Softer US inflation slams dollar as LatAm currencies shine

( 3 min read )

- Go back to blog home

- Latest

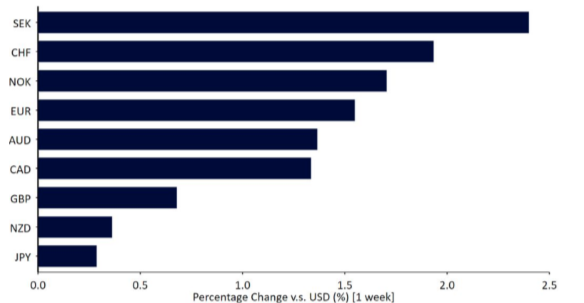

Markets used a slightly better than expected headline inflation print in the US to send the dollar further down against all major currencies last week, save the Japanese yen.

The economic and central bank calendar is relatively light this week. In the UK, the CPI report for March stands out on Wednesday. Perhaps the main focus will be the release of the PMIs of business activity on Friday across the major economies, including the Eurozone. We expect to see continued bullishness from business executives as banking fears recede and signs emerge that central banks are nearing the end of the hiking cycle, which could contribute to the buoyant moves in financial markets and drive further dollar weakness, as investors ditch the safe havens.

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 17/04/2023

GBP

Sterling lagged its European peers last week, though it still managed to close higher against the US dollar and remains the best performing currency so far this year, after the Swiss franc. Last week’s slightly softer than expected GDP print for February may partly explain this underperformance, even if the data continues to defy calls for a UK recession.

This will be a rather important week for both the Bank of England and the pound. The labour report out on Tuesday is expected to show strong wage growth, above 6%, while the inflation report out the next day should show similar levels for core inflation. These numbers mean that the MPC hiking cycle is not over yet, and we think that the pound should remain supported, particularly against the US dollar.

EUR

The euro broke through the psychological level of 1.10 to the US dollar mid-last week for the first time in a year, though it fell back somewhat on Friday on the back of rising inflation expectations in the US. Investors continue to bet on a widening in US-Euro Area interest rate differentials, which can largely explain the move higher in the common currency. ECB member speeches have been largely hawkish of late, with most members either in support of another 50bp hike or open to the possibility at the next Governing Council meeting in May.

So far, the concerns about banks and reduced expansion of credit have not impacted Europe, as we expect this to continue to be the case. With credit expansion intact, the China recovery in full swing, and no signs as yet of any easing in core inflation pressures, the ECB hiking campaign continues and we expect the euro rally to continue.

USD

Last week provided the worst possible combination of economic data releases and market sentiment for the US dollar. On one hand, a generally buoyant investor outlook diminished its attractiveness as a safe haven. On the other, inflation and labour data are starting to signal that the Fed’s desired cooling may be finally arriving. Both the headline CPI print and producer price inflation fell short of expectations last week, more-or-less cementing expectations that the next 25bp hike from the Fed will be the last in the current cycle.

Inflation expectations out on Friday were the one discordant note, with a large jump in the short term data point that brought the dollar slide to an abrupt end. This week, the US data calendar will be very light, so the greenback may trade mostly sideways.

JPY

The yen underperformed almost every other currency last week, as investors continued to push back their expected timing of Japan rate hikes further into the future. New Bank of Japan governor Ueda officially took to office last week, while delivering his first public speech at the helm of the central bank. His remarks were largely dovish, as he committed to the existing ultra-loose policy stance, while appearing in no rush to announce a change in tact just yet. We continue to think that an end to the yield curve control policy is on the way,although policymakers will probably await additional inflation prints before committing to such an historic policy shift. Inflation data for March will be unveiled on Friday, so expect this to get plenty of attention among market participants.

CNY

The yuan was among a minority of emerging market currencies that did not rally against the broadly weaker US dollar last week. The yuan’s underperformance was somewhat surprising, particularly considering that the economic recovery remains on track, geopolitical tensions appear to be fading and China’s trade data points to very strong exports (+14.8% YoY in March), which should be a positive sign for the currency.

The March inflation data, which showed an almost complete absence of price pressures, could be behind at least some of the currency’s underperformance. Producer prices moved deeper into deflationary territory, with the PPI index declining by 2.5% year-on-year. More importantly, and unexpectedly, consumer inflation dropped to just 0.7% from 1%. Although it can be contested whether it tells us much about the strength of the recovery,some assume that the PBOC may be more eager to ease policy this year.

This week will be filled with news from China. On Tuesday, we’ll focus on the Q1 GDP release, which is expected to show strong recovery in growth to the tune of 2% or so in quarterly terms. We’ll also receive a big data package for March, which will provide us some insight on the state of consumption, production, real estate sector and unemployment. On Thursday, we’ll receive an announcement regarding the key loan prime rates. No change is expected in either 1- and 5-year rate.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports

🔊 Stay up to date with our podcast FXTalk