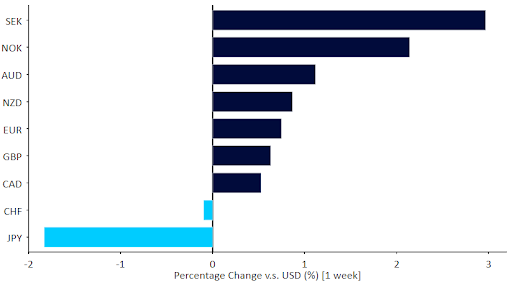

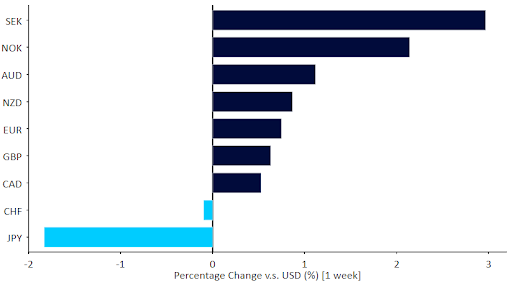

Stock markets and risk assets generally posted impressive moves last week, discounting the impact of the Russian invasion of Ukraine and treating Fed hawkishness as a case of "buy the rumour, sell the news".As an example of the optimism pervading financial markets, European stock indices closed the week at essentially the level they were the day of the invasion. In currency markets, the Swedish krona was the best performer of the week, with the safe-haven Japanese yen at the bottom of the G10 rankings. Emerging markets continue to post gains, with Latin American currencies benefiting particularly from their commodity exporting economies and the distance from the war. We note that our favourite, the Brazilian real, tops the performance tables among all major currencies so far this year, up well over 10% against the dollar.Focus this week will be on the Thursday release of the Eurozone and UK PMIs (now renamed S&P) indices of business activity. They are the first ones to reflect the impact of the invasion of Ukraine, so uncertainty is unusually high, but market consensus expects a retracement towards still highly expansionary levels. Aside from that, no fewer than six Federal Reserve officials are scheduled to speak this week. We expect them to clarify the timing and extent of hikes in what looks like a very front-loaded tightening cycle out of the US, though so far the dollar has conspicuously failed to benefit from the Fed hawkish communications last week. Finally, the UK February inflation report on Wednesday should see yet another jump to a fresh multi-decade record.Figure 1: G10 FX Performance Tracker (1 week)

On Wednesday, the March preliminary PMIs will be published, the first data showing the effect of the war in Ukraine on the country's economy.

On Wednesday, the March preliminary PMIs will be published, the first data showing the effect of the war in Ukraine on the country's economy.

GBP

The Bank of England delivered yet another head fake to markets at its March meeting last Thursday. Though it hiked rates as expected, there was one dovish dissent and the statement was revised in a decidedly dovish direction. We would not overreact to this change, as the MPC communications have been quite erratic during this tightening cycle, but it warrants revising some of our optimism on sterling downwards.We expect another strong inflation report out of the UK on Wednesday, with fresh 30-year records printed in both the core and headline numbers, which should further puzzle traders about the Bank of England's apparent dovish turn last week.EUR

A quiet week in the Eurozone, with only a lagged report on industrial production from January, and a massive though expected fall in investors expectations for future growth after the shock of the Russian invasion. The latter index has not been particularly useful in predicting growth lately, but it bears noting.The common currency had a volatile week but managed to rally and end up solidly above the 1.10 level versus the US dollar. ECB President Lagarde and chief economist Philip Lane are both scheduled to speak this week, but the main event will be the release of the flash PMI numbers for March, a first look at the stagflationary impact of the war on the European economy.

USD

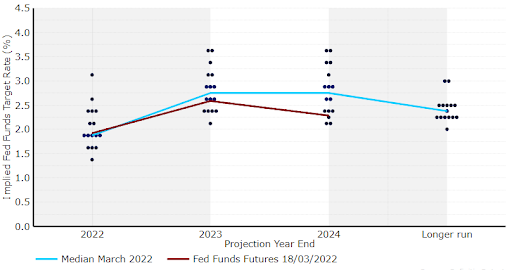

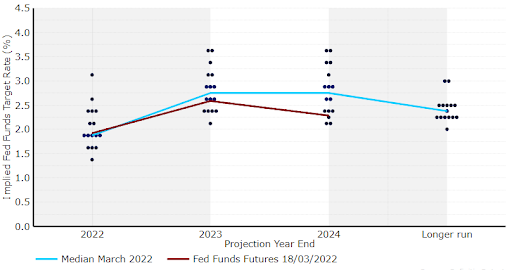

The Federal Reserve validated expectations for a hike in every remaining meeting in 2022 last week, with its ‘dot plot’ suggesting members expect seven 25 basis point hikes this year. Its long term forecasts were more dovish, but given its forecasting track record we would not place too much store in those.The failure of the dollar to rally in the wake of the meeting is due to two factors. First, the general increase in risk appetite, which hurt the dollar, as it has acted as a safe-haven since the Ukraine invasion started. Second, a sense by markets that at current levels a lot is in the price already, and upside may be limited from here. This week we should see some clarification as to which one of these factors dominates.Figure 2: FOMC Dot Plot [March 2022]

CHF

The Swiss franc was one of the worst-performing G10 currencies last week, ending 1% lower against the euro as markets grew increasingly optimistic that some sort of de-escalation in Ukraine may be on the horizon. In addition to hanging onto any good news, particularly some positive noises from the Ukraine-Russia talks, investors appear to be more accustomed to the situation, however awful it may be.The franc’s behaviour in the near-term will most likely continue to depend on market sentiment, which continues to be driven mostly by the war in Ukraine. On Thursday, we’ll also focus on the latest SNB meeting. No change in rates is expected, but the bank’s comments regarding the franc and its inflation forecast will be closely watched. The SNB will likely reiterate that it stands ready to intervene in the FX market, and it could fine-tune the language, although we don’t expect a major shift in its rhetoric regarding the exchange rate. The inflation forecast is also likely to be revised significantly higher.AUD

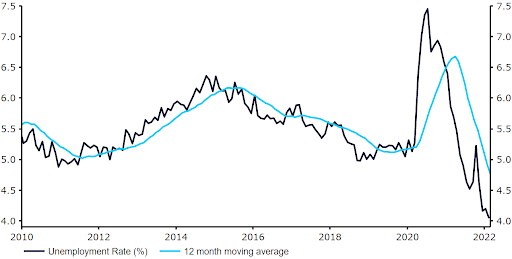

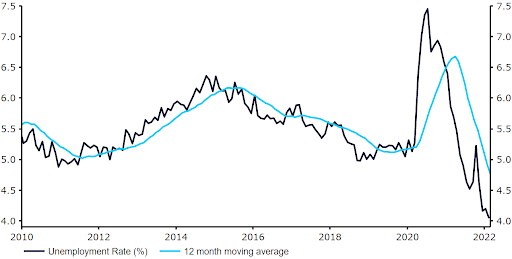

The Australian dollar appreciated to its highest level in nearly five months on the USD last week, in large part due to the rebound in risk appetite. Data showed that Australia’s unemployment rate also dropped to a 14-year low of 4% in February, as activity recovered quickly from the shutdown caused by omicron. AUD has continued to be further supported by the recent comments from Reserve Bank of Australia governor Philip Lowe, who said earlier this month that a rate hike is possible this year as the Russia-Ukraine war threatens to increase inflation. Markets are now almost fully pricing in a 25 basis point hike as soon as the bank’s June meeting.Figure 2: Australia Unemployment Rate (2012 - 2022) On Wednesday, the March preliminary PMIs will be published, the first data showing the effect of the war in Ukraine on the country's economy.

On Wednesday, the March preliminary PMIs will be published, the first data showing the effect of the war in Ukraine on the country's economy.CAD

The improvement in risk appetite and the increase in commodity prices allowed the Canadian dollar to appreciate to its highest level in almost two months on the US dollar last week. According to data published last week, February inflation data also surprised to the upside, coming in at 5.7%, the highest level since August 1991. Excluding gasoline, inflation rose at a fresh record pace of 4.7%. As inflation continues to rise, investors expect the Bank of Canada to remain aggressive and continue raising interest rates at its upcoming meetings. We expect another rate increase at the BoC’s next meeting on 13th April, with the real question being whether this will be a standard 25 basis point move, or a larger 50 basis point hike.With no major economic data due out of Canada this week, CAD may be mostly driven by events in Ukraine and the continued volatility in commodity markets, notably oil.CNY

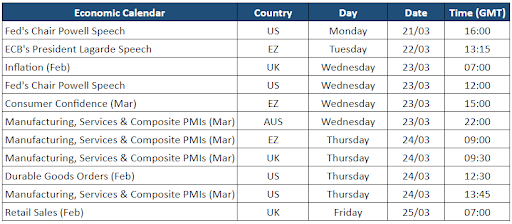

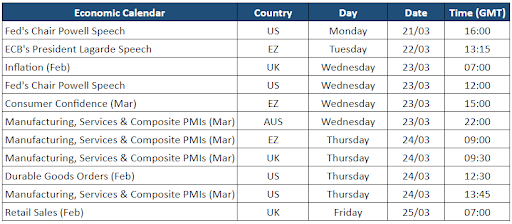

The Chinese yuan has been on quite a rollercoaster ride lately, with USD/CNY soaring early last week, before pairing most of its recent losses. The sell-off has been a consequence of covid fears, with new cases in China rising to the highest level since February 2020, leading to new restrictions and local lockdowns. The number of new cases has, however, stabilised, enabling some optimism. Furthermore, the currency was boosted by news that Saudi Arabia is reportedly considering pricing some of its oil sales to China in yuan, and that Chinese regulators should issue market-friendly policies to ‘invigorate the economy’. The latter further supports the argument that China’s policymakers will continue moving decisively to help the economy battle the consequences of the pandemic and shake off the effects of a regulatory crackdown from last year.To further this optimistic note, economic data has, on the whole, proved better than expected. The January-February period brought major upward surprises to investment, production, and retail sales data. The only negative was an increase in the surveyed urban unemployment rate to 5.5% from 5.1% in December, which suggests support for the economy may still be needed. Nevertheless, the PBOC decided to keep its loan prime rates unchanged today, in line with consensus. Further easing seems likely in the coming months, in our view, particularly considering the impact of covid.Economic Calendar (21/03/2022 - 25/03/2022)

.svg)

.svg)

.svg)