Safe havens suffer as optimism returns to market

( 3 min read )

- Go back to blog home

- Latest

Typical market correlations broke down last week, after the forced merger of Credit Suisse with UBS had allayed European banking concerns only temporarily.

Market focus is shifting back from banking headlines to economic data. This will be a sparse week as the holidays approach, but attention will doubtless focus on the US employment report on Friday. Elsewhere it should be a relatively quiet week, with limited trading after Thursday. It will be interesting to see the reaction to the massive OPEC cut in oil production announced over the weekend, beyond the huge spike in oil prices of course. So far, the commodity dependent currencies have posted modest advances, although gains appear to be held back by concerns surrounding the impact on higher inflation.

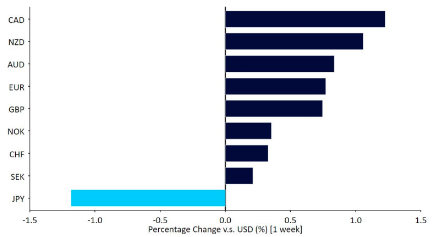

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 03/04/2023

GBP

A slightly better than expected Q4 GDP number, which was revised upwards to show modest growth, was all that traders needed to send sterling higher against every other G10 currency last week, save the Canadian dollar. The pound has been the best performing major currency since the start of the year. We attribute this to the resilience of UK economic data, the isolation of Britain’s banking sector to external shocks and the hawkish stance adopted by the Bank of England. BoE governor Bailey warned last week that the recent banking turmoil would unlikely derail additional rate hikes, with another 25bp move appearing highly likely at the next meeting in May.

Every week, the prospect of a UK recession grows less likely and the pound, a long-unloved currency that is by some measures the cheapest among the G10, is reaping the benefits. There isn’t much on tap this holiday week, so we expect sterling to trade tightly together with the euro against non-European currencies.

EUR

The ECB is getting little relief from the recent Euro Area inflation numbers. Although headline inflation continues to fall, this is largely due to the sharp drop witnessed in energy prices, particularly natural gas, since the August 2022 peak. The far stickier core inflation index actually printed at yet another record high in March, with the monthly number coming in at double economists expectations. This key metric is now up a whopping 3% above ECB rates, practically guaranteeing a continuation of the recent rate hikes.

The fact that banking fears in the Eurozone seem to have disappeared will leave the European Central Bank with plenty of room to catch up to the Federal Reserve in the coming months. Between interest rate hikes and the excellent news coming from the China recovery, we think that the path is clear for further euro appreciation.

USD

The US economy produced two pieces of good news last week. The PMIs of business activity rebounded strongly, adding to the sense that the US economy has so far shrugged off the banking concerns and continues to grow amid a very tight labour market. The February PCE inflation report, the Fed’s preferred measure, came in a touch softer than expected, with the headline number easing to 5% – its lowest level since September 2021.

Both of the aforementioned data points contributed to a strong rally in US stocks and the weakening of the US dollar, as safe-haven flows reversed. This week we expect more of the same, as the path of least resistance for the US dollar is downwards for now. A decent nonfarm payrolls report on Friday could seal the deal for a final 25bp rate hike from the Fed at its March meeting. We do, however, think that it would probably take an extraordinarily strong set of data, particularly on wages, to convince markets of more hikes beyond then.

JPY

The Japanese yen has flip flopped from being the best performing currency in the G10 during the height of the banking turmoil, to the worst now that concerns have significantly receded. Even against the US dollar, which fell across the board, the yen was down around 1% last week, and has now lost over half of its month-to-date

gains. A stronger-than-expected set of inflation numbers out last week, notably on the core index, were not enough to save the yen, as investors await the Bank of Japan leadership change before jumping to any conclusions over the impact of the data on monetary policy.

This week is largely void of macroeconomic news out of Japan, aside from household spending data later in the week. With that in mind, an ongoing easing in banking concerns could lead to a continued retracement in the yen, as could heightened expectations for central bank rate hikes following today’s jump in oil prices.

CNY

The yuan ended last week little changed against the US dollar, although it underperformed most of its emerging market peers. The trade-weighted CFETS RMB index fell by 0.5%, despite some positive economic data. Last week’s NBS PMI data surprised to the upside, indicating a strong recovery, particularly in the services sector – the non-manufacturing PMI climbed to 58.2, its highest level since May 2011.

Today’s manufacturing PMI from Caixin, which focuses on smaller and export-oriented firms, did, however, disappoint heavily, declining to 50.0, indicating neither expansion nor contraction in activity. While this may tell us more about the state of external demand, it confirms the unevenness of the economic recovery. This week is likely to be a fairly quiet week before Easter, interrupted by the Qingming Festival (Tomb Sweeping Day) on Wednesday. The focus will be primarily on external news, but we’ll keep an eye on the Caixin services PMI data, coming out on Thursday.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports

🔊 Stay up to date with our podcast FXTalk