmanuel Macron was re-elected as French president which, together with reports that the ECB is ready to move more aggressively in response to inflation, should be supporting the common currency. We have, however, seen a sharp sell-off in risk assets so far this morning at the expense of the safe havens, particularly the US dollar and Japanese yen. Investors are fretting over the possibility of a slowdown in global growth in response to fresh concerns over additional lockdowns in China and tighter monetary policy globally. Investor risk appetite looks likely to remain the main driver of currencies in the coming days. On the data front, the April flash inflation report in the Eurozone on Thursday is shaping up to be a key event of the trading week, though we will also see a slew of growth and inflation data points out of the US. An upward surprise in Eurozone inflation could see the headline number dangerously close to 8%. We think that this would help the case for a July hike, forcing further repricing of European rates and helping the common currency along.Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

GBP

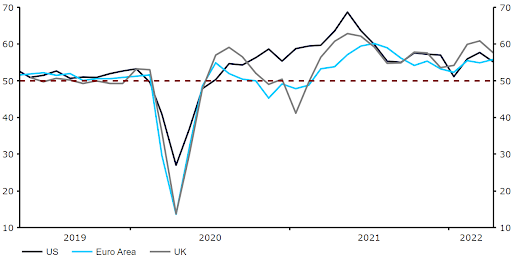

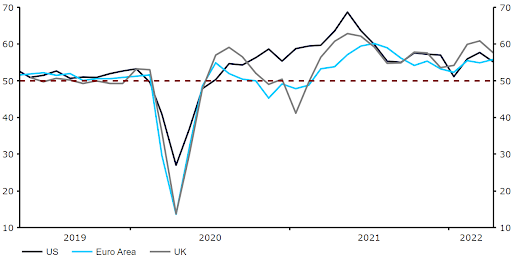

Weak numbers across the board last week helped sink the pound below the 1.30 level against the dollar. Retail sales, consumer confidence, and the PMIs of business activity were all weaker than expected, and the Bank of England´s muddled communications about its response to the inflationary wave are not helping. We note, however, that the PMIs are still consistent with strong growth and the economy is at or very near full employment, and we regard the latest move lower in sterling as a significant overreaction.This week sees no significant macroeconomic news and the Bank of England has entered its pre-meeting blackout period, so expect the pound to trade off events elsewhere.EUR

In spite of the volatility, the outlook turned somewhat more positive for the euro last week. The April PMIs were better than expected, suggesting that the Eurozone economy is weathering the impact of the Ukraine war rather well. Just as importantly, rhetoric out of the ECB has taken a hawkish turn. Remarks from both De Guindos and President Lagarde last week suggest that a July hike is possible, with both policymakers sounding increasingly alarmed by inflationary pressures.The April flash inflation print out on Thursday could seal the case for a July hike; a headline number near 8% is definitely possible, and the march higher in the core index should continue, making it increasingly difficult to blame the spike in energy prices.Figure 2: G3 PMIs (2019 - 2022)

USD

Now that a 50 basis point hike is more or less priced in, not just for the next meeting of the Federal Reserve, but also the following two, some Fed officials are bringing up the possibility of a 75 basis point hike.We have been banging the table that markets were not pricing in sufficient Federal Reserve hikes for well over a year, but we think we are getting close to the point where enough is being priced in for the near term, and further increases in US bond yields should be limited to the longer end of the interest rate curve. For now, at least, the short-term rate differential between the US and the Eurozone appears to be stabilising, which means the dollar rally against European currencies may run out of steam soon.CHF

The Swiss franc ended last week around the middle of the G10 performance dashboard, although it sold off rather sharply against the euro. We think that the franc’s weakness can be linked to a sharp rally in US yields, particularly on the shorter end. We’ve seen a bit of a rebound in the currency during the ‘risk off’ period so far this morning, although the franc has been the least favoured of the three main safe-haven currencies.Some dovish comments from SNB Chairman Jordan weighed on the franc last week. Jordan said that a ‘substantial amount of the inflation today may be temporary’, although the bank would keep a close eye on the situation. Somewhat remarkably, markets are now pricing in around 160 basis points of rate hikes from the SNB this year. We think that this is excessive, and see a much greater risk of the bank under-delivering on investor expectations for hikes this year, rather than exceeding them.This week we’ll focus on shifts in market rates, as well as changes in risk sentiment. We’ll also be keeping an eye on sentiment data from Switzerland, particularly the KOF leading indicator, out on Friday.AUD

The Australian dollar was the worst performer in the G10 last week, falling to a near two month low versus the US dollar. AUD was pressured lower by hawkish comments from Federal Reserve Chair Jerome Powell, who hinted at aggressive rate hikes. By contrast, the Reserve Bank of Australia has continued to lag well behind in tightening monetary policy.On domestic data, Australia’s April PMIs were encouraging and remained comfortably in expansionary territory this month. The S&P Global flash services PMI rose to 56.6 in April from 55.6 in March, its highest level in two months and the third consecutive month of expansion in the sector. In addition, the manufacturing index rose to 57.9, its highest level in five months. We think that the strong growth outlook should encourage the RBA to raise rates at its June meeting, and we’ll be paying particularly close attention to upcoming central bank remarks for confirmation of this view.In the meantime, the most important event for AUD this week will likely be the release of the first quarter inflation report on Wednesday. We think that a surprise to the upside here could seal the deal for a move in rates at the June meeting.CAD

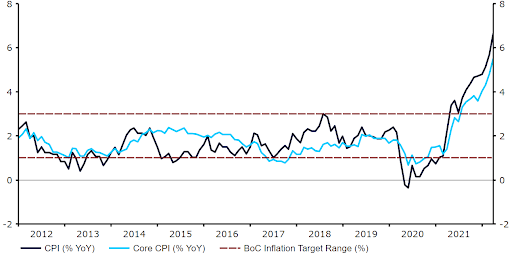

The Canadian dollar weakened to its lowest level in a month against its US counterpart last week, in large part due to hawkish comments by Federal Reserve Chair Jerome Powell.CAD did, however, outperform most of its major peers, we think due to growing expectations in favour of Bank of Canada interest rate hikes. Canada’s annual inflation rate climbed to 6.7% in March, its highest since January 1991 and well above the 6.1% that investors had anticipated. Excluding gasoline, consumer price growth also jumped to 5.5%, its highest level on record. We think that this inflation data strengthens the case for the Bank of Canada to tighten policy more aggressively this year, and firmly opens the door to another 50 basis point interest rate hike when the bank next convenes in June.Figure 3: Canada Inflation Rate (2012 - 2022) Several BoC member speeches are scheduled for this week, including Governor Macklem. Aside from that, February GDP will be published on Friday.

Several BoC member speeches are scheduled for this week, including Governor Macklem. Aside from that, February GDP will be published on Friday.CNY

Last week was an unusually brutal one for the yuan. The currency suffered one of its largest sell-offs against the US dollar in recent years and was one of the worst-performing currencies worldwide. The USD/CNY cross has jumped above the 6.55 level this morning, its lowest level in around a year.We link the sell-off in CNY to a number of reasons, primarily China’s Covid situation, which has deteriorated again in the past few days. Strict lockdowns drag on in many of the country’s major cities, notably Shanghai. Mass testing has also begun in Beijing, raising concerns that the capital may also be on the brink of tighter restrictions. This does not bode well for Chinese, or indeed global, growth - we’ve seen a series of downward revisions to China’s GDP forecasts from both public and private institutions, suggesting this view is taking hold. Contrary to most of its peers, the PBoC has also continued to ease monetary policy, which has further weighed on the yuan. The PBoC also appears comfortable with a weaker currency, as this could be a form of easing to support the economy. In an attempt to balance a set of factors, the bank did not cut its key loan prime rates last week, contrary to expectations.The ongoing response of authorities to rising covid cases will remain the main driver of the yuan this week. We’ll also be keeping an eye on the latest PMI data for April, out on Saturday, which are set to show a significant contraction in business activity for the second month in a row.Economic Calendar (25/04/2022 - 29/04/2022)

.svg)

.svg)

.svg)