“Safe haven” currencies strengthen on geopolitical tensions

- Go back to blog home

- Latest

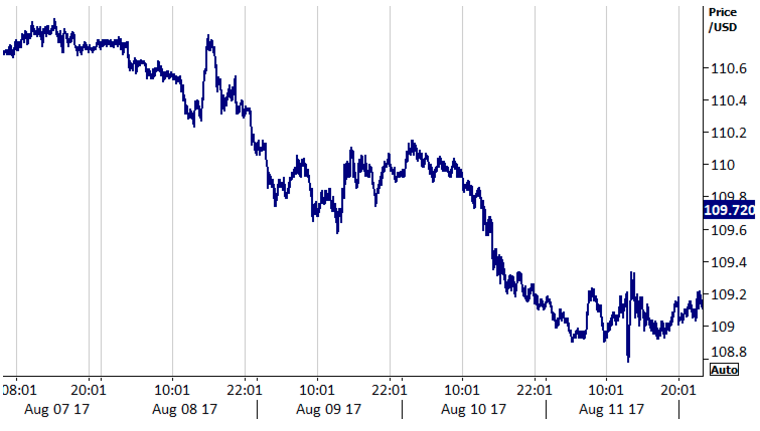

Tensions in the Korean peninsula disturbed the seasonal quiet in foreign exchange markets last week.

Figure 1: USD/JPY (07/08/2017 – 11/08/2017)

Around the world, equity markets fell and sovereign bond yield declined as volatility indicators everywhere rebounded strongly from recent extraordinarily low levels. The Dollar failed to benefit significantly from the sudden bout of risk aversion, as US interest rates fell and the July inflation number on Friday came in slightly lower than expected.

The biggest move of the week, however, came from the New Zealand Dollar. The kiwi fell sharply against every other major currency, as the Reserve Bank of New Zealand escalated its verbal efforts to keep a lid on its currency.

Aside from unpredictable geopolitical developments, this week will provide little new information to move markets. UK inflation, and the publication of the minutes of the last meeting of both the Federal Reserve and the ECB are just about the only interesting events among major currencies.