Sterling hits new lows despite massive stimulus package

- Go back to blog home

- Latest

The UK government’s gigantic fiscal stimulus programme announced by Chancellor Rishi Sunak did little to inspire sterling on Tuesday.

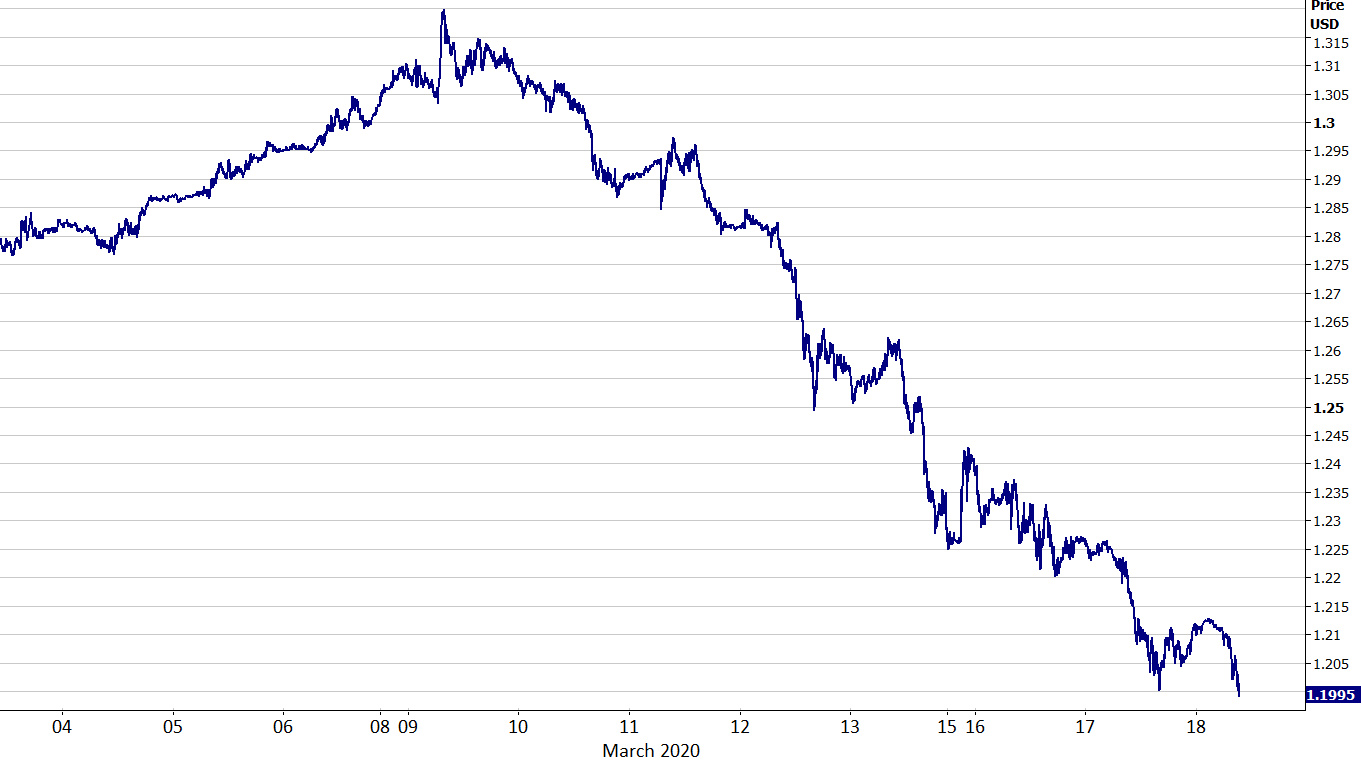

Despite the historic announcement, sterling traders appeared unimpressed, perhaps due to the fact that we are receiving news of similar packages around the world, such as those mentioned overleaf. The GBP/USD cross hit fresh six month lows on Tuesday, down another 1% for the day (Figure 1). Despite recouping some of these losses during Asian trading, the pair made another march towards these lows this morning as investors continue to flock to the safety of the US dollar.

Figure 1: GBP/USD (March 2020)

There is a general feeling in the market that interest rate cuts from the major central banks can only go so far in supporting the global economy from the current crisis. Targeting spending, generous loan packages and the forbearance of debt, such as that announced by the UK government yesterday should be far more effective in keeping the most at risk industries afloat.

Trump prepares rescue package for US economy

As mentioned, news of fiscal stimulus packages are now being announced around the world. The US government yesterday outlined its fiscal plans, with the Trump administration proposing $1 trillion of stimulus yesterday. Including within the measures are cash handouts to households, the deferral of taxes and generous business loans to small companies. This follows on from a similar announcement out of Germany last week, with authorities there freeing up €550 billion worth of loans, mainly for smaller businesses.

In contrast to sterling, the dollar bounced on the news, given that it provides investors with yet another reason to buy the already well bid currency. US stocks also bounced back, although this looks highly likely to be temporary as investors steer clear of high risk investments. There is a chance that the US follows suit with a number of other governments around the world in banning short selling for a temporary time period, much like it did in the ‘08 crisis. For now, however, we expect the current trend to continue in the next few days – investors going long on the dollar due to its safe-haven status and shorting equities around the world in favour of lower risk investments.

Euro slide continues as big European recession looms

The euro similarly fell foul of the dollars strength again yesterday, shedding around 1.5% for the day and opening this morning below the 1.10 level.

One of the first few pieces of economic news that encompasses the crisis was yesterday’s ZEW economic sentiment index from Germany, which fell to its lowest level since late-2011. The index plunged to -49.5 in March from +8.7 in February. Given that the crisis has still not yet peaked in Europe, we think that similar data over the next few weeks will come in even worse and show that the Euro Area economy is heading for a sizable recession. With Europe now at the epicenter of the crisis, the bloc’s economy will be hit especially hard, which we think ensures that further losses for EUR/USD are very much on the cards in the coming days. This could cause the pair to test the 1.05 level sooner rather than later.