Sterling jumps on Oxford vaccine news, lockdown end

( 3 min )

- Go back to blog home

- Latest

FX trading opened for the week in a highly volatile fashion on Monday, a contrast to last week where most major currencies moved within relatively narrow ranges.

There is now real optimism that inoculations can begin as soon as next month, providing light at the end of the tunnel for an end to the pandemic. Rather unsurprisingly, sterling was the best performing major currency on the news, given that the UK has already ordered 100 million doses of the vaccine and would be front of the queue in order to receive it. The pound jumped by over half a percent to its strongest position since the beginning of September at one stage, helped further by talk of an imminent Brexit deal and the government’s announcement that the England-wide lockdown will end as planned on 2nd December. Yesterday’s PMI numbers also beat expectations, with growth in manufacturing even picking up pace despite the lockdown measures.

US PMIs beat expectations despite rising COVID cases

The US dollar had started yesterday on the back foot, although roared back into life following yesterday afternoon’s strong PMI numbers.

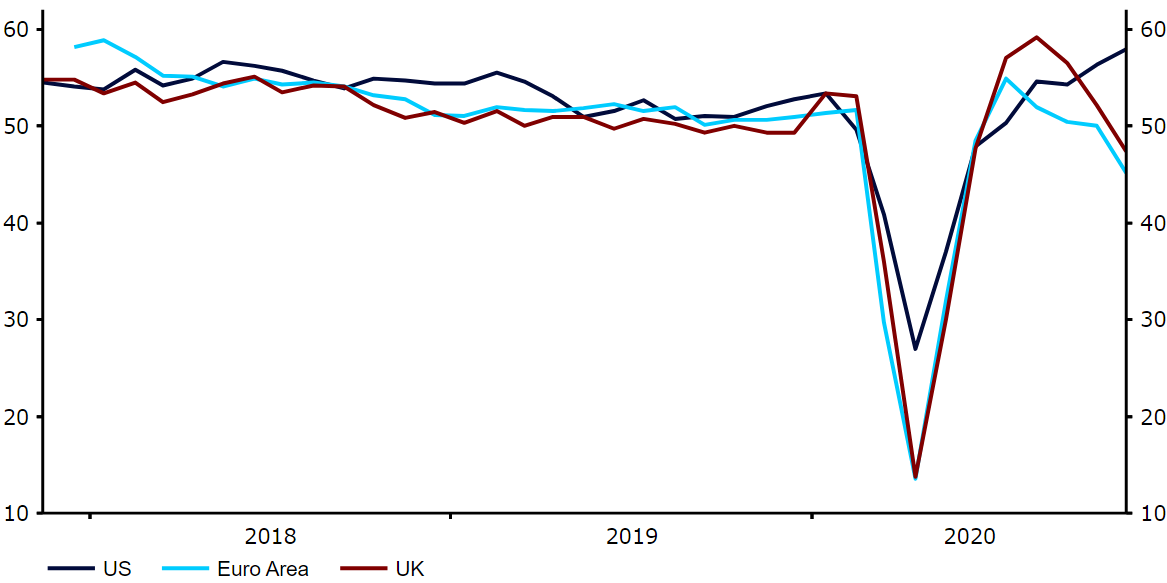

The US services PMI leapt up to 57.7 in November, its highest level since 2015, with the manufacturing index also far outstripping expectations (56.7 versus the 53.0 pencilled in). This is a quite remarkable sign of expansion given the sharp jump in COVID cases and reintroduction of restrictions in some US states. It also comes in sharp contrast to the same data out of the Euro Area, which saw a collapse in services activity even deeper into contractionary territory (41.3 from 46.9).

Figure 1: US, Euro Area & UK Composite PMIs (2017 – 2020)

Source: Refinitiv Datastream Date: 24/11/2020

We have, however, seen the dollar back on the retreat again this morning amid the news that Donald Trump has accepted that the presidential transition to Joe Biden should begin. While Trump is continuing to contest the result of the election, this is the first real step towards a concession that would remove any lingering uncertainty surrounding a prolonged legal campaign. Aside from political news, a number of speeches from FOMC officials could receive the most attention today in an otherwise relatively quiet day of economic announcements.