Spotlight on The Republic of Kenya – Mobility vs. Mediocrity

( 5 min read )

- Go back to blog home

- Latest

Kenya has seen unprecedented economic growth in recent years which has had a profound impact on the reduction of poverty and boosting prosperity. According to the World Bank the poverty headcount rate has declined from 43.7% in 2006 to 36.8% in 2015 (the latest data available), and GDP has averaged 5.7% between 2013 and 2018; almost 2% higher than the average for other Sub-Saharan countries (~3.8%). That fantastic growth trajectory has been considerably derailed with projected GDP growth of 1.5% in 2020 due to Covid-19.

World Bank support

In late May 2020 the World Bank Board of Directors approved a $1 billion budget support operation for Kenya which supports reforms that help advance the government’s inclusion growth agenda, including affordable housing and support to farmer’s income. This second of two programmatic series is aimed at recreating mid-term fiscal buffers and crowding in private investment. The preparation and submission of this request preceded the Covid-19 pandemic but the approval is very timely, given the shock that will be felt by the Kenyan economy, the emergency response to the pandemic and to strengthen the public health preparedness as a result of Covid-19.

Mobile payments

While many nations, even some of the most advanced, are implementing mobile payment networks, Kenya has been at the forefront of this initiative for over a decade. M-PESA has revolutionised the payments channel locally and has been the model for many other emerging markets. The mobile payments channel has been a growing effort in Kenya and has basically created a banking segment for many who have gone unbanked for many years. So it should be no surprise that a mobile network like M-PESA was founded by a mobile provider – Vodafone. Vodafone’s subsidiary Safaricom; the result of the defunct Kenya Postal and Communications Company, has been the leader behind this initiative, proving that money can be made by servicing the low income segment.

M-PESA was actually a solution by mistake; originally M-PESA (PESA meaning Money is Swahili) was set up for microloan management, but operators quickly realised that Kenyans were using it for something else. Rather than using M-PESA to repay loans, they were using it to send money to each other. So agents were disbursed to locations that could pay out or receive deposits over a Safaricom account. Now almost 93% of the Kenyan population have access to mobile payments; the amount of physical currency needs has dropped, which has had a material impact on crime related to fraud and thievery as less people need to have cash on hand to pay for goods and services.

Cross border payments still have their limitations

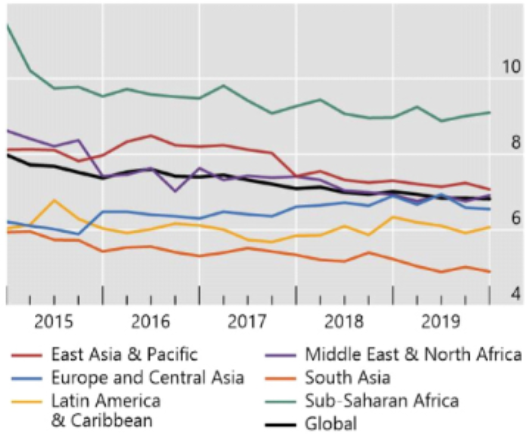

Whilst onshore P2P and mobile payments have been successfully changing the dynamic of financial access in Kenya, cross border payments have continued to be challenging. Access to local bank accounts and/or payment rails, standardised payment messages, client details, purpose of payment(s) and lack of supporting documentation, fraud and lack of trust, cost and access to liquidity are significant impediments to getting payments to the right place, at the right time and the correct amount with any level of certainty. Despite the innovations of mobile payments there are two major shortcomings that beneficiaries have when receiving cross border payments; a bank account to receive funds, and when that account does not exist, the expense to receive and collect funds. In particular, this has a material effect on payroll and trade related transactions. As you can see from the chart below, sub-saharan costs are the highest in the industry.

Average Costs by Region:

Regions according to BIS World Bank Pyments Costs Review, March 2020

Some of the costs are explicit, but some are implicit and have a larger, trickle down effect. Many providers who make KES payments (Kenyan Shilling) fail to disclose the operational inefficiencies that translate to failed payments and increased costs. Banks and money transfer firms use a correspondent banking network to achieve payments in lower volume markets and countries or regions where they do not have a core competency. The correspondent bank (man in the middle) typically lifts charges from either the receiving or sending party and sometimes the beneficiary bank also has a beneficiary bank, adding more fees to expected end transaction amounts. What this means is that the expected amount is lessened by these transaction charges, so employees do not receive the expected amount or products are stranded at the port because the invoice or bill of lading is short the expected amount.

In other circumstances, these same providers may send a base currency to the beneficiary bank or local bank, and ask them to convert to the local currency and make payment. An onshore bank’s offshore affiliate is contracted to receive USD offshore with a committed rate. However, when the local branch receives the instruction the rate can change due to the timing of the receipt or because there is missing information and settlement is elongated whilst the beneficiary is being contacted for receipt prior to conversion. Again, payroll and trade related transitions seem to be most affected.

The outcome of these inefficiencies means that importers and exporters are hesitant to engage in trade unless it is invoiced in a base currency, putting the conversion costs back on the contra party. It also has an impact on companies engaging in operating activities onshore in Kenya. Paying both local and expatriate employees less than expected impacting employee satisfaction. It also cannot be discounted that having access to local rails means getting better response times when issues do arise.

The short of this is to know your provider and be sure to get transparency into their transactional flow. This will help you understand their limitations and how that impacts your day to day activities.

If you have any questions or concerns about your currency risk or payment needs in the African region, or any other location, please contact us at:

Eurozone

0203 9665 573

Asia

+65 6817 5248

Americas

+1 647 694 2122

Email at:

[email protected]