Sterling hits 3-week high on Macron, Merkel optimism

- Go back to blog home

- Latest

French President Macron spoke equally optimistically regarding the possibility of a deal, opening the door to an amendment to the withdrawal agreement that could garner enough backing within the House of Commons. This would not involve renegotiating the entire withdrawal agreement, but finding a solution to the Northern Irish backstop within the next 30 days.

While these comments are, of course, highly encouraging, no such solution has yet been presented. Until it does, the rally we’re seeing in the Pound is likely to prove short lived.

Will Powell’s Jackson Hole appearance shift the USD?

All eyes in the US today will be on Federal Reserve chair Jerome Powell, who will be making his long anticipated appearance at the Jackson Hole central bank conference.

Recent comments from FOMC members have been somewhat less dovish than expected, with members Daly, George, Harker, Mester and Rosengren all downplaying the need for rate cuts earlier this week. That being said, expectations for a rate cut at the bank’s September meeting are very high and we still expect Powell to lay the groundwork for another move next month. If, however, Powell stops short of indicating additional cuts are possible beyond September, then we could see a fairly aggressive upward move in the US dollar today as investors begin dialling back their expectations for Fed cuts.

Eurozone PMIs pick up pace in August

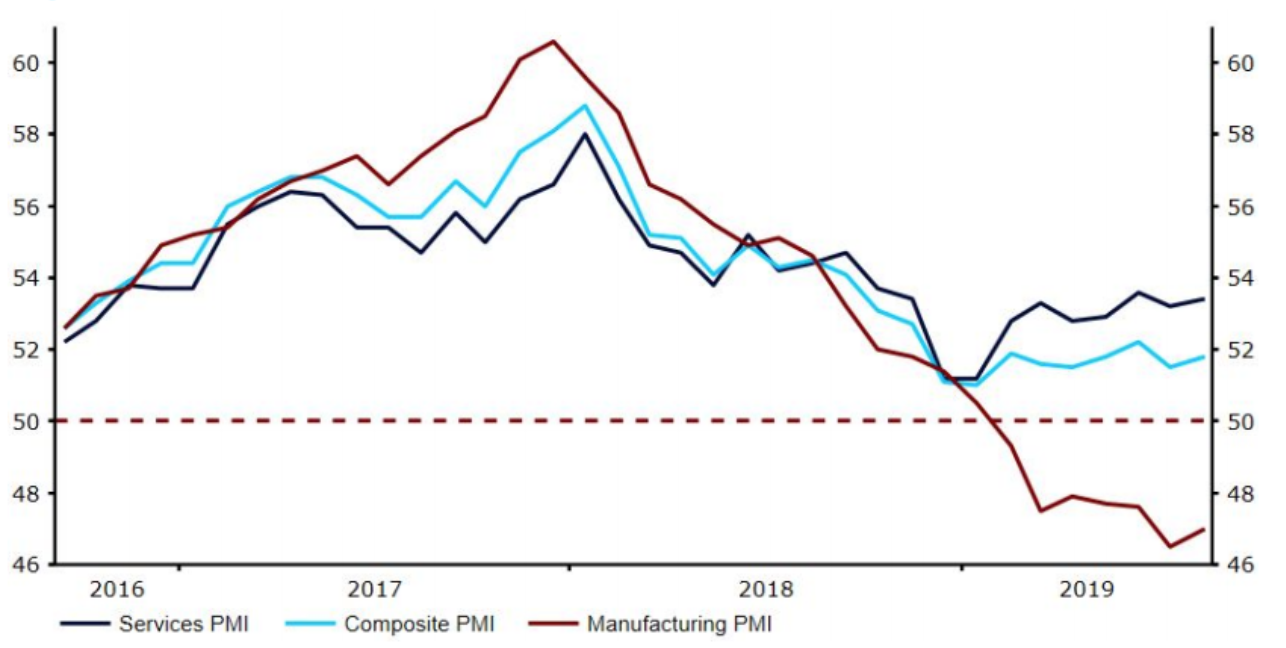

In the lead up to Powell’s Jackson Hole comments, EUR/USD edged moderately lower and is currently trading back below the 1.11 level. This weakness can be largely attributed to a confluence of European downside risks, namely the uncertain political situation in Italy and concerns that Germany could be heading towards a recession in the second quarter of the year. Yesterday’s EZ PMI data was actually much better-than-expected, although fragility in the manufacturing sector remains a cause for concern.

While the overall composite index rose to 51.8 in August from July’s 51.2, the manufacturing index remained at a contractionary 47.0. Activity in the German manufacturing industry remained particularly weak and well below the level of 50 that denotes flat growth.

Figure 1: Eurozone PMIs (2016 – 2019)