Sterling recovers from 3 year low against Euro after this morning’s inflation data

- Go back to blog home

- Latest

Sterling fell to a fresh 3 year low against the Euro on Monday, although recovered this morning following an impressive set of inflation figures. The Pound also inched away from a near 31 year trough versus the US Dollar.

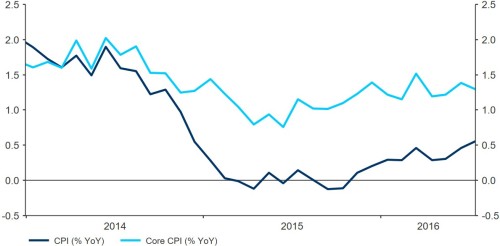

Figure 1: UK Inflation Rate (2014 – 2016)

On Monday currency traders had been selling the Pound due to the Bank of England’s recent decision to cut interest rates to a record low. This sent the Pound plunging below 1.15 to the Euro yesterday for the first time since 2013.

Investors remain wary that a host of economic data this week could ramp up the pressure on the UK central bank to increase stimulus further in the coming months. We’ll see the first post-referendum unemployment and wage data this week, with Thursday’s retail sales figures particularly anticipated, given its reflection of overall economic activity.

The US Dollar was sold-off heavily this morning following comments from Federal Reserve member John Williams. Williams claimed that central banks and governments could be forced to set higher inflation targets and increase fiscal spending in order to buffer the effect of persistently low interest rates.

This sent the Euro sharply higher this morning to its strongest position since the Brexit vote.

The latest GDP numbers in Japan came in much weaker than expected, further piling pressure on the Bank of Japan to increase its large scale stimulus measures in order to support its ailing economy. GDP barely grew in the second quarter, expanding just 0.2% with weaker exports and business investment weighing heavily on overall output. However, the Yen continues to edge alarmingly close to 100 to the USD for only the second time in 3 years.

We now look to inflation figures across the pond today, with US consumer price growth forecast to dip to 0.9%.

Major currencies in detail:

GBP

The Pound recovered from its 1 month low against the US Dollar this morning, edging 0.4% higher against the Greenback.

House price data overnight added to the recent stream of disappointing economic news since the Brexit vote. Rightmove’s housing price index fell 1.2% in the month, with prices particularly hard hit in London, falling in excess of 2%. Other than that, yesterday was a very light day of news in the UK.

Today should be a much busier day in term of economic news. Labour data on Wednesday and retail sales on Thursday will both be hotly anticipated.

EUR

The Euro was little moved around its August range on Monday, although rose sharply by 0.7% against the US Dollar this morning following the dovish comments from John Williams.

The latest confidence surveys from ZEW for August are all expected to rebound following their post-Brexit slump in July. Resilience among Eurozone consumers to the shock Brexit vote could delay easing from the ECB this year. Germany’s central bank, Bundesbank, yesterday claimed that the referendum outcome would have limited impact on short term output in Europe’s largest economy.

Thursday’s European Central Bank minutes will present the greatest event risk for markets this week, with investors looking for clues as to potential policy changes at the Governing Council’s meeting on the 8th September.

USD

The US Dollar index dipped 0.65% as markets opened this morning following comments from Fed member Williams and dimming expectations for a September interest rate hike by the Federal Reserve.

The only real data of note yesterday came out of the US. The National Association of Home Builders housing market index rose to 60 in August, from a downwardly revised 58. The New York Empire State Manufacturing Index fell to -4.21 from 0.55.

Recent weak economic data in the US has caused markets to price in less than a 50% chance of a Federal Reserve rate hike by December.

Today looks set to be a busy day in the US economy. Housing and inflation data at 13:30 UK time will be followed by a speech from Federal Reserve member Dennis Lockhart in the afternoon.

Receive these market updates via email