Risk sentiment improves ahead of Biden inauguration

- Go back to blog home

- Latest

Investors were in an upbeat mood ahead of today’s inauguration of Joe Biden as the 46th president of the United States.

These comments lifted the euro back above the 1.21 level yesterday, with emerging market currencies also broadly stronger versus the greenback. Aside from politics and the latest pandemic developments, EUR/USD traders will now begin to turn their attention to Thursday’s ECB meeting. While we don’t envisage any immediate change in policy, President Lagarde may once again talk up concerns over a stronger euro, which could weigh on the currency towards the end of the week.

UK inflation rises in December despite tight virus restrictions

The pound received some strong headwinds from the broadly weaker US dollar yesterday, soaring through the 1.36 mark during late-London trading.

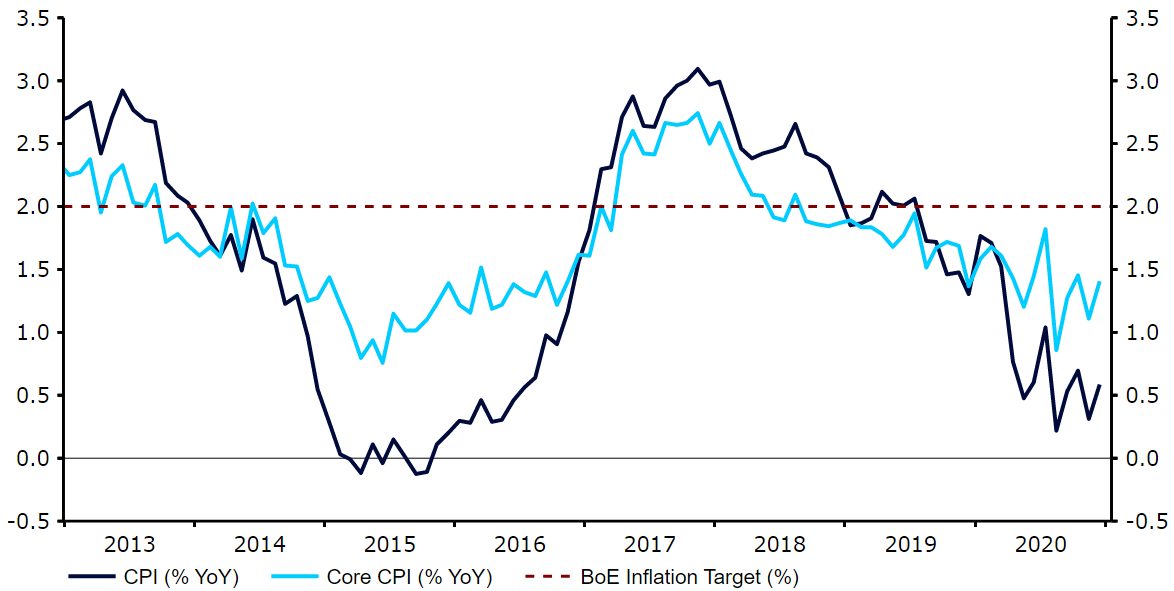

Sterling also rose to its strongest position since May 2020 versus the common currency following the release of this morning’s UK inflation data. Headline price growth rose more-than-expected in December, despite the tight virus restrictions in place over the Christmas period. The main headline inflation measure increased back to 0.6% last month from 0.3%, with core price growth back up to 1.4% year-on-year (Figure 1). This will no doubt dampen any expectations regarding the possibility of an additional interest rate cut from the Bank of England, which appears highly unlikely any time soon following comments from governor Andrew Bailey early last week.

Bailey is scheduled to speak again later today, although we don’t expect any new information. We will instead be awaiting a number of tier-1 UK macroeconomic data releases on Friday, notably retail sales for December and the preliminary business activity PMIs for January.

Figure 1: UK Inflation Rate (2013 – 2020)

Source: Refinitiv Datastream Date: 20/01/2021