Safe-haven dollar on course for best week in six months

( 3 min )

- Go back to blog home

- Latest

Risk currencies stabilised on Thursday, in a week where most have sold-off sharply versus the US dollar amid fears regarding tighter virus restrictions put in place across much of Europe.

Attention this week has been heavily on central bank speakers. FOMC chair Powell spoke again during his testimony to Congress on Thursday, although his remarks were very similar to previous communications as he called on the US government to further support the economy. The most noteworthy comments probably came from Fed member Bullard, who noted that he thought the US economy may make a full recovery by the end of 2020. This is a highly optimistic appraisal not shared by the majority of his peers, so the dollar took little notice.

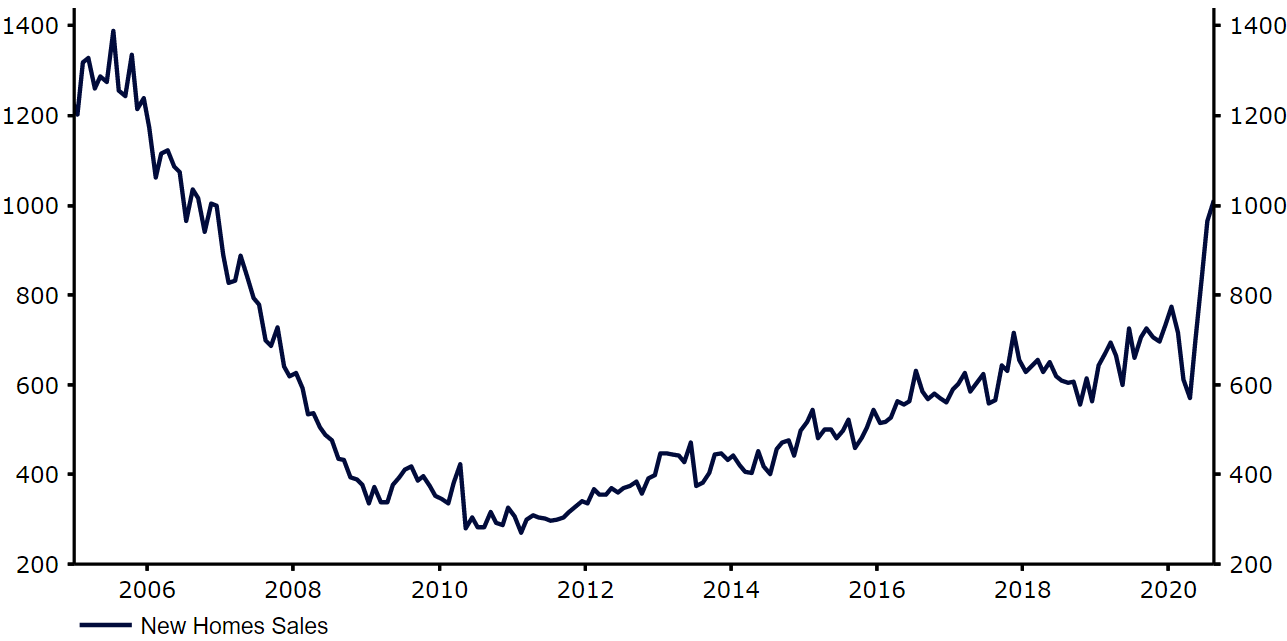

Meanwhile, US housing data out on Thursday was highly encouraging, pointing to robust levels of demand within the sector. Sales jumped by another 4.8% in August, with more than one million new homes purchased last month (Figure 1) – the most in a single month since 2006. This probably has much to do with record low borrowing rates. A similarly impressive reading from this afternoon’s durable goods order data would be another positive sign and could provide impetus for another move higher in the dollar.

Figure 1: US Home Sales (2005 – 2020)

Source: Refinitiv Datastream Date: 25/09/2020

Sterling outperforms as Sunak unveils Job Support Scheme

Sterling has been one of the better performing major currencies in the past two or three days, in part due to the UK government’s announcement of more fiscal stimulus. The UK’s new Job Support Scheme will replace the existing furlough programme on 1st November and will run for at least six months. Rather than a like for like replacement, this will involve the government topping up salaries for workers whose employees are only able to bring them back part-time. While the programme has come in for a fair bit of criticism domestically, the announcement of more job support measures was enough to briefly lift the pound back above the 1.28 level this morning.

Markets largely overlooked comments from Bank of England governor Bailey who said that the central bank was exploring whether the use of negative interest rates would be a successful and viable option in the UK. This is largely in line with what Bailey has announced in the last couple of MPC meetings, so came as no real shock to investors.