Slowing US inflation data drags Dollar lower

- Go back to blog home

- Latest

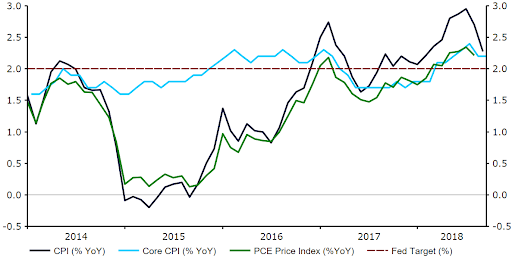

The US Dollar fell across the board on Thursday after a disappointing set of inflation figures suggested that upward pressure on prices may be easing in the world’s largest economy.

Figure 1: US Inflation Rate (2014 – 2018)

The EUR/USD rate was further helped on its way yesterday by some upbeat comments out of the latest European Central Bank accounts that suggested a normalisation in policy remained on the cards in 2019. The message out of the accounts was largely in line with that out of the meeting itself, providing some comfort for Euro bulls. Policymakers noted the risk posed by global trade tensions, although stated that domestic cost pressures were broadly stronger. We continue to think that the bank is on course to raise rates in the second half of next year, contingent on a pick-up in core inflation.

Eurozone industrial production numbers will be worth looking out for today. Other than that, Friday bodes to be a relatively quiet day in terms of economic announcements.

Brexit concerns continue ahead of crucial EU summit

Sterling edged modestly higher against the US Dollar over the course of trading on Thursday, although lost ground versus the Euro amid ongoing concerns over a Brexit deal.

While optimism over the possibility of a deal increased in the past few sessions following some positive comments from Jean-Claude Juncker, doubts remain over the Irish border issue that many feared could derail a potential deal. Currency traders will be closely watching the headlines over the coming days for an indication as to likelihood that a deal on Brexit is agreed at next Thursday’s EU summit in Brussels. Theresa May will be briefing her cabinet on progress over the negotiations this coming Wednesday.

Bank of England members Carney and Vlieghe failed to comment on monetary policy during speeches yesterday. With economic announcements limited in the UK today, the Pound will continue to be driven almost exclusively by Brexit news.